Consumer Protection Attorney Who Handles Identity Theft Cases

Identity theft has become an increasingly prevalent issue in our digital age, affecting millions of consumers annually. This form of fraud involves the unauthorized use of an individual’s personal information for financial gain or other nefarious purposes. As technology advances, so do the methods employed by identity thieves, making it a constantly evolving threat to consumer security and financial well-being. In this article we will discuss how you can handle the situation with Consumer Protection Attorneys.

Table of Contents

Role of consumer protection attorneys in identity theft cases

Consumer protection attorneys play a crucial role in assisting victims of identity theft. These legal professionals specialize in navigating the complex web of consumer rights, federal and state laws, and the often-challenging process of restoring a victim’s identity and financial standing. Their expertise is invaluable in helping consumers recover from the devastating effects of identity theft and in holding responsible parties accountable.

Understanding Identity Theft

A. Definition and types of identity theft

Identity theft occurs when someone wrongfully obtains and uses another person’s personal data for deception or fraud, typically for economic gain. Common types include:

1. Financial identity theft

2. Medical identity theft

3. Criminal identity theft

4. Synthetic identity theft

5. Child identity theft

B. Common Identity Theft Schemes

Identity thieves employ various methods to obtain personal information, including:

1. Phishing emails and websites

2. Data breaches

3. Skimming devices on ATMs and point-of-sale terminals

4. Dumpster diving for discarded documents

5. Social engineering tactics

C. Impact on consumers and their rights

The consequences of identity theft can be severe and long-lasting, affecting victims in numerous ways:

1. Financial losses and damaged credit scores

2. Emotional distress and time-consuming recovery process

3. Potential criminal record if the thief commits crimes using the victim’s identity

4. Difficulty obtaining loans, employment, or housing due to compromised personal information

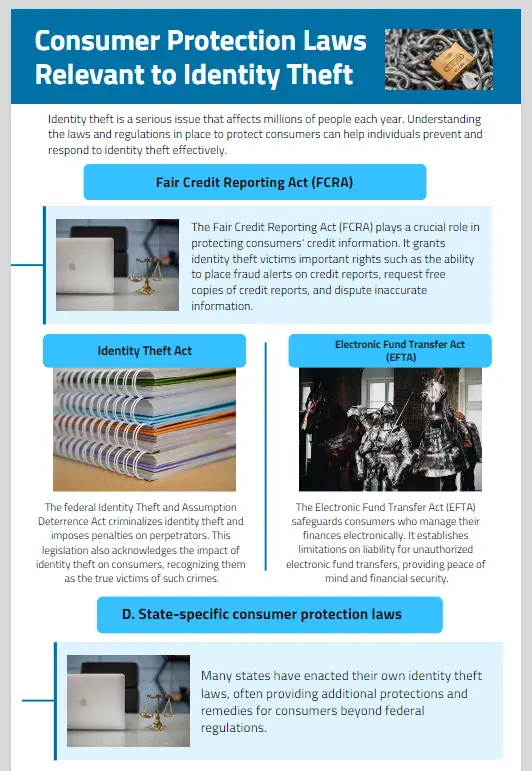

Consumer Protection Laws Relevant to Identity Theft

A. Fair Credit Reporting Act (FCRA)

The FCRA regulates the collection, dissemination, and use of consumer credit information. It provides important protections for identity theft victims, including the right to:

1. Place fraud alerts on credit reports

2. Obtain free copies of credit reports

3. Dispute inaccurate information

B. Identity Theft and Assumption Deterrence Act

This federal law criminalizes identity theft and provides for penalties against perpetrators. It also recognizes consumers as true victims of this crime.

C. Electronic Fund Transfer Act (EFTA)

The EFTA provides protections for consumers using electronic methods to manage their finances, including limitations on liability for unauthorized electronic fund transfers.

D. State-specific consumer protection laws

Many states have enacted their own identity theft laws, often providing additional protections and remedies for consumers beyond federal regulations.

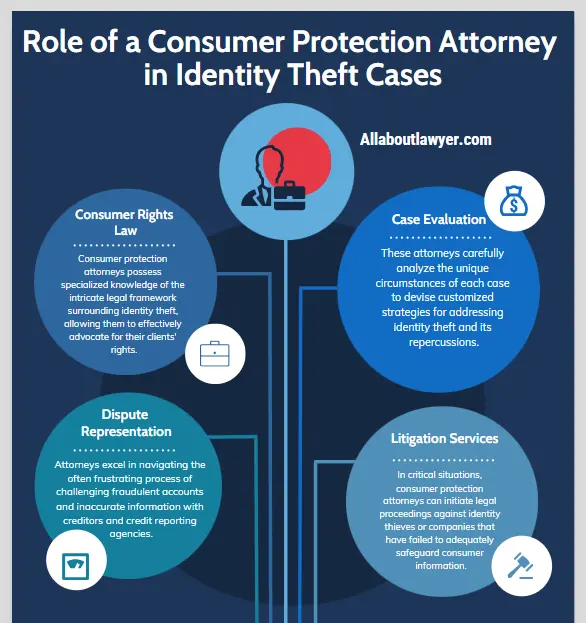

Role of a Consumer Protection Attorney in Identity Theft Cases

A. Legal expertise in consumer rights and identity theft laws

Consumer protection attorneys possess specialized knowledge of the complex legal framework surrounding identity theft, enabling them to effectively advocate for their clients.

B. Case evaluation and strategy development

These attorneys assess each case’s unique circumstances to develop tailored strategies for addressing the identity theft and its consequences.

C. Representation in disputes with creditors and credit bureaus

Attorneys can navigate the often-frustrating process of disputing fraudulent accounts and inaccurate information with creditors and credit reporting agencies.

D. Litigation against identity thieves and negligent companies

When necessary, consumer protection attorneys can pursue legal action against perpetrators of identity theft or companies that failed to adequately protect consumer information.

E. Assistance with identity restoration

Attorneys guide clients through the process of restoring their identity, including interactions with government agencies, financial institutions, and other relevant parties.

Related article:

Phongsavanh Bank Identity Theft Scam

Services Provided by Identity Theft Consumer Protection Attorneys

A. Credit report dispute resolution

Attorneys help clients dispute and remove fraudulent accounts and inquiries from credit reports, working directly with credit bureaus and creditors.

B. Debt collector harassment cessation

They can invoke protections under the Fair Debt Collection Practices Act to stop harassment from debt collectors pursuing fraudulent debts.

C. Fraudulent account removal

Attorneys assist in closing and removing accounts opened fraudulently in the victim’s name.

D. Damages recovery

In some cases, attorneys can help clients recover financial damages resulting from identity theft, including legal fees and lost wages.

E. Identity theft prevention counseling

Lawyers provide guidance on best practices to prevent future instances of identity theft and protect personal information.

The Legal Process for Identity Theft Cases

A. Initial consultation and case evaluation

The process begins with a thorough review of the client’s situation and the extent of the identity theft.

B. Evidence gathering and documentation

Attorneys help collect and organize all relevant documentation, including police reports, credit reports, and correspondence with creditors.

C. Notification to relevant parties (creditors, agencies)

Formal notifications are sent to all affected parties, including creditors, credit bureaus, and relevant government agencies.

D. Dispute filing and follow-up

Attorneys file disputes with credit bureaus and creditors, following up to ensure proper resolution.

E. Negotiation and settlement

When possible, lawyers negotiate with creditors and other parties to resolve issues without litigation.

F. Litigation (if necessary)

If disputes cannot be resolved through negotiation, attorneys may file lawsuits to protect their clients’ rights and seek appropriate remedies.

Benefits of Hiring a Consumer Protection Attorney for Identity Theft

A. Expertise in complex legal procedures

Attorneys navigate the intricate legal landscape more efficiently than most consumers could on their own.

B. Time and stress savings for the consumer

Legal representation allows victims to focus on their personal recovery while the attorney handles the legal aspects of their case.

C. Potentially higher success rates in disputes and claims

Experienced attorneys often achieve better outcomes in disputes with creditors and credit bureaus.

D. Access to legal resources and networks

Attorneys have access to specialized resources and professional networks that can be beneficial in resolving identity theft cases.

Choosing the Right Consumer Protection Attorney for Identity Theft Cases

A. Specialization in identity theft and consumer protection

Look for attorneys with specific experience in handling identity theft cases and a strong background in consumer protection law.

B. Track record of successful cases

Consider the attorney’s history of resolving identity theft cases successfully for their clients.

C. Understanding of current digital landscape and cybercrime

Choose an attorney who stays current with evolving digital threats and cybercrime trends.

D. Communication skills and responsiveness

Select a lawyer who communicates clearly and responds promptly to client inquiries.

E. Fee structure and payment options

Discuss fees upfront and consider attorneys who offer flexible payment options or contingency fee arrangements.

Preventive Measures and Consumer Education

A. Identity theft prevention strategies

Attorneys often provide guidance on best practices for protecting personal information and reducing the risk of identity theft.

B. Consumer rights education

Lawyers educate clients about their rights under various consumer protection laws.

C. Credit monitoring services

Information on effective credit monitoring tools and services may be provided to help detect potential identity theft early.

D. Secure online practices

Guidance on safe internet usage and protecting digital information is often part of an attorney’s preventive advice.

Collaboration with Other Professionals

A. Working with law enforcement agencies

Attorneys may coordinate with local and federal law enforcement in criminal investigations related to identity theft.

B. Coordination with credit bureaus

Lawyers often have established channels for efficient communication with major credit reporting agencies.

C. Partnerships with cybersecurity experts

Some attorneys collaborate with cybersecurity professionals to address technical aspects of identity theft cases.

D. Cooperation with financial institutions

Attorneys may work directly with banks and other financial institutions to resolve fraudulent transactions and accounts.

Emerging Trends in Identity Theft and Consumer Protection

A. Synthetic identity theft

This growing form of fraud combines real and fake personal information to create new identities.

B. Medical identity theft

Theft of personal information to obtain medical services or insurance benefits is becoming more common.

Criminals increasingly target children’s identities due to the length of time before detection is likely.

This involves the fraudulent use of a business’s identity for financial gain or to perpetrate other crimes.

Recovery and Restoration After Identity Theft

A. Steps to restore credit and financial standing

Attorneys guide clients through the process of correcting credit reports and rebuilding their financial reputation.

B. Emotional support and counseling resources

Lawyers may provide referrals to support services to help clients cope with the emotional impact of identity theft.

C. Long-term protection strategies

Ongoing advice is often provided to help clients maintain their financial security and prevent future incidents.

Conclusion

A. Recap of the importance of consumer protection attorneys in identity theft cases

Consumer protection attorneys play a vital role in helping victims navigate the complex aftermath of identity theft.

B. Empowering consumers to protect their identities and rights

Knowledge and proactive measures are key to preventing and addressing identity theft effectively.

C. Call to action for those experiencing identity theft issues

Encourage individuals facing identity theft to seek professional legal assistance promptly to protect their rights and facilitate recovery.

FAQs

A. How much does it cost to hire a consumer protection attorney for identity theft?

Costs vary, but many offer free initial consultations and may work on contingency or offer flexible payment plans.

B. How long does it typically take to resolve an identity theft case?

Resolution time varies greatly depending on case complexity, but can range from a few months to over a year.

C. Can a consumer protection attorney help if my business experiences identity theft?

Yes, many consumer protection attorneys also handle business identity theft cases.

D. What should I do immediately if I suspect I’m a victim of identity theft?

File a police report, contact your financial institutions, and consider reaching out to a consumer protection attorney for guidance.

E. Are there any pro bono services available for identity theft victims?

Some legal aid organizations and law school clinics offer free or low-cost services for identity theft victims who meet certain criteria.

For more such informative article kindly visit All About Lawyer Official Website.

About the Author

Sarah Klein, JD, is a former criminal defense attorney with hands-on experience in cases involving DUIs, petty theft, assault, and false accusations. Through All About Lawyer, she now helps readers understand their legal rights, the criminal justice process, and how to protect themselves when facing charges.

Read more about Sarah