Is Alimony Taxable in Ohio? Alimony Tax Implications In Ohio

Short answer to Is Alimony Taxable in Ohio? is that If you’re receiving alimony in Ohio under a post-2018 agreement, alimony is not considered taxable income after 2018. This means you don’t need to report these payments as income on your federal tax return.

Tax season can be particularly confusing when it comes to alimony payments. If you’re paying or receiving alimony in Ohio, you might be wondering, “Is Alimony Taxable in Ohio?” This comprehensive guide will explore the complexities of alimony taxation in Ohio, recent changes in tax laws, and what they mean for both payers and recipients.

Table of Contents

Understanding Alimony Tax Rules

Federal Tax Law Changes

The landscape of alimony tax laws underwent significant changes with the implementation of the Tax Cuts and Jobs Act in 2017. This alimony tax reform dramatically altered how alimony is treated for tax purposes, and it’s crucial to understand these new alimony tax laws to ensure proper compliance and avoid potential issues with the IRS.

Current Tax Treatment (Post-2018)

For alimony agreements finalized after December 31, 2018, the tax implications have shifted dramatically:

1. Alimony Payers:

If you’re paying alimony in Ohio under a post-2018 agreement, you can no longer claim an alimony tax deduction. The alimony tax deduction after 2018 has been eliminated at the federal level.

2. Alimony Recipients:

If you’re receiving alimony in Ohio under a post-2018 agreement, alimony is not considered taxable income after 2018. This means you don’t need to report these payments as income on your federal tax return.

Ohio Specifics Alimony Tax Rules

State Tax Conformity

When it comes to the Ohio tax code on alimony, the state generally conforms to federal tax treatment. This means that Ohio alimony tax laws typically align with the federal changes mentioned above. However, it’s always wise to stay informed about any potential Ohio alimony tax conformity updates or changes.

Potential Exceptions

While Ohio largely follows federal guidelines, it’s important to be aware of any potential Ohio exceptions for alimony taxation. These exceptions, if they exist, could impact how you handle alimony payments on your state tax return.

Related Articls For You:

How Much Alimony Does A Stay-at-Home Mom Get?

How Many Years Do You Have to Be Married to Get Alimony?

Bridge The Gap Alimony Florida

Impact on Pre-2019 Alimony Agreements

It’s important to note that these changes generally only apply to alimony payments made under agreements finalized after December 31, 2018. Pre-2019 agreements typically follow the old tax rules unless modified. If your alimony agreement was made before 2019 and specifies tax treatment, those terms might still govern the tax implications of your alimony payments.

Importance of Consulting a Tax Professional

Tax Code Complexities

The tax code for alimony in Ohio can be intricate, with potential nuances that may affect your specific situation. Given these complexities, it’s highly recommended to consult a tax advisor for alimony-related questions.

Personalized Tax Advice

Seeking guidance from a tax professional for alimony in Ohio can provide you with personalized insights based on your unique circumstances. An Ohio CPA specializing in alimony taxes can offer valuable expertise to ensure you’re handling your alimony payments correctly from a tax perspective.

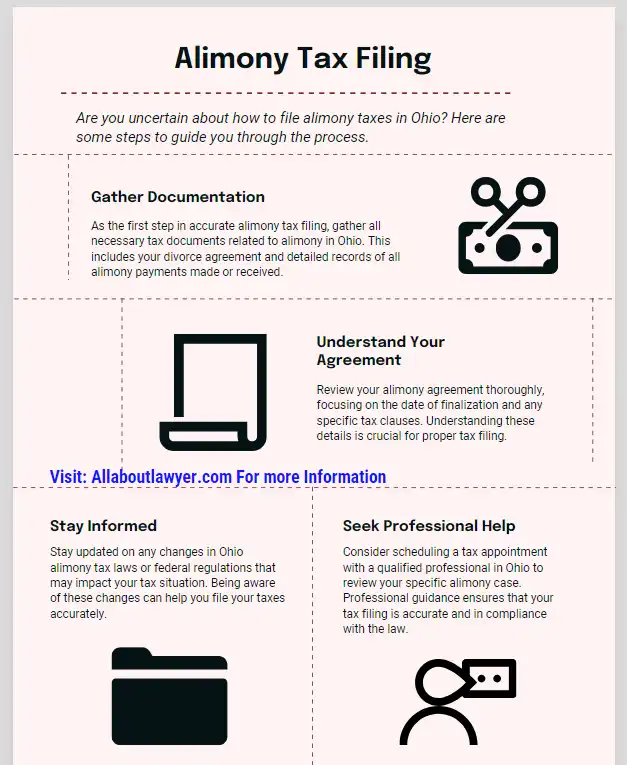

Steps for Accurate Alimony Tax Filing

1. Gather Documentation:

Collect all relevant tax documents for alimony in Ohio, including your divorce agreement and records of payments made or received.

2. Understand Your Agreement:

Review your alimony agreement, paying special attention to when it was finalized and any specific tax provisions.

3. Stay Informed:

Keep up-to-date with any changes in Ohio alimony tax laws or federal regulations that might affect your situation.

4. Seek Professional Help:

Consider scheduling a tax appointment in Ohio with a qualified professional to review your specific alimony situation.

Conclusion

Understanding the current tax treatment of alimony is crucial for accurate alimony tax filing in Ohio. By staying informed and seeking professional guidance, you can avoid tax mistakes with alimony in Ohio and ensure compliance with both federal and state tax laws. Remember, while this guide provides general information about alimony taxation in Ohio, it’s always best to consult with a qualified tax professional for personalized advice tailored to your unique situation.

FAQs

1. Is alimony taxable income for the recipient in Ohio (after 2018)?

No, under current federal law, alimony received is not considered taxable income in Ohio or any other state for agreements made after December 31, 2018.

2. Can I still deduct alimony payments from my taxes in Ohio (after 2018)?

No, federal tax law changes eliminated the deduction for alimony payments made under agreements finalized after December 31, 2018.

3. Do these federal tax changes apply to alimony agreements made before 2019?

No, these changes generally only apply to alimony payments made under agreements finalized after December 31, 2018. Pre-2019 agreements typically follow the old tax rules unless modified.

4. What if my alimony agreement was made before 2019 and specifies tax treatment?

The terms of your pre-2019 agreement might still govern the tax implications of your alimony payments. Consulting a tax professional is recommended to ensure proper handling.

5. Should I consult a tax advisor about my alimony situation in Ohio?

Absolutely! Tax codes can be complex, and a qualified tax professional can provide personalized advice based on your specific circumstances and Ohio’s potential exceptions (if any).

Remember, staying informed and seeking professional guidance is key to navigating the complexities of alimony taxation in Ohio. Whether you’re paying or receiving alimony, understanding your tax obligations can help you make informed financial decisions and avoid potential issues with tax authorities.

About the Author

Sarah Klein, JD, is a former family law attorney with over a decade of courtroom and mediation experience. She has represented clients in divorce, custody cases, adoption, Alimony, and domestic violence cases across multiple U.S. jurisdictions.

At All About Lawyer, Sarah now uses her deep legal background to create easy-to-understand guides that help families navigate the legal system with clarity and confidence.

Every article is based on her real-world legal experience and reviewed to reflect current laws.

Read more about Sarah