What is Reasonable Compensation for a Power of Attorney?

When entrusting someone with the responsibility of managing your affairs through a power of attorney (POA), the question of fair remuneration for their services often arises. This comprehensive guide will explore what is reasonable compensation for a power of attorney examining various factors that influence payment, legal considerations, and best practices for determining appropriate fees.

Table of Contents

Understanding Power of Attorney and the Role of an Attorney-in-Fact

Before delving into compensation, it’s crucial to understand what a power of attorney entails and the responsibilities of an attorney-in-fact. A power of attorney is a legal document that grants an individual (the attorney-in-fact or agent) the authority to act on behalf of another person (the principal) in specified matters. This can include financial decisions, healthcare choices, or both, depending on the type of POA.

The attorney-in-fact duties can vary widely, from managing day-to-day financial transactions to making critical healthcare decisions. Given the significance of these responsibilities, it’s understandable that the question of fair compensation arises.

The Concept of Reasonable Compensation Understanding what is reasonable compensation for a power of attorney

The term “reasonable compensation” is intentionally flexible, as what’s considered reasonable can vary based on numerous factors. In general, reasonable compensation for a power of attorney should reflect the time, effort, and expertise required to fulfill the duties outlined in the POA document.

Factors Influencing POA Compensation

Several factors can influence what’s considered appropriate POA fees:

1. Complexity of Duties:

The more complex and time-consuming the responsibilities, the higher the compensation may be.

2. Duration of Service:

Long-term commitments may warrant different compensation structures compared to short-term or one-time tasks.

3. Expertise Required:

If specialized knowledge (e.g., financial management, healthcare expertise) is necessary, this may justify higher compensation.

4. Relationship to the Principal:

Family members often serve without compensation, but this isn’t always the case, especially for long-term or complex situations.

5. Geographic Location:

Compensation norms can vary by region, reflecting differences in cost of living and local practices.

6. Assets Involved:

The value and complexity of the assets being managed can influence compensation rates.

7. Time Commitment:

The amount of time required to fulfill the POA duties is a significant factor in determining fair payment.

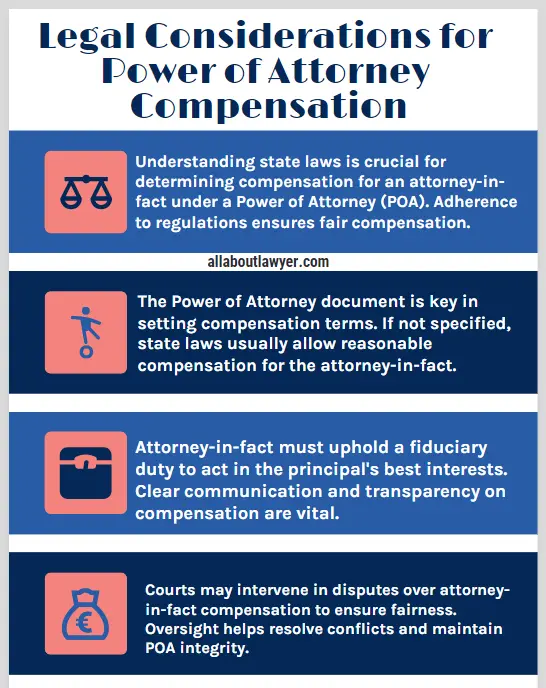

Legal Considerations for Power of Attorney Compensation

When considering attorney-in-fact payment, it’s important to be aware of the legal landscape:

1. State Laws In Compensation for a Power of Attorney:

Some states have specific laws or guidelines regarding POA compensation. It’s crucial to consult local regulations.

2. Power of Attorney Document Specifications:

The POA document itself may specify compensation terms. If it doesn’t, state law typically allows for reasonable compensation.

3. Fiduciary Duty:

The attorney-in-fact has a fiduciary duty to act in the best interests of the principal, which includes being transparent about compensation.

4. Court Oversight:

In some cases, especially with contested compensation, courts may review and determine what constitutes reasonable fees.

Common Compensation Structures For Power of Attorney

There are several ways to structure power of attorney compensation:

1. Hourly Rate:

This is common for professional fiduciaries and can range from $50 to $250 per hour, depending on expertise and location.

2. Flat Fee:

For specific tasks or time periods, a flat fee might be appropriate. This could range from a few hundred to several thousand dollars, depending on the scope.

3. Percentage of Assets:

Some POAs are compensated based on a percentage of the assets they manage, typically ranging from 0.5% to 3% annually.

4. Combination Approach:

Some arrangements use a combination of these methods, such as a base fee plus an hourly rate for extra tasks.

Guidelines for Determining Reasonable Compensation For POAs

When setting or evaluating POA compensation, consider these guidelines:

1. Document Everything: Keep detailed records of time spent, tasks performed, and any expenses incurred.

2. Be Transparent: Discuss compensation openly with all involved parties to avoid misunderstandings.

3. Consider Professional Rates: Look at what professionals (e.g., financial advisors, caregivers) in your area charge for similar services.

4. Evaluate Complexity: Assess the difficulty and responsibility level of the tasks involved.

5. Consider Opportunity Costs: Factor in any lost opportunities or personal sacrifices made by the attorney-in-fact.

6. Seek Professional Advice: Consult with a lawyer or financial advisor to ensure compensation is fair and legally sound.

Potential Pitfalls in Power of Attorney Compensation

While compensation for POA services is often justified, there are potential issues to be aware of:

1. Conflict of Interest: Excessive compensation could be seen as a breach of fiduciary duty.

2. Family Disputes: Compensation can sometimes lead to conflicts among family members, especially if not discussed openly.

3. Tax Implications: Compensation received as a power of attorney is typically considered taxable income.

4. Medicaid Considerations: In some cases, POA compensation could affect Medicaid eligibility for the principal.

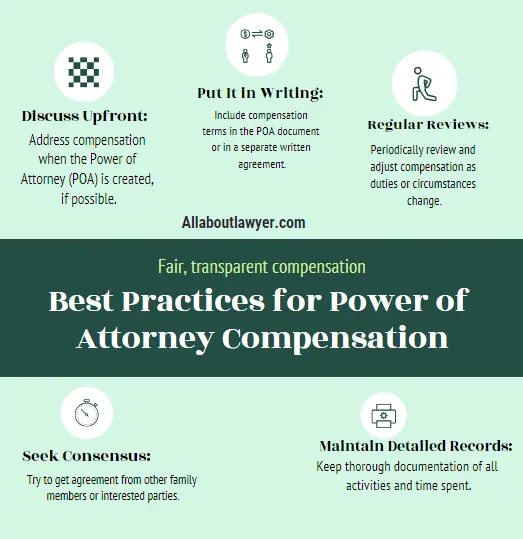

Best Practices for Power of Attorney Compensation

To ensure fair and transparent compensation:

1. Discuss Upfront: Address compensation when the POA is created, if possible.

2. Put It in Writing: Include compensation terms in the POA document or in a separate written agreement.

3. Regular Reviews: Periodically review and adjust compensation as duties or circumstances change.

4. Seek Consensus: Try to get agreement from other family members or interested parties.

5. Maintain Detailed Records: Keep thorough documentation of all activities and time spent.

When Professional Help May Be Needed

In some situations, it may be beneficial to seek professional assistance:

1. Complex Estates: For large or complicated estates, professional management might be warranted.

2. Legal Compliance: To ensure all compensation arrangements comply with state laws and regulations.

3. Dispute Resolution: If conflicts arise over compensation, mediation or legal intervention may be necessary.

4. Tax Planning: To understand and plan for the tax implications of POA compensation.

Conclusion

Determining reasonable compensation for a power of attorney requires careful consideration of various factors, including the scope of responsibilities, time commitment, expertise required, and legal considerations. While there’s no one-size-fits-all answer, the key is to ensure that compensation is fair, transparent, and in line with the fiduciary duties of the attorney-in-fact.

By understanding the factors that influence compensation, being aware of legal considerations, and following best practices, principals and attorneys-in-fact can establish compensation arrangements that are equitable and legally sound. Remember, the goal is to ensure that the person managing your affairs is fairly compensated for their time and effort while always acting in your best interests.

Whether you’re creating a power of attorney, serving as an attorney-in-fact, or trying to determine fair compensation, it’s often beneficial to consult with legal and financial professionals to navigate this complex area effectively.

Related Articles For You:

Is Conservatorship the Same as Power of Attorney?

FAQs

Can a family member serving as power of attorney be compensated?

Yes, family members can be compensated for serving as power of attorney, especially if their duties are extensive or long-term. However, many family members choose to serve without compensation.

How is power of attorney compensation taxed?

Compensation received for serving as a power of attorney is typically considered taxable income and should be reported on your tax return.

Can a power of attorney pay themselves without permission?

While a power of attorney can often pay themselves reasonable compensation, it’s best to have this agreed upon in advance and documented. Taking compensation without prior agreement or disclosure could be seen as a breach of fiduciary duty.

What if the power of attorney document doesn’t mention compensation?

A: If the POA document is silent on compensation, state law typically allows for reasonable compensation. However, it’s best to discuss and agree upon compensation terms with all relevant parties.

Can a court challenge or change power of attorney compensation?

Yes, if compensation is disputed or seems unreasonable, a court can review and potentially modify POA compensation. Courts have the authority to ensure that attorneys-in-fact are not abusing their positions for financial gain.

About the Author

Sarah Klein, JD, is an experienced estate planning attorney who has helped clients with wills, trusts, powers of attorney, and probate matters. At All About Lawyer, she simplifies complex estate laws so families can protect their assets, plan ahead, and avoid legal headaches during life’s most sensitive moments.

Read more about Sarah

Thanks for this article. I would also like to talk about the fact that it can possibly be hard if you are in school and starting out to create a long credit score. There are many scholars who are only trying to endure and have a lengthy or positive credit history are often a difficult matter to have.