Three Stages of a Records Lifecycle: Creation, Use & Disposition — Legal Requirements & Best Practices

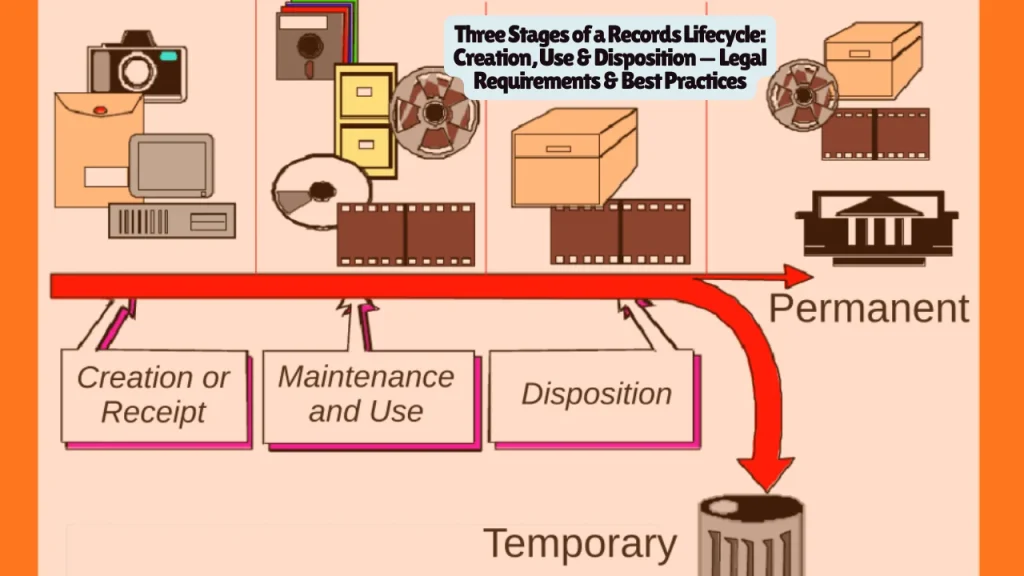

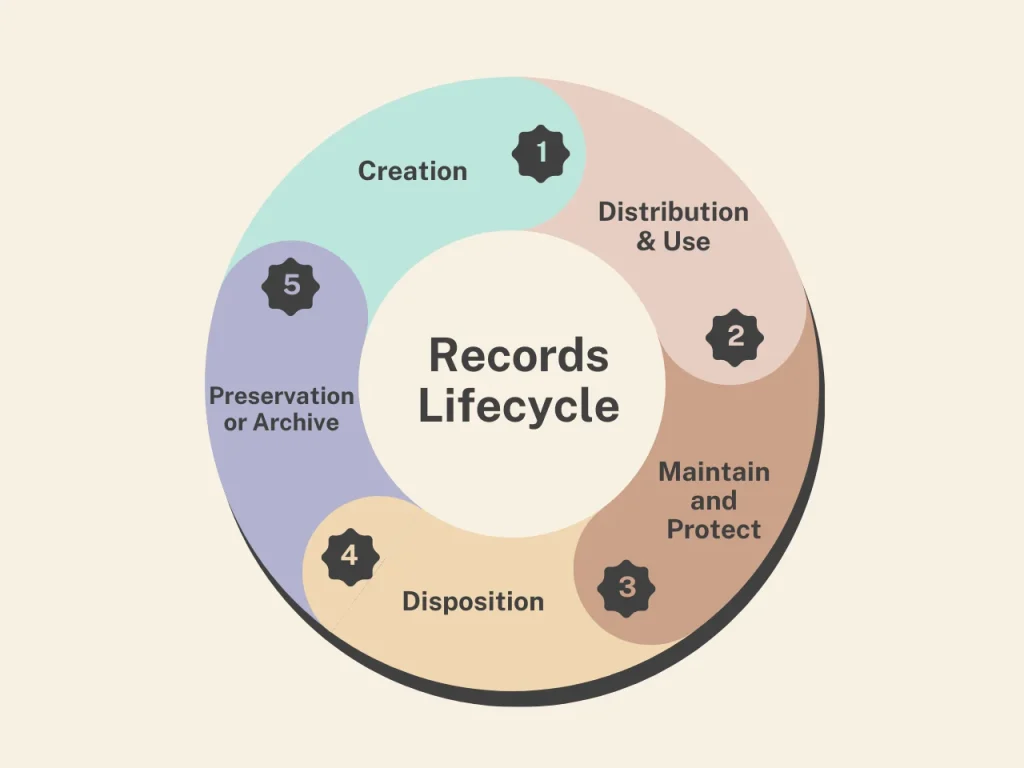

The three stages of a records lifecycle are creation/receipt, maintenance/use, and disposition. These stages govern how organizations create, capture, store, access, and ultimately destroy or preserve business records. Federal laws including the Sarbanes-Oxley Act (5-7 year retention), HIPAA (6 year minimum), and the Federal Records Act impose strict retention requirements, with criminal penalties including 20 years imprisonment for destroying records during federal investigations under 18 U.S.C. § 1519.

What Are the Three Stages of a Records Lifecycle?

The records lifecycle concept originated in the 1930s when Emmett Leahy of the U.S. National Archives developed a program to define records management from creation through destruction or archiving. All records lifecycle models feature three core stages, though terminology varies across frameworks.

Stage 1: Creation/Receipt – Records are generated internally or received from external sources. This stage includes document capture, classification, metadata assignment, and initial storage decisions.

Stage 2: Maintenance/Use – Records are stored, accessed, updated, and protected. Organizations implement access controls, security measures, backup systems, and retrieval protocols during active and inactive use periods.

Stage 3: Disposition – Records reach the end of their retention period and are either destroyed according to approved schedules or transferred to archives for permanent preservation based on historical or legal value.

ISO 15489-1:2016, the international standard for records management adopted in over 50 countries, defines these stages as part of a comprehensive framework ensuring records serve as authoritative evidence of business activity throughout their existence.

What Is the Creation/Receipt Stage?

The creation stage marks when records enter an organization’s custody. Records are created through internal business processes or received from external parties, employees, customers, vendors, or regulatory agencies.

Key Activities During Creation:

- Generating documents through business transactions (contracts, invoices, reports, emails)

- Receiving records from external sources (correspondence, regulatory filings, vendor documentation)

- Capturing records in appropriate systems (physical filing, document management systems, enterprise content management platforms)

- Assigning metadata (date, author, subject, classification level, retention code)

- Classifying records according to organizational taxonomy or file plans

- Applying security controls based on sensitivity levels

- Establishing unique identifiers (file numbers, barcodes, digital signatures)

Legal Requirements at Creation:

Sarbanes-Oxley Section 802 requires that financial records and audit materials be created with controls ensuring accuracy and completeness. Section 404 mandates internal controls for producing accurate financial statements, making the creation stage critical for SOX compliance.

HIPAA requires covered entities to create documentation of policies and procedures for protecting health information. Records must be created “accurately and timely documenting the information” according to the Privacy Rule.

Related article: What Is a Litigation Hold? Legal Duties, Sanctions & How to Implement One

Best Practices for Creation Stage:

Establish clear policies defining what constitutes a record versus transitory information. The National Archives and Records Administration (NARA) defines records as materials documenting business activities, providing evidence of transactions, and supporting legal obligations.

Implement standardized naming conventions and file structures. Consistent naming ensures records can be located quickly and reduces duplication. For example: ProjectName_DocumentType_YYYYMMDD_Version.

Capture comprehensive metadata at creation. ISO 15489 describes metadata as “the fuel that drives the recordkeeping engine”—without it, context disappears, relationships break, and systems fail to function accountably.

Train employees on their recordkeeping responsibilities. Staff must understand which documents qualify as records, how to classify them properly, and where to store them according to organizational policy.

Use templates and forms to standardize record creation. Templates ensure required information is captured consistently and reduce errors that could compromise record integrity.

What Happens During the Maintenance/Use Stage?

The maintenance stage encompasses the period when records provide active business value. Organizations must balance accessibility for legitimate users with security controls protecting sensitive information.

Active vs. Inactive Records:

Active records are referenced regularly—monthly, weekly, or daily—to support ongoing business operations. These records require immediate accessibility, often stored in primary office locations or hot storage systems with fast retrieval capabilities.

Inactive records are accessed less than once monthly but must be retained for legal, fiscal, or audit purposes. Inactive records can be moved to off-site storage facilities or cold storage systems, reducing costs while maintaining availability when needed.

Key Maintenance Activities:

- Storing records in secure, organized repositories (physical storage rooms, cloud systems, document management platforms)

- Implementing access controls based on roles and permissions

- Maintaining backup and disaster recovery systems

- Updating records as business circumstances change

- Tracking record locations and movements

- Monitoring access logs and audit trails

- Migrating records to new systems or formats

- Conducting periodic audits to verify retention compliance

- Applying legal holds when litigation is reasonably anticipated

Legal Requirements During Maintenance:

The Sarbanes-Oxley Act Section 802 mandates a minimum 5-7 year retention period for audit and review documents supporting financial statements. Accountants must retain records for at least 5 years, while work papers supporting financial statements require 7-year retention under subsequent amendments.

HIPAA requires covered entities to maintain HIPAA-related documents for at least 6 years from creation date or last effective date for policies. This includes policies, procedures, audit logs, training records, and business associate agreements under 45 CFR §164.316(b)(1) and (2).

The Gramm-Leach-Bliley Act (GLBA) requires financial institutions to retain email and customer records for 7 years minimum to support regulatory compliance and consumer protection requirements.

State records retention laws vary significantly. California requires employment records for 3-4 years depending on the record type. Texas mandates 5-7 year retention for financial records. Organizations operating in multiple states must comply with the longest applicable retention period.

Access Controls and Security:

Organizations must implement role-based access controls (RBAC) ensuring only authorized personnel can view, modify, or delete records. The principle of least privilege grants users minimum access necessary to perform their job functions.

Encryption protects records during storage and transmission. HIPAA requires encryption of electronic protected health information (ePHI) when appropriate safeguards are applied under the Security Rule.

Audit trails track who accessed records, when, and what actions were taken. SOX compliance requires maintaining detailed logs of financial record access and modifications.

Legal holds suspend normal retention schedules when litigation, government investigations, or audits are reasonably anticipated. Organizations must preserve all potentially relevant records in their current state, even if retention periods have expired. Failure to implement legal holds can result in spoliation sanctions including adverse inference instructions, monetary penalties, and case dismissal.

Best Practices for Maintenance Stage:

Implement comprehensive backup strategies following the 3-2-1 rule: maintain 3 copies of data, on 2 different media types, with 1 copy stored off-site.

Conduct regular records inventories to identify records requiring retention, assess storage costs, and locate records eligible for disposition.

Migrate records proactively to new systems or formats before obsolescence. Waiting until systems fail or formats become unreadable creates recovery challenges and potential compliance gaps.

Train staff on proper record handling including version control, check-in/check-out procedures, and secure disposal of working copies.

Document all record movements, transfers, and system migrations to maintain chain of custody for legal defensibility.

What Does the Disposition Stage Involve?

Disposition is the final lifecycle stage where organizations determine whether to destroy records that have met retention requirements or transfer them to archives for permanent preservation.

Disposition Options:

Destruction – The process of eliminating records beyond possible reconstruction. ISO 15489 defines destruction as complete elimination ensuring records cannot be recovered or restored.

Transfer to Archives – Moving records of enduring historical, legal, or research value to permanent custody in organizational archives or state/federal archives facilities.

Transfer to Successor Organization – Conveying custody to merging companies, acquiring entities, or successor agencies when business operations change hands.

Key Disposition Activities:

- Reviewing retention schedules to identify eligible records

- Obtaining management approval for destruction

- Suspending disposition when legal holds exist

- Documenting destruction with certificates of destruction

- Securely destroying physical records (cross-cut shredding, pulping, incineration)

- Overwriting electronic media multiple times to prevent data recovery

- Transferring permanent records to archives with appropriate metadata and finding aids

- Maintaining disposition logs as evidence of compliance

Legal Requirements for Disposition:

The Sarbanes-Oxley Act Sections 802 and 1102 impose criminal penalties for destroying records to obstruct federal proceedings or investigations. Violations carry up to 20 years imprisonment under 18 U.S.C. § 1519 and § 1512.

These provisions apply to all organizations including nonprofits when federal investigations, audits, Congressional inquiries, or court proceedings are underway or reasonably anticipated. Organizations cannot change retention policies after litigation begins—doing so constitutes evidence destruction.

State records laws govern disposition of government records. Many states require government agencies to obtain approval from state archives or records commissions before destroying records. Unauthorized destruction of public records may constitute criminal violations under state law.

NARA regulations at 36 CFR Part 1228 require federal agencies to obtain authorization from the Archivist of the United States before disposing of any federal records. Agencies submit SF-115 forms requesting disposition authority.

Retention Schedules:

Records retention schedules document how long organizations must maintain records before disposition. Schedules group similar records into series based on function, subject, or business process.

Retention periods derive from three factors: (1) legal and regulatory requirements, (2) operational business needs, and (3) historical or archival value. The longest applicable period governs retention decisions.

Sample retention periods from federal laws:

- Financial statements and audit documents: 5-7 years (SOX)

- HIPAA policies and procedures: 6 years (HIPAA)

- Email records at banks: 7 years (GLBA)

- Employee tax records: 4 years (Fair Labor Standards Act)

- Employee benefit plans: 6 years (ERISA)

- Securities and Exchange Commission filings: Permanent

State laws may impose longer retention periods than federal requirements. Organizations must research all applicable federal, state, and industry-specific retention mandates.

Destruction Methods:

Physical Records:

- Cross-cut shredding rendering documents unreadable

- Pulping converting paper to slurry

- Incineration through licensed disposal services

- Chemical decomposition for highly sensitive records

Electronic Records:

- Data wiping overwriting storage media 3-7 times

- Degaussing using magnetic fields to erase data

- Physical destruction of hard drives, tapes, and storage devices

- Cryptographic erasure destroying encryption keys

Simply deleting files or emptying recycle bins is insufficient. Electronic data remains recoverable through forensic tools. Organizations must overwrite data or physically destroy storage media to meet legal standards for destruction.

Certificates of Destruction:

Maintain documentation proving records were destroyed according to schedule. Certificates should include: record series destroyed, date ranges covered, destruction date, destruction method, quantity destroyed, and signatures of personnel supervising destruction.

Certificates demonstrate compliance during audits, litigation, and regulatory examinations. Without documentation, organizations cannot prove they properly disposed of records containing confidential information.

Best Practices for Disposition Stage:

Implement automated retention management systems that flag records eligible for disposition based on metadata and retention schedules.

Require dual approval for destruction—one person identifying eligible records and another verifying retention compliance before authorizing destruction.

Suspend all disposition when litigation, investigations, or audits commence. Implement litigation hold procedures ensuring preservation until legal matters conclude.

Conduct annual purge days reviewing records eligible for destruction and executing disposal in organized campaigns rather than ad-hoc destruction.

Transfer records of permanent value to archives with comprehensive finding aids, inventories, and metadata ensuring future researchers can locate and understand records.

What Federal Laws Govern Records Management?

Federal Records Act (44 U.S.C. Chapters 21, 29, 31, 33):

Establishes requirements for creating, maintaining, and disposing of federal agency records. Requires agencies to establish records management programs, schedules, and controls. NARA provides oversight and approves disposition authorities.

Sarbanes-Oxley Act of 2002 (Public Law 107-204):

Enacted following Enron and WorldCom accounting scandals. Creates strict requirements for financial record retention and imposes criminal penalties for destruction during federal proceedings.

Section 802 (18 U.S.C. § 1519) prohibits destruction, alteration, or falsification of records with intent to obstruct federal investigations. Violations carry fines and up to 20 years imprisonment.

Section 1102 (18 U.S.C. § 1512) prohibits corruptly altering, destroying, or concealing records to impair their availability in official proceedings. Penalties include up to 20 years imprisonment.

Section 404 requires public companies to implement internal controls ensuring accurate financial statement production, necessitating robust records management systems.

SOX applies directly to publicly traded companies but impacts nonprofits and private companies through provisions prohibiting obstruction of federal proceedings, which apply to all organizations.

Health Insurance Portability and Accountability Act (HIPAA):

Requires covered entities (healthcare providers, insurers, clearinghouses) and business associates to retain HIPAA-related documentation for 6 years minimum under 45 CFR §164.316(b).

Required records include: policies and procedures for protecting health information, audit logs, risk assessments, training records, business associate agreements, and breach notification documentation.

The Privacy Rule does not specify medical record retention periods. Covered entities must follow state medical record laws, which typically range from 5-10 years depending on patient type and record content.

Gramm-Leach-Bliley Act (GLBA):

Mandates financial institutions retain customer records, correspondence, and email for 7 years minimum to comply with consumer protection and financial privacy requirements.

Fair Labor Standards Act (FLSA):

Requires employers to retain wage and hour records for 3 years and supporting documentation (time cards, work schedules, wage computations) for 2 years.

Securities and Exchange Commission (SEC) Rules:

Rule 17a-4 requires broker-dealers to retain communications, trading records, and customer documentation for 3-6 years depending on record type. Electronic records must be stored in non-rewritable, non-erasable format (WORM storage).

Internal Revenue Service (IRS) Requirements:

Requires businesses to retain tax returns and supporting documentation for 3-7 years depending on circumstances. Returns involving substantial underreporting require 6-year retention.

What Are Records Retention Schedules?

Records retention schedules document how long organizations must keep records before disposition. Schedules organize records into series—groups of similar records created through comparable business activities.

Components of Retention Schedules:

Record Series Title: Descriptive name identifying record types (e.g., “Employee Personnel Files,” “General Ledger Records,” “Board Meeting Minutes”)

Description: Explanation of record contents, purpose, and common file types included in the series

Office of Record: Department or unit responsible for maintaining official record copies

Retention Period: Time records must be kept before disposition eligibility, expressed in years, months, or event-based triggers (e.g., “7 years after fiscal year end,” “3 years after employee separation”)

Disposition Authority: Legal citations, regulatory requirements, or business justifications supporting retention periods

Disposition Action: Whether records are destroyed or transferred to archives when retention expires

Example Retention Schedule Entry:

Record Series: Employment Applications (Not Hired)

Description: Applications, resumes, and interview notes for candidates not offered positions

Office of Record: Human Resources

Retention Period: 1 year after application date

Disposition Authority: EEOC regulations 29 CFR §1602.14

Disposition Action: Destroy (shred)

Developing Retention Schedules:

Organizations must conduct comprehensive records inventories identifying all record types, locations, formats, volumes, and current retention practices.

Research applicable legal requirements from federal agencies, state laws, industry regulations, and professional standards. Legal counsel should review schedules to ensure compliance.

Analyze operational business needs determining how long departments require record access for daily operations, reference purposes, and decision-making.

Assess historical value identifying records documenting significant organizational decisions, activities, achievements, or controversies meriting permanent preservation.

Draft schedules organizing records into logical series with clear retention periods. Obtain approval from senior management, legal counsel, and records management committees.

Communicate schedules to all staff with training on applying retention periods correctly. Make schedules easily accessible through intranets, handbooks, and records management systems.

Review and update schedules annually as laws change, new record types emerge, and business needs evolve.

What Best Practices Support Each Lifecycle Stage?

Creation Stage Best Practices:

Develop records management policies approved by senior executives defining organizational records, roles and responsibilities, and compliance obligations.

Implement document templates standardizing information capture and ensuring required metadata is recorded consistently.

Classify records at creation using organizational taxonomies, security classifications, and retention codes linked to approved schedules.

Deploy capture technologies including document scanners, electronic forms, and automated workflows reducing manual data entry and improving accuracy.

Train employees on recordkeeping obligations during onboarding and provide refresher training annually.

Maintenance Stage Best Practices:

Store records in secure repositories with appropriate environmental controls (temperature, humidity, fire suppression) for physical records and redundancy, encryption, and access controls for electronic records.

Implement enterprise content management (ECM) or electronic records management (ERM) systems centralizing records, enforcing retention, and automating workflows.

Conduct quarterly access reviews verifying only authorized personnel retain record access and removing permissions when job duties change.

Perform annual records inventories identifying volumes, locations, and retention status for all record series.

Migrate electronic records proactively to prevent format obsolescence. Monitor technology trends and plan migrations before systems reach end-of-life.

Disposition Stage Best Practices:

Review retention schedules quarterly identifying records eligible for disposition and preparing destruction lists for management approval.

Obtain written authorization before destroying any records. Maintain approval documentation demonstrating compliance.

Use certified destruction services for physical and electronic records. Obtain certificates of destruction as evidence of proper disposal.

Suspend all disposition immediately when litigation, investigations, or audits commence. Communicate legal holds to all staff and monitor compliance.

Transfer permanent records to archives with comprehensive metadata, inventories, and finding aids supporting future access and research.

What Technologies Support Records Lifecycle Management?

Electronic Records Management Systems (ERMS):

Purpose-built platforms managing electronic records throughout their lifecycle. ERMS automate retention, enforce security, track versions, and generate audit trails. Examples include OpenText, IBM FileNet, and Laserfiche.

Enterprise Content Management Systems (ECM):

Broader platforms managing documents, records, web content, digital assets, and business processes. ECM systems include records management modules alongside document management, workflow automation, and collaboration tools. Examples include Microsoft SharePoint, Alfresco, and M-Files.

Document Management Systems (DMS):

Focus on document storage, version control, and collaboration. DMS may include basic retention features but typically lack comprehensive records management capabilities. Examples include DocuWare, Dropbox Business, and Google Workspace.

Retention Management Tools:

Specialized applications managing retention schedules, automating disposition, and enforcing legal holds. Tools integrate with ECM/ERMS platforms to apply retention rules. Examples include Zasio, RecordLion, and Gimmal.

Data Loss Prevention (DLP) Systems:

Monitor data movement, prevent unauthorized transfers, and enforce security policies protecting sensitive records during the maintenance stage.

Backup and Disaster Recovery Solutions:

Ensure records survive system failures, natural disasters, and cyber incidents. Cloud backup services, tape backup systems, and replication technologies support business continuity.

Electronic Discovery (eDiscovery) Platforms:

Search, collect, review, and produce records during litigation. eDiscovery tools identify responsive documents, apply legal holds, and redact privileged information. Examples include Relativity, Exterro, and Everlaw.

Key Technology Features:

Automated Retention: Systems apply retention schedules automatically based on metadata, eliminating manual tracking and reducing compliance risks.

Legal Hold Capabilities: Suspend disposition for records subject to litigation, investigations, or audits while maintaining normal processing for other records.

Audit Trails: Log all record access, modifications, and dispositions creating defensible evidence of compliance.

Version Control: Track document revisions, maintain version history, and restore prior versions when needed.

Security Controls: Enforce role-based access, encrypt sensitive records, and prevent unauthorized access or modification.

Records Declaration: Designate documents as official records subject to retention schedules and protection from unauthorized deletion.

Integration: Connect with email systems, file shares, databases, and business applications capturing records from all sources.

What Are the Legal Risks of Non-Compliance?

Criminal Penalties:

Sarbanes-Oxley violations carry up to 20 years imprisonment and substantial fines under 18 U.S.C. § 1519 and § 1512. Individuals convicted of destroying records during federal investigations face criminal records, incarceration, and restitution obligations.

Civil Penalties:

Regulatory agencies impose fines for retention violations. SEC Rule 17a-4 violations result in fines, trading suspensions, and firm closures. HIPAA violations carry civil penalties from $100 to $50,000 per violation, with annual maximums of $1.5 million per violation category.

Spoliation Sanctions:

Courts impose sanctions when parties destroy, lose, or fail to preserve relevant records during litigation. Sanctions include:

Adverse Inference Instructions: Juries receive instructions that destroyed records likely contained information unfavorable to the destroying party.

Issue or Case Preclusion: Courts may rule against parties on specific issues or dismiss entire cases.

Monetary Sanctions: Courts award opposing parties attorney fees, costs, and compensatory damages for spoliation.

Evidence Exclusion: Courts prohibit parties from introducing evidence or raising defenses.

Recent cases demonstrate significant spoliation consequences. Companies have paid millions in sanctions for failing to preserve electronic records, implement legal holds, or produce documents during discovery.

Regulatory Actions:

Industry regulators can suspend licenses, impose operating restrictions, require compliance monitoring, and pursue enforcement actions against organizations with deficient records management.

Reputational Harm:

Public disclosure of records management failures damages organizational credibility. News coverage of data breaches, lost records, or document destruction erodes customer trust and investor confidence.

Operational Disruptions:

Without proper records management, organizations cannot locate critical information when needed. Missing records delay transactions, impede decision-making, and force expensive reconstruction efforts.

How Should Organizations Implement a Records Management Program?

Step 1: Obtain Executive Sponsorship

Secure commitment from senior leadership including CEO, CFO, and General Counsel. Executive support ensures adequate resources, organizational cooperation, and accountability.

Step 2: Appoint a Records Management Officer

Designate a qualified professional responsible for program oversight, policy development, staff training, and compliance monitoring. The Records Management Officer should report to senior management and have authority to enforce policies.

Step 3: Establish a Records Advisory Board

Create a cross-functional committee including representatives from legal, IT, compliance, operations, and business units. The board reviews policies, approves retention schedules, addresses compliance issues, and provides guidance on records management matters.

Step 4: Conduct a Records Inventory

Document all organizational records including types, locations, volumes, formats, retention practices, and custodians. The inventory reveals what records exist and identifies compliance gaps.

Step 5: Develop Records Management Policies

Create comprehensive policies defining records, establishing roles and responsibilities, outlining lifecycle management procedures, and specifying compliance obligations. Obtain senior management approval and publish policies through employee handbooks, intranets, and training programs.

Step 6: Create Retention Schedules

Develop detailed retention schedules covering all organizational records. Research legal requirements, analyze business needs, assess historical value, and document disposition authorities. Obtain legal counsel review before implementation.

Step 7: Implement Technology Solutions

Deploy ECM, ERMS, or retention management systems supporting automated retention, legal holds, audit trails, and secure disposition. Integrate systems with email, file shares, and business applications to capture records comprehensively.

Step 8: Train Staff

Provide initial training to all employees on records management policies, retention schedules, legal obligations, and proper handling procedures. Conduct annual refresher training and role-specific training for records-intensive positions.

Step 9: Monitor Compliance

Conduct regular audits assessing policy adherence, retention schedule application, security control effectiveness, and disposition execution. Address deficiencies promptly and report findings to senior management.

Step 10: Update Program Continuously

Review and update policies, schedules, and procedures annually as laws change, business operations evolve, and new record types emerge. Monitor legal developments, technology advances, and industry best practices.

What Industry Standards Guide Records Management?

ISO 15489:2016 – Information and Documentation – Records Management:

The global standard for records management defining fundamental concepts and principles. ISO 15489 provides frameworks for creating, capturing, and managing records in any format or technological environment.

The standard covers: records and metadata concepts, policy development, role assignment, monitoring and training, business context analysis, records requirements identification, records controls, and creation/capture/management processes.

ISO 15489 has been adopted in over 50 countries and translated into more than 15 languages. The 2016 revision emphasizes metadata as critical for maintaining context, relationships, and system functionality. Organizations following ISO 15489 demonstrate commitment to internationally recognized best practices.

ARMA International Generally Accepted Recordkeeping Principles:

ARMA International, the leading records management professional association, established eight principles for effective recordkeeping:

Accountability: Assign senior executive responsibility for records management. Designate a Records Management Officer and establish a Records Advisory Board.

Integrity: Construct records management programs ensuring records are complete, accurate, and reliable as evidence.

Protection: Implement safeguards protecting records from unauthorized access, use, disclosure, modification, and destruction.

Compliance: Design programs meeting legal, regulatory, and organizational requirements.

Availability: Maintain records accessible to authorized users when needed for business operations and legal obligations.

Retention: Retain records for appropriate periods based on legal, regulatory, fiscal, operational, and historical requirements.

Disposition: Dispose of records when retention requirements expire using secure destruction methods or archival transfers.

Transparency: Document records management processes, decisions, and actions in transparent, understandable ways.

DoD 5015.2 Standard (Superseded by DoD 5015.02-STD):

The U.S. Department of Defense standard defining requirements for records management software. Many government agencies and defense contractors require systems meeting DoD 5015.2 certification.

The standard specifies mandatory and optional requirements for records declaration, metadata, access controls, retention, disposition, audit trails, and other records management functions.

National Archives and Records Administration (NARA) Guidance:

NARA provides extensive guidance for federal agencies on records management including bulletins, directives, handbooks, and technical specifications. While targeting federal agencies, NARA guidance offers valuable best practices applicable to all organizations.

Key NARA resources include records management handbooks, scheduling guidance, electronic records management requirements, and digitization standards.

Frequently Asked Questions

What is the difference between records and documents?

Records are documents, data, or information maintained as evidence of business activities, legal obligations, or historical value. Not all documents are records. Transitory materials like draft documents, personal notes, and reference copies are not records. Records have permanent or defined retention periods and cannot be deleted casually.

How long should organizations keep email?

Email retention depends on content, not format. Business emails documenting transactions, decisions, or policies are records subject to retention schedules. Retention periods range from 30 days for routine correspondence to permanent retention for significant business communications. SOX requires audit-related emails retained 5-7 years. HIPAA mandates 6-year retention for covered entity emails containing protected health information.

Can organizations change retention policies during litigation?

No. Changing retention policies after litigation is reasonably anticipated constitutes evidence destruction under Sarbanes-Oxley. Organizations must preserve all potentially relevant records in their current state when litigation, investigations, or audits commence. Legal holds suspend normal retention schedules until legal matters resolve.

What is the difference between destruction and deletion?

Destruction means eliminating records beyond possible reconstruction. Simply deleting files or emptying recycle bins does not constitute destruction—data remains recoverable. True destruction requires overwriting electronic media multiple times or physically destroying storage devices. ISO 15489 defines destruction as complete elimination preventing recovery.

Do retention schedules apply to backup tapes?

Yes. Backup tapes containing records subject to retention schedules must be managed according to those schedules. Organizations cannot claim backup tapes are exempt from retention requirements. During litigation, opposing parties can request backup restoration to recover deleted or modified records.

How should organizations handle employee personal files?

Employee personal items stored on company systems may become company records if they contain business-related information. Policies should prohibit storing personal files on company systems and clarify that company-issued devices and storage are for business purposes only. Organizations should allow employees to retrieve personal files before device decommissioning.

What happens when federal and state retention requirements conflict?

Apply the longer retention period. If federal law requires 5-year retention and state law mandates 7 years, retain records for 7 years. Organizations operating in multiple states must comply with the most stringent applicable requirements.

Key Resources:

National Archives and Records Administration (NARA): www.archives.gov – Federal records management guidance and requirements

ARMA International: www.arma.org – Professional association providing standards, training, and certification for records managers

ISO Technical Committee 46/Subcommittee 11: www.iso.org – International standards organization developing records management standards

Society of American Archivists: www.archivists.org – Professional guidance on archival preservation and records of permanent value

Sources: ISO 15489:2016, NARA records management guidance, Sarbanes-Oxley Act (Public Law 107-204), HIPAA regulations (45 CFR Parts 160 and 164), ARMA International standards, verified legal databases, and established records management principles.

Last Updated: December 20, 2025

Legal Disclaimer

This article is provided for informational purposes only and does not constitute legal advice. The information presented is based on publicly available federal laws, regulations, industry standards, and established records management principles current as of December 20, 2025. Legal requirements vary by jurisdiction, industry, and organizational circumstances.

Readers should not rely on this article as a substitute for professional legal counsel. Specific retention requirements depend on applicable federal laws, state laws, industry regulations, and organizational policies. If you require legal advice regarding records management, retention requirements, or compliance obligations, please consult a qualified attorney licensed in your jurisdiction.

AllAboutLawyer.com makes no representations or warranties regarding the accuracy, completeness, or timeliness of the information provided. Laws and regulations governing records management are subject to change, and readers are encouraged to verify current requirements through legal counsel and official government sources.

About the Author

Sarah Klein, JD, is a licensed attorney and legal content strategist with over 12 years of experience across civil, criminal, family, and regulatory law. At All About Lawyer, she covers a wide range of legal topics — from high-profile lawsuits and courtroom stories to state traffic laws and everyday legal questions — all with a focus on accuracy, clarity, and public understanding.

Her writing blends real legal insight with plain-English explanations, helping readers stay informed and legally aware.

Read more about Sarah