Property Tax Appeal Lawyer Fees | Costs, Fee Structures, and Value for Your Case

Facing a high property tax bill? Property tax appeal lawyers can help, but understanding property tax appeal lawyer fees is crucial. This comprehensive guide explores factors affecting lawyer fees and strategies for navigating the process cost-effectively. Whether you’re a homeowner or property investor, knowing the ins and outs of property tax appeal costs can save you money and headaches.

This guide is intended for homeowners and property owners considering hiring a lawyer to appeal their property tax assessment.

Table of Contents

Understanding Property Tax Appeals

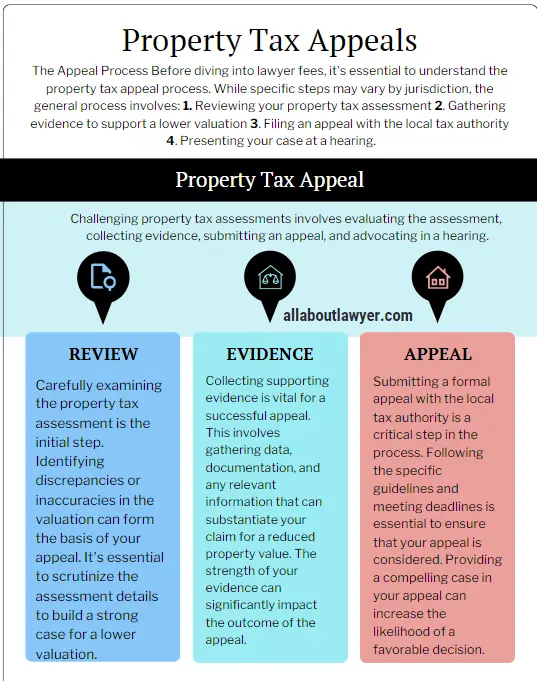

The Appeal Process

Before diving into lawyer fees, it’s essential to understand the property tax appeal process. While specific steps may vary by jurisdiction, the general process involves:

1. Reviewing your property tax assessment

2. Gathering evidence to support a lower valuation

3. Filing an appeal with the local tax authority

4. Presenting your case at a hearing

While it’s possible to handle this process yourself, hiring a lawyer can offer several benefits:

– Expertise in local property tax laws

– Experience negotiating with tax authorities

– Higher success rates in reducing assessments

However, these benefits come at a cost. Let’s explore the factors that influence property tax appeal lawyer fees.

Factors Affecting Property Tax Appeal Lawyer Fees

Complexity of the Case

Complex cases involving high-value properties or intricate legal issues tend to incur higher fees. Factors that can increase complexity include:

– Commercial or industrial properties

– Properties with unique features or recent improvements

– Cases involving multiple parcels or years of assessment

Lawyer’s Experience

Experienced property tax appeal lawyers often command higher fees but may offer a higher success rate. When considering a lawyer’s experience, look at:

– Years of practice in property tax law

– Track record of successful appeals

– Familiarity with local tax authorities and processes

Location

Legal fees can vary depending on the lawyer’s location and the local market. For example, property tax appeal lawyers in major metropolitan areas typically charge higher rates than those in smaller towns.

Common Fee Structures

Hourly Rate

Many lawyers charge an hourly rate for their time spent working on your case. Hourly rates can range from $150 to $500 or more, depending on the factors mentioned earlier.

Pros:

– You only pay for the time spent on your case

– Transparent billing

Cons:

– Costs can be unpredictable

– May be more expensive for complex cases

Contingency Fee

A popular option for property tax appeals is the contingency fee structure. Under this arrangement, the lawyer receives a percentage of the tax savings achieved.

Pros:

– No upfront costs

– Lawyer is incentivized to maximize your savings

Cons:

– You may pay more if the savings are substantial

– Some lawyers may be selective about which cases they take on contingency

Typical contingency fees range from 25% to 50% of the first year’s tax savings.

Flat Fee

Some lawyers offer a flat fee for specific appeal stages or the entire process. This can provide cost certainty but may be less common for complex cases.

Pros:

– Predictable costs

– Can be more affordable for straightforward cases

Cons:

– May not cover unexpected complications

– Lawyer may be less incentivized to maximize savings

Strategies for Managing Costs Property Tax Appeal Lawyer Fees

Compare Fee Structures

Obtain quotes from multiple lawyers to compare their fee structures and find the best fit for your budget. Don’t be afraid to ask for detailed breakdowns of potential costs.

Gather Information

The more information you gather about your property’s value and comparable properties, the less lawyer time may be needed. This can help reduce costs, especially if you’re paying an hourly rate.

Key information to collect:

– Recent sales data for similar properties

– Documentation of your property’s condition

– Any factors that might negatively impact value

Consider Alternatives

In some cases, appealing directly to the assessor’s office might be an option, though success rates can be lower. Consider the complexity of your case and your comfort level with the process before deciding to go it alone.

Conclusion

Property tax appeal lawyer fees can vary widely, but understanding the factors involved and exploring cost-management strategies can empower you to make informed decisions. Weigh the potential cost savings from a successful appeal against the lawyer’s fees to determine if professional help is worth it for your situation.

Remember, this guide offers general information, and seeking personalized legal advice from a qualified professional is always recommended for your specific case.

Related Articles For You:

Kentucky Property Right-of-Way Laws

FAQs

Q: Is it always worth hiring a lawyer for a property tax appeal?

A: Not necessarily. If the potential tax savings are low, the lawyer’s fees might outweigh the benefit. Consider the complexity of the case and your comfort level navigating the appeal process. For high-value properties or complex situations, a lawyer’s expertise can often justify the cost.

Q: What information should I gather before consulting with a lawyer?

A: Collect your property tax assessment notice, recent comparable property sales data, and any documentation supporting your valuation argument. This might include:

– Photos of your property’s condition

– Recent appraisals

– Information about nearby properties that sold for less than your assessment

Q: Can I negotiate the lawyer’s fees?

A: In some cases, negotiation might be possible, particularly for hourly rates or flat fees. Be upfront about your budget and inquire about potential fee structures. Some lawyers may be willing to work out a custom arrangement, especially for long-term clients or multiple properties.

By understanding these key aspects of property tax appeal lawyer fees, you’ll be better equipped to navigate the process and potentially reduce your property tax burden cost-effectively.

About the Author

Sarah Klein, JD, is a former civil litigation attorney with over a decade of experience in contract disputes, small claims, and neighbor conflicts. At All About Lawyer, she writes clear, practical guides to help people understand their civil legal rights and confidently handle everyday legal issues.

Read more about Sarah