Will County Property Tax Appeal Attorney Your Guide to Reducing Real Estate Tax Burden

When it comes to homeownership, property taxes can be a significant financial burden. In Will County, Illinois, many property owners find themselves seeking ways to reduce their tax liability. This is where a skilled Will County property tax appeal attorney can make a substantial difference. In this comprehensive guide, we’ll explore the role of these legal professionals, the property tax appeal process, and how they can help you potentially lower your real estate tax burden.

Table of Contents

Understanding Property Taxes in Will County

Before delving into the appeal process, it’s crucial to understand how property taxes work in Will County. Property taxes are based on the assessed value of your property and the tax rate set by local government entities. The Will County Supervisor of Assessments is responsible for determining the value of properties within the county.

Several factors can influence your property’s assessed value:

1. Location

2. Size of the property

3. Age and condition of structures

4. Recent improvements or renovations

5. Comparable sales in the area

It’s important to note that the assessed value may not always accurately reflect the true market value of your property, which is where the opportunity for an appeal arises.

The Role of a Will County Tax Relief Counsel

A Will County property tax appeal attorney specializes in challenging property tax assessments on behalf of homeowners and commercial property owners. These legal professionals possess in-depth knowledge of local tax laws, assessment procedures, and appeal processes. Their primary goal is to help clients reduce their tax burden by proving that their property has been overvalued by the assessor’s office.

Key responsibilities of a tax assessment challenge lawyer include:

1. Evaluating the accuracy of your property assessment

2. Gathering evidence to support a lower valuation

3. Preparing and filing appeal documents

4. Representing you at appeal hearings

5. Negotiating with county officials on your behalf

The Property Tax Appeal Process in Will County

Understanding the appeal process is crucial for property owners considering challenging their tax assessment. Here’s an overview of the typical steps involved:

1. Review Your Assessment Notice: Each year, Will County property owners receive an assessment notice. Review this carefully to determine if you believe your property has been overvalued.

2. Gather Evidence: Collect documentation supporting your claim of overvaluation. This may include recent appraisals, comparable sales data, or evidence of property defects that may lower its value.

3. File an Appeal: Submit your appeal to the Will County Board of Review within the specified deadline. This is typically 30 days from the date of your assessment notice.

4. Informal Hearing: In many cases, you’ll have an opportunity for an informal hearing with a representative from the assessor’s office to discuss your appeal.

5. Formal Hearing: If the informal hearing doesn’t resolve the issue, a formal hearing will be scheduled with the Board of Review.

6. Decision and Further Appeals: After the hearing, you’ll receive a decision. If you’re still unsatisfied, you may have the option to appeal to the Illinois Property Tax Appeal Board or the circuit court.

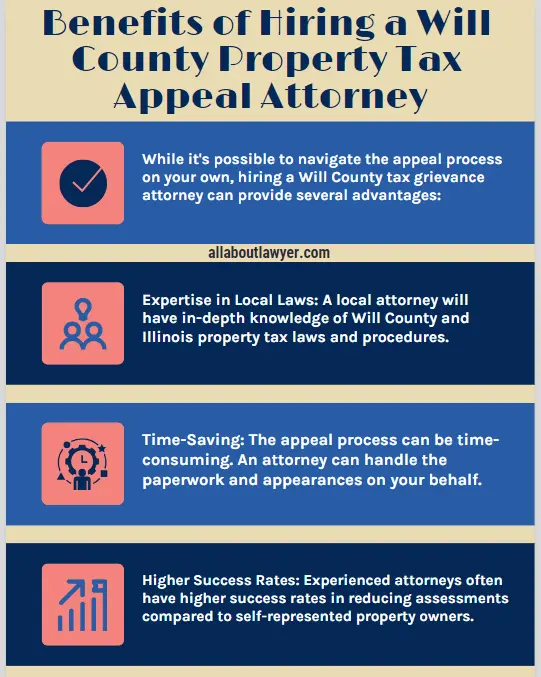

Benefits of Hiring a Will County Property Tax Appeal Attorney

While it’s possible to navigate the appeal process on your own, hiring a Will County tax grievance attorney can provide several advantages:

1. Expertise in Local Laws:

A local attorney will have in-depth knowledge of Will County and Illinois property tax laws and procedures.

2. Time-Saving:

The appeal process can be time-consuming. An attorney can handle the paperwork and appearances on your behalf.

3. Higher Success Rates:

Experienced attorneys often have higher success rates in reducing assessments compared to self-represented property owners.

4. Negotiation Skills:

Lawyers are skilled negotiators who can effectively argue your case before the Board of Review.

5. Access to Resources:

Attorneys have access to databases and resources that can help build a strong case for reassessment.

Strategies Employed by Tax Reduction Specialists

Experienced Will County property tax appeal attorneys employ various strategies to challenge assessments:

1. Comparable Sales Analysis: Presenting data on similar properties that have sold for less than your assessed value.

2. Income Approach: For commercial properties, analyzing the property’s income potential to argue for a lower valuation.

3. Cost Approach: Examining the cost to replace your property minus depreciation to justify a lower assessment.

4. Identifying Assessment Errors: Spotting mistakes in property records that may have led to an inflated assessment.

5. Highlighting Property Defects: Presenting evidence of issues that negatively impact your property’s value.

Related Articles For You:

A Real Estate Broker Who Accidentally Violates Fair Housing Laws

When Does the New Real Estate Law Go Into Effect?

Choosing the Right Will County Property Tax Appeal Attorney for Your Case

Selecting the right Will County real estate tax advisor is crucial for the success of your appeal. Consider the following factors:

1. Experience: Look for an attorney with a proven track record in property tax appeals.

2. Local Knowledge: Choose a lawyer familiar with Will County’s specific assessment and appeal processes.

3. Communication Skills: Ensure the attorney can explain complex tax concepts in understandable terms.

4. Fee Structure: Understand how the attorney charges for their services. Some may work on a contingency basis.

5. Client Reviews: Read testimonials or speak with past clients to gauge the attorney’s effectiveness.

The Importance of Timely Action

In property tax appeals, timing is critical. Will County has strict deadlines for filing appeals, typically within 30 days of receiving your assessment notice. Missing these deadlines can result in losing your right to appeal for that tax year. A proactive approach and prompt consultation with a tax assessment review petition expert can ensure you don’t miss these crucial windows of opportunity.

Potential Outcomes of a Successful Appeal

A successful property tax appeal can lead to several positive outcomes:

1. Immediate Tax Savings: A reduced assessment translates to lower property tax bills.

2. Long-Term Benefits: Lowered assessments often carry forward to future tax years.

3. Improved Property Marketability: Lower tax burdens can make your property more attractive to potential buyers.

4. Refunds: In some cases, you may be eligible for refunds on overpaid taxes.

Preparing for Your Consultation For Will County Property Tax Appeal Attorney

When meeting with a Will County property valuation lawyer for the first time, come prepared with the following information:

1. Your most recent property tax bill

2. Assessment notices for the current and previous years

3. Any recent appraisals of your property

4. Documentation of property defects or needed repairs

5. Information on comparable properties in your area

The Future of Property Tax Appeals in Will County

As property values continue to fluctuate and local budgets evolve, the landscape of property tax appeals in Will County is likely to change. Staying informed about local real estate trends, changes in assessment practices, and new appeal procedures is crucial. A knowledgeable attorney can help you navigate these changes and continue to advocate for fair property taxation.

Conclusion

Challenging your property tax assessment in Will County can be a complex but potentially rewarding process. With the help of a skilled Will County property tax appeal attorney, you can navigate the intricacies of the appeal system and potentially achieve significant tax savings. By understanding the appeal process, gathering strong evidence, and leveraging the expertise of a legal professional, you can work towards ensuring that your property is fairly assessed and that you’re not overpaying on your real estate taxes.

Remember, every property and every case is unique. While this guide provides a comprehensive overview, consulting with a qualified attorney is the best way to understand your specific situation and the potential for a successful appeal. Don’t let an unfair assessment burden you with excessive taxes – take action and explore your options for appealing your Will County property tax assessment today.

FAQs

Q: How often can I appeal my property taxes in Will County?

A: You can appeal your property taxes annually in Will County. However, you must file your appeal within the specified deadline each year, typically 30 days from the date of your assessment notice.

Q: What are the chances of success in a property tax appeal?

A: Success rates vary, but many property owners do see reductions in their assessments. Working with an experienced attorney can significantly improve your chances of a successful appeal.

Q: How long does the appeal process take in Will County?

A: The timeline can vary, but typically the process takes several months from filing to decision. Your attorney can provide a more specific estimate based on current caseloads and procedures.

Q: Will appealing my property taxes affect my mortgage payments?

A: If your property taxes are escrowed as part of your mortgage payment, a successful appeal resulting in lower taxes could potentially lower your monthly mortgage payment. However, this would depend on your specific mortgage agreement.

Q: Can I appeal my property taxes if I’ve recently purchased the property?

A: Yes, you can appeal your property taxes even if you’ve recently purchased the property. The purchase price can actually be strong evidence in your appeal, especially if it’s lower than the assessed value.

About the Author

Sarah Klein, JD, is an experienced estate planning attorney who has helped clients with wills, trusts, powers of attorney, and probate matters. At All About Lawyer, she simplifies complex estate laws so families can protect their assets, plan ahead, and avoid legal headaches during life’s most sensitive moments.

Read more about Sarah