11 Words To Stop a Debt Collector? The Truth and What Actually Works

Saying “Please cease and desist all calls and contact with me, immediately” can legally stop communication—but not the debt itself. If you want real protection, invoke your full rights under the FDCPA §809. Here’s how to turn federal law into your strongest shield.

Table of Contents

The “11 Words” Myth vs. Reality

The Myth:

“Please cease and desist all calls and contact with me, immediately.”

This phrase, dubbed the “11-word trick,” is often touted online as a magic bullet to stop debt collectors cold.

The Reality:

- Yes, it can halt direct communication under the Fair Debt Collection Practices Act (FDCPA).

- No, it does not erase debt, prevent lawsuits, or repair credit.

- Think of it as a shield—not a sword.

What Happens When You Use the 11 Words

Once a debt collector receives this cease contact request in writing, they are legally bound to:

- Stop all direct contact—calls, texts, emails, letters.

- Only communicate to confirm receipt or notify of legal action.

IMPORTANT:

Verbal statements hold no legal weight. You must send your request in writing via certified mail with a return receipt.

How to Use the 11 Words Properly

Step-by-Step:

| Step | Action |

| 1 | Write clearly at the top of a letter: “Please cease and desist all calls and contact with me, immediately.” |

| 2 | Include your name, address, account number, and date. |

| 3 | Send it via certified mail with tracking. |

| 4 | Save proof of delivery for future legal action. |

What the 11 Words Don’t Do

- Don’t eliminate the debt: You still owe unless proven invalid.

- Don’t prevent lawsuits: Collectors can still sue if the debt is within the statute of limitations.

- Won’t stop credit damage: Debts can still appear on your credit report for up to 7 years.

Related article: Can You Ignore a Collection Agency?

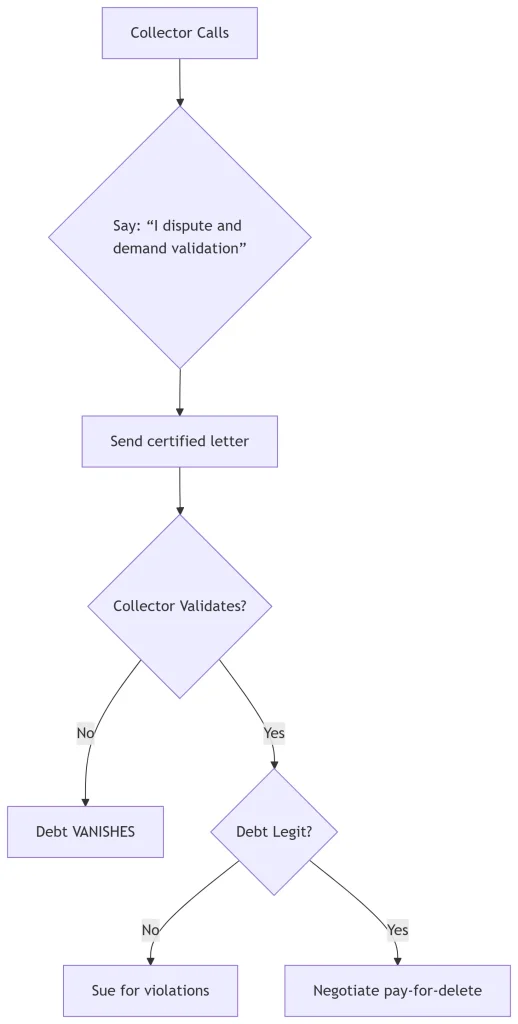

The Real Power Move: Demand Debt Validation

If you truly want to stop collection attempts and force proof, send this instead:

“I dispute this debt and demand written validation under FDCPA §809.”

Why It Works:

- Forces collectors to pause collection until they provide:

- Original creditor’s name/address

- Itemized balance

- Proof of ownership (chain of title)

- Original creditor’s name/address

- Triggers compliance under federal law

- Creates a legal paper trail

Fact: Around 34% of debts are dropped because collectors can’t validate them.

Sample Letter: Debt Validation Request

less

CopyEdit

[Your Name]

[Your Address]

[Date]

[Debt Collector’s Name]

[Collector’s Address]

RE: Account #[XXXX]

I dispute this debt and demand validation under FDCPA §809.

Please provide:

– The original creditor’s full name and address

– A full itemized breakdown of the debt

– Proof that your agency legally owns or collects on this debt

– A copy of the original contract bearing my signature

Until full validation is received, cease all collection efforts.

Sincerely,

[Your Name]

Certified Mail #: [XXXXXXX]

Other Legal Phrases That Work

| Phrase | Legal Effect |

| “I revoke consent to call my cell phone. Contact only by mail.” | Under TCPA, this can yield $500–$1,500 per call if ignored. |

| “This debt is time-barred. Cease collection per FDCPA §805(c).” | Stops collections on debts past the statute of limitations. |

| “I am recording this call.” | Legal in 38 states. Collectors often hang up to avoid liability. |

Your Rights When Collectors Violate the FDCPA

| Collector Violation | Your Legal Response |

| Ignoring validation request | File complaint with CFPB or FTC, or sue for $1,000 per violation. |

| Continuing to call after consent revoked | File a TCPA claim—potentially worth $500–$1,500 per call. |

| Harassment or threats | Document everything. Seek legal counsel. Collectors can face stiff penalties. |

When to Use the Nuclear Options

| Situation | Action |

| Collector threatens arrest or violence | Say: “This call is being recorded. I will sue for FDCPA violations.” |

| Debt isn’t yours | Send identity theft affidavit and police report. |

| Collector contacts employer or family | Include prohibition in your cease letter—FDCPA limits third-party contact. |

What to Do After Sending the Letters

- Track All Communication

Use spreadsheets or apps to document every call, email, and letter. - Dispute Inaccuracies

If the debt is false or outdated, dispute it with credit bureaus. - Negotiate Carefully

Only engage in repayment plans after full validation. Get agreements in writing (ideally with pay-for-delete terms). - Prepare for Court

If sued, respond with a formal Answer promptly. Ignoring a lawsuit can result in default judgment.

Aftermath: Managing Your Credit

| Debt Type | Credit Impact | Solution |

| Invalid | Score may drop | File disputes to remove |

| Valid | -100 to -150 pts | Request pay-for-delete |

| Time-barred | Still reports | Wait for it to fall off (7 years) |

Does This Apply Internationally?

The “11 words” and debt validation letters are based on U.S. law (FDCPA). However:

- Canada, UK, Australia have similar consumer protections.

- Adapt your language based on local regulations.

- Check with your country’s consumer rights office.

Final Takeaway

The 11-word phrase is YOUR shorthand weapon under FDCPA—use it right: in writing, by certified mail, and as part of a broader strategy. It gives you control, reduces harassment, and sets the stage for validation, negotiation, and legal defense. Empower yourself—don’t just react.

About the Author

Sarah Klein, JD, is a former consumer rights attorney who spent years helping clients with issues like unfair billing, product disputes, and debt collection practices. At All About Lawyer, she simplifies consumer protection laws so readers can defend their rights and resolve problems with confidence.

Read more about Sarah