Should I Get a Lawyer for Debt Collection? When and Why to Look For Legal Representation

When faced with mounting debts and persistent creditors, many individuals find themselves wondering whether they should look for legal representation for debt recovery or not. This article will explore should you get a lawyer for debt collection, understand various aspects of engaging a lawyer for debt collection, helping you make an informed decision about your financial future.

Table of Contents

Understanding Debt Collection and Legal Representation

Before delving into whether you should hire counsel for unpaid accounts, it’s essential to understand what debt collection entails and how legal representation fits into the process.

Debt collection is the practice of pursuing payments of debts owed by individuals or businesses. When creditors are unable to recover debts on their own, they may turn to debt collection agencies or consider legal action. This is where the question of legal representation comes into play.

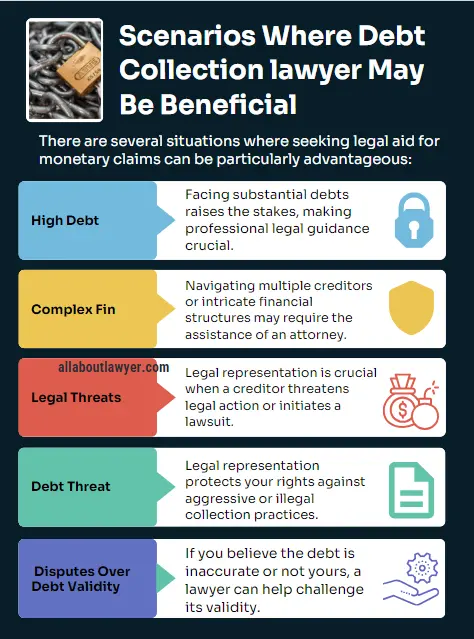

Scenarios Where Debt Collection lawyer May Be Beneficial

There are several situations where seeking legal aid for monetary claims can be particularly advantageous:

1. Large Debt Amounts:

If you’re dealing with substantial debts, the stakes are higher, and professional legal guidance can be crucial.

2. Complex Financial Situations:

For those with multiple creditors or complicated financial structures, an attorney can help navigate the intricacies.

3. Threats of Legal Action:

If a creditor has threatened to sue or has already filed a lawsuit, retaining an attorney for bill collection becomes more pressing.

4. Harassment from Debt Collectors:

When facing aggressive or potentially illegal collection practices, legal representation can help protect your rights.

5. Disputes Over Debt Validity:

If you believe the debt is inaccurate or not yours, a lawyer can help challenge its validity.

Benefits of Hiring a Lawyer for Debt Collection

Engaging legal services for delinquencies can offer several advantages:

1. Expert Knowledge:

Attorneys specializing in debt collection understand the nuances of relevant laws, including the Fair Debt Collection Practices Act.

2. Negotiation Skills:

Lawyers can often negotiate more effectively with creditors, potentially securing better terms or settlements.

3. Legal Protection:

An attorney can shield you from harassing or illegal practices by debt collectors.

4. Strategic Planning:

Legal experts can help develop a comprehensive strategy for addressing your debts, considering options like debt consolidation or bankruptcy.

5. Court Representation:

If your case goes to court, having professional legal representation can significantly impact the outcome.

Potential Drawbacks of Legal Representation

While there are many benefits to enlisting a barrister for fiscal recovery, it’s also important to consider potential drawbacks:

1. Cost: Legal fees can be substantial, potentially adding to your financial burden.

2. Time Investment: Working with an attorney may require significant time and effort on your part.

3. No Guaranteed Outcome: Even with legal representation, there’s no guarantee of a favorable result.

4. Potential for Escalation: In some cases, involving a lawyer might escalate the situation, leading to more aggressive action from creditors.

Alternatives to Hiring A Debt Collection Attorney

Before deciding to contract a solicitor for financial dues, consider these alternatives:

1. Credit Counseling: Non-profit credit counseling agencies can provide advice and potentially help negotiate with creditors.

2. Debt Settlement Companies: These organizations negotiate with creditors on your behalf, though be cautious of potential risks and fees.

3. DIY Negotiation: For smaller debts or straightforward cases, you might be able to negotiate directly with creditors.

4. Debt Consolidation: Combining multiple debts into a single loan with potentially better terms can be an option for some.

When Legal Representation is Crucial

There are certain situations where acquiring an advocate for monetary pursuit becomes particularly important:

1. Lawsuit Threats or Filings: If you’ve been served with a lawsuit, immediate legal representation is crucial.

2. Wage Garnishment: If creditors are threatening to garnish your wages, a lawyer can help protect your income.

3. Asset Seizure: When facing the potential loss of property or assets, legal guidance is essential.

4. Bankruptcy Considerations: If you’re considering bankruptcy, consulting with an attorney is virtually mandatory.

The Process of Working with a Debt Collection Attorney

If you decide to secure counsel for payment collection, here’s what you can expect:

1. Initial Consultation: Most attorneys offer a free or low-cost initial consultation to assess your case.

2. Case Evaluation: Your lawyer will review your financial situation and the details of your debts.

3. Strategy Development: Based on your circumstances, the attorney will develop a plan of action.

4. Negotiation or Litigation: Depending on the strategy, your lawyer will either negotiate with creditors or represent you in court.

5. Resolution: The goal is to reach a resolution that improves your financial situation, whether through settlement, debt reduction, or other means.

Costs of Debt Collection Attorney

The expense of obtaining a legal expert for bill pursuit varies widely based on factors such as:

1. Case Complexity: More complex cases generally incur higher fees.

2. Attorney’s Experience: More experienced lawyers typically charge higher rates.

3. Fee Structure: Attorneys may charge hourly rates, flat fees, or contingency fees (a percentage of the debt reduced or eliminated).

4. Geographic Location: Legal fees can vary significantly based on your location.

Choosing the Right Attorney

If you decide to employ a lawyer for financial recovery, consider these factors:

1. Specialization: Look for an attorney who specializes in debt collection or consumer rights.

2. Experience: Consider the lawyer’s track record in handling cases similar to yours.

3. Reputation: Research online reviews and ask for references.

4. Communication Style: Choose an attorney whose communication style aligns with your preferences.

5. Fee Structure: Ensure you understand and are comfortable with the lawyer’s fees before proceeding.

Legal Strategies for Debt Resolution

A skilled attorney can employ various legal strategies for debt resolution:

1. Debt Validation: Challenging the validity of the debt and requiring creditors to prove its legitimacy.

2. Negotiation: Working out payment plans or settlements with creditors.

3. Legal Defense: If sued, mounting a defense based on factors like statute of limitations or improper documentation.

4. Bankruptcy Filing: In severe cases, guiding you through the bankruptcy process.

5. Fair Debt Collection Practices Act (FDCPA) Claims: Pursuing claims against debt collectors who violate federal law.

The Impact of Legal Representation on Credit

It’s important to consider how engaging a lawyer might affect your credit:

1. Short-Term Impact: Legal action might temporarily lower your credit score.

2. Long-Term Benefits: Successfully resolving debts can ultimately improve your credit situation.

3. Credit Report Accuracy: A lawyer can help ensure that resolved debts are accurately reported to credit bureaus.

Conclusion

The decision to get a lawyer for debt collection and Know how much a debt lawyer cost is highly personal and depends on your specific financial situation, the amount and nature of your debts, and the actions of your creditors. While legal representation can provide expert guidance, protection, and potentially better outcomes, it also comes with costs and is not always necessary for every debt situation.

Before making a decision, carefully assess your financial circumstances, consider the potential benefits and drawbacks of legal representation, and explore all available options. In many cases, consulting with a lawyer for an initial assessment can provide valuable insights, even if you ultimately decide not to retain their services for the entire process.

Remember, the goal is to resolve your debt issues in the most effective and least damaging way possible. Whether that involves hiring an attorney or pursuing alternative solutions, the key is to take proactive steps towards regaining your financial health and peace of mind.

Related Articles For You:

Who Pays the Debts in a Divorce? Financial Responsibility in the UK

FAQs

How much does it typically cost to hire a lawyer for debt collection issues?

A: Costs can vary widely, from a few hundred dollars for simple consultations to several thousand for complex cases. Many lawyers offer free initial consultations and various fee structures, including hourly rates, flat fees, or contingency arrangements.

Can a lawyer prevent debt collectors from contacting me?

A: Yes, once you have legal representation, debt collectors are generally required to communicate through your attorney rather than contacting you directly.

Will hiring a lawyer guarantee that my debts will be forgiven or reduced?

A: No, there are no guarantees in debt resolution. However, a lawyer can often negotiate more effectively and may be able to secure better terms or settlements than you could on your own.

Is it worth getting a lawyer for a small amount of debt?

A: For small debts, the cost of legal representation may outweigh the potential benefits. Consider the amount of debt versus the cost of legal services when making your decision.

About the Author

Sarah Klein, JD, is a former consumer rights attorney who spent years helping clients with issues like unfair billing, product disputes, and debt collection practices. At All About Lawyer, she simplifies consumer protection laws so readers can defend their rights and resolve problems with confidence.

Read more about Sarah