How Much Does Probate Cost in Illinois? Fees, Factors, and Cost Management Strategies

Handling the probate process in Illinois can be a complex and potentially costly endeavor. Understanding how much does probate cost in Illinois and various expenses associated with estate administration in the Prairie State is crucial for executors, beneficiaries, and individuals planning their estates. This comprehensive guide will explore the factors influencing probate costs in Illinois, providing insights into fees, potential expenses, and strategies for managing the financial aspects of the probate process.

Table of Contents

Understanding Probate in Illinois

Before delving into the specific costs, it’s essential to understand what probate entails in Illinois. Probate is the legal process through which a deceased person’s estate is settled and distributed. This process involves validating the will (if one exists), appointing an executor or administrator, paying debts and taxes, and distributing the remaining assets to beneficiaries.

In Illinois, the probate process is governed by the Illinois Probate Act, which outlines the procedures and requirements for estate administration. The complexity and duration of the probate process can significantly impact the overall costs involved.

Factors Influencing Probate Cost in Illinois

Several factors can affect the total expenses associated with probate in the Prairie State:

1. Estate Size and Complexity

2. Presence of a Valid Will

3. Family Dynamics and Potential Disputes

4. Asset Types and Locations

5. Debts and Taxes Owed by the Estate

6. Executor’s Choices in Estate Management

Each of these factors can contribute to varying degrees of complexity and, consequently, influence the overall cost of the probate process.

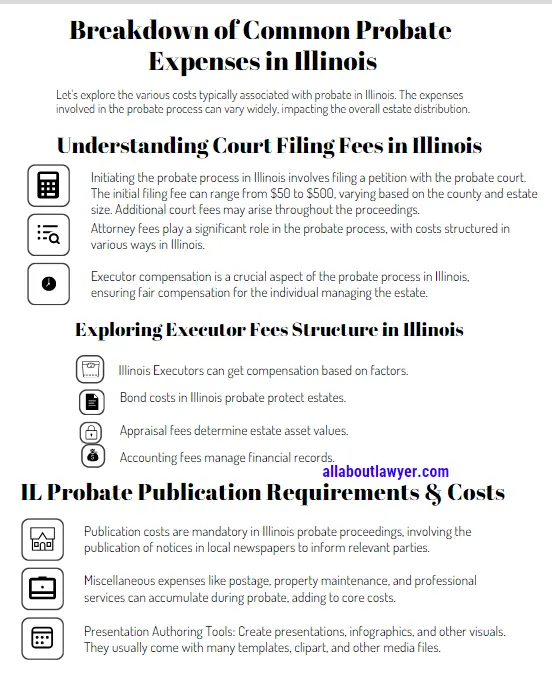

Breakdown of Common Probate Expenses in Illinois

Let’s explore the various costs typically associated with probate in Illinois:

1. Court Filing Fees

The probate process begins with filing a petition in the appropriate Illinois probate court. The initial filing fee can range from $50 to $500, depending on the county and the size of the estate. Additional court fees may be incurred for various filings throughout the process.

2. Attorney Fees

Legal representation is often one of the most significant expenses in the probate process. In Illinois, attorney fees for probate can be structured in several ways:

– Hourly Rates: Typically ranging from $150 to $500 per hour

– Flat Fees: For straightforward estates, some attorneys offer flat-rate services

– Percentage of Estate Value: Some attorneys charge a percentage, often between 2% to 5% of the estate’s value

The complexity of the estate and the attorney’s experience level can significantly impact these fees.

3. Executor Fees

In Illinois, executors are entitled to reasonable compensation for their services. The Illinois Probate Act allows for:

– A percentage of the estate value (typically 2-5%)

– Hourly rates for time spent on estate matters

– A fixed fee agreed upon by all beneficiaries

Executors who are also beneficiaries of the estate sometimes waive their fees to maximize inheritance for all beneficiaries.

Related Articles For You:

What-is-reasonable-compensation-for-a-power-of-attorney

4. Bond Costs

Illinois may require the executor to post a bond to protect the estate from mismanagement. Bond costs typically range from 0.5% to 2% of the estate’s value, though this requirement can sometimes be waived in the will or by agreement of all beneficiaries.

5. Appraisal and Valuation Fees

Determining the value of estate assets often requires professional appraisals. Costs can vary widely depending on the types of assets involved:

– Real Estate Appraisals: $300 – $800 per property

– Business Valuations: $3,000 – $20,000+

– Personal Property Appraisals: $200 – $400 per hour

6. Accounting Fees

Complex estates may require the services of an accountant to manage financial records, prepare tax returns, and ensure proper distribution. Accounting fees can range from $1,000 to $5,000 or more, depending on the estate’s complexity.

Read also: How To Claim A Deceased Loved One’s Bank Account Without Probate?

7. Publication Costs

Illinois law requires notice of the probate proceedings to be published in a local newspaper. This typically costs between $100 and $400, depending on the publication and the number of required notices.

8. Miscellaneous Expenses

Additional costs may include:

– Postage and copying fees

– Property maintenance costs for estate assets

– Travel expenses for the executor

– Professional fees for specialized services (e.g., real estate agents, investment advisors)

Read also:

How much does probate cost in Minnesota?

Strategies for Managing Probate Costs in Illinois

While probate expenses can be significant, there are strategies to help manage and potentially reduce these costs:

1. Proper Estate Planning

Engaging in comprehensive estate planning can significantly streamline the probate process and reduce associated costs. This may include:

– Creating a clear, well-drafted will

– Utilizing living trusts to bypass probate for certain assets

– Proper beneficiary designations on accounts and policies

2. Choosing the Right Executor

Selecting a competent and trustworthy executor can help ensure efficient estate administration and potentially lower costs.

3. Considering Simplified Probate Procedures

Illinois offers simplified probate procedures for smaller estates:

– Small Estate Affidavit: For estates under $100,000 with no real estate

– Summary Administration: For estates valued at less than $50,000

These procedures can significantly reduce probate costs and complexity.

4. Negotiating Professional Fees

Don’t hesitate to discuss fees upfront with attorneys and other professionals. Sometimes, negotiating a flat fee or caps on hourly rates can help control costs.

5. DIY Probate (with caution)

While not advisable for complex estates, individuals with simple estates and legal knowledge may choose to handle some probate tasks themselves to reduce costs. However, this approach carries risks and should be carefully considered.

6. Regular Communication

Maintaining open communication among executors, beneficiaries, and professionals can help prevent misunderstandings and potential disputes that could increase costs.

Probate Cost in Illinois-Specific Considerations

Several factors unique to Illinois can impact probate costs:

1. Illinois Estate Tax

While Illinois does not have an inheritance tax, it does impose an estate tax on estates valued over $4 million (as of 2021). This can add significant costs to larger estates.

2. Real Estate Considerations

Illinois has specific requirements for handling real estate in probate, which can add complexity and cost, especially for out-of-state property.

3. Creditor Claim Period

Illinois has a 6-month creditor claim period, which can extend the probate process and potentially increase administrative costs.

Conclusion

The cost of probate in Illinois can vary widely, ranging from a few thousand dollars for simple estates to tens of thousands or more for complex cases. While the expenses can be significant, understanding the factors influencing these costs and implementing strategic planning can help manage and potentially reduce the financial burden of probate.

It’s important to remember that while cost is a significant consideration, ensuring the proper and legal administration of an estate should be the primary goal. Seeking professional advice from experienced Illinois probate attorneys and financial advisors can provide valuable insights and potentially save money in the long run by avoiding costly mistakes.

Ultimately, the best approach to managing probate costs in Illinois involves a combination of careful planning, informed decision-making, and judicious use of professional services. By understanding the potential expenses and available strategies, individuals can navigate the probate process more effectively, ensuring a smoother transfer of assets while minimizing unnecessary costs.

Related Articles For You:

How Much Does Probate Cost in Minnesota?

FAQs

How long does probate typically take in Illinois?

The probate process in Illinois typically takes 6 to 12 months for straightforward estates. However, complex estates or those involving disputes can take several years to settle.

Can probate be avoided in Illinois?

Yes, probate can be avoided or minimized through estate planning strategies such as living trusts, joint ownership of assets, and proper beneficiary designations on accounts and policies.

Is probate always necessary in Illinois?

No, probate is not always necessary. Estates valued under $100,000 with no real estate may qualify for a simplified process using a Small Estate Affidavit.

Who pays for probate costs in Illinois?

Probate costs are typically paid from the estate’s assets before distribution to beneficiaries. In rare cases where the estate has insufficient funds, the executor might be responsible for covering some costs.

Visit All About Lawyer Website for more articles.

About the Author

Sarah Klein, JD, is an experienced estate planning attorney who has helped clients with wills, trusts, powers of attorney, and probate matters. At All About Lawyer, she simplifies complex estate laws so families can protect their assets, plan ahead, and avoid legal headaches during life’s most sensitive moments.

Read more about Sarah