Naples Consumer Bankruptcy Law | Financial Expert Legal Insights to Financial Recovery In Southwest Florida

In the picturesque city of Naples, Florida, known for its stunning beaches and luxurious lifestyle, financial struggles can still affect residents. When debt becomes out of hands, understanding Naples consumer bankruptcy law becomes crucial for those seeking a fresh financial start. This comprehensive guide will explore the intricacies of bankruptcy law in Naples, offering insights into the process, options available, and how it can provide a path to financial recovery.

Table of Contents

Understanding Consumer Bankruptcy Law in Naples

Consumer bankruptcy is a legal process designed to help individuals overwhelmed by debt to either eliminate their debts or create a manageable repayment plan. In Naples, as in the rest of Florida, consumer bankruptcy is governed by both federal and state laws, providing residents with specific protections and options.

Types of Consumer Bankruptcy Available in Naples

There are two primary types of consumer bankruptcy available to Naples residents:

1. Chapter 7 Bankruptcy:

Often referred to as “liquidation bankruptcy,” this option allows individuals to discharge most unsecured debts.

2. Chapter 13 Bankruptcy:

Known as “reorganization bankruptcy,” this option enables individuals with regular income to create a repayment plan to pay off their debts over time.

Each type has its own eligibility requirements and implications, which a qualified Naples bankruptcy attorney can help you navigate.

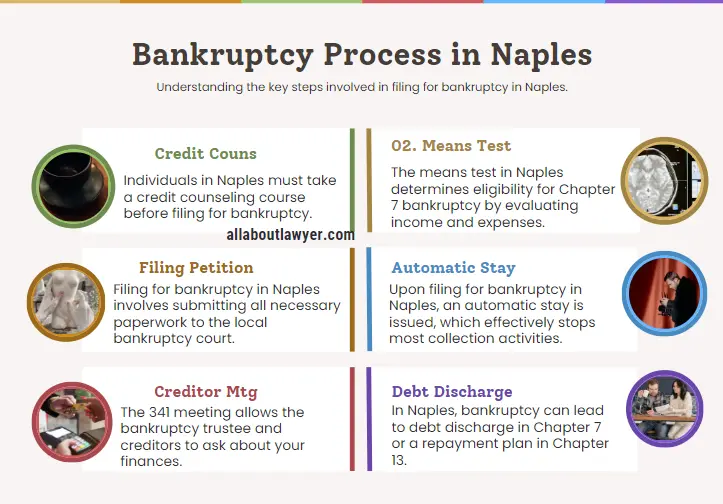

The Bankruptcy Process in Naples

Filing for bankruptcy in Naples involves several key steps:

1. Credit Counseling:

Before filing, individuals must complete a credit counseling course from an approved provider.

2. Means Test:

This determines eligibility for Chapter 7 bankruptcy based on income and expenses.

3. Filing the Petition:

This involves submitting necessary paperwork to the Naples bankruptcy court.

4. Automatic Stay:

Upon filing, an automatic stay goes into effect, halting most collection activities.

5. Creditor Meeting:

Also known as a 341 meeting, this is where the bankruptcy trustee and creditors can ask questions about your financial situation.

6. Debt Discharge or Plan Confirmation:

Depending on the type of bankruptcy, debts are either discharged (Chapter 7) or a repayment plan is confirmed (Chapter 13).

Bankruptcy Exemptions in Naples

Florida bankruptcy code provides specific exemptions that allow filers to protect certain assets. Some key exemptions include:

– Homestead Exemption: Protects unlimited value in a primary residence under certain conditions.

– Personal Property Exemption: Protects up to $1,000 in personal property ($4,000 if not claiming homestead).

– Motor Vehicle Exemption: Protects up to $1,000 equity in a motor vehicle.

– Wildcard Exemption: Up to $4,000 in any property if not claiming homestead.

Understanding these exemptions is crucial in determining how bankruptcy will affect your assets.

The Role of a Naples Consumer Bankruptcy Attorney

the complexities of Naples consumer bankruptcy law can be challenging. A qualified bankruptcy attorney can provide invaluable assistance by:

– Assessing your financial situation

– Advising on the best type of bankruptcy for your circumstances

– bankruptcy petition preparation

– Representing you in court and at the creditor meeting

– Ensuring compliance with all legal requirements

Alternatives to Bankruptcy in Naples

Before deciding on bankruptcy, it’s worth exploring alternatives that may be suitable for your situation:

1. Debt Consolidation: Combining multiple debts into a single, more manageable payment.

2. Debt Negotiation: Working with creditors to reduce the amount owed.

3. Credit Counseling: Receiving guidance on budgeting and debt management.

A Naples financial rehabilitation expert can help you explore these options and determine the best course of action.

The Impact of Bankruptcy on Your Credit

While bankruptcy can provide relief from overwhelming debt, it’s important to understand its impact on your credit:

– A bankruptcy filing can remain on your credit report for up to 10 years.

– Your credit score will likely decrease initially.

– You may face challenges obtaining credit in the short term.

However, with proper management, it’s possible to begin rebuilding your credit soon after bankruptcy.

Life After Bankruptcy in Naples

Filing for bankruptcy isn’t the end of your financial journey. Post-bankruptcy credit rebuilding is an important step towards financial recovery. Some strategies include:

– Obtaining a secured credit card

– Making timely payments on all obligations

– Monitoring your credit report for errors

– Creating and sticking to a budget

Recent Changes in Naples Consumer Bankruptcy Law

Bankruptcy laws can change, affecting the process and options available. Recent changes that Naples residents should be aware of include:

– Adjustments to income limits for Chapter 7 eligibility

– Changes to exemption amounts

– Modifications to the means test calculations

Staying informed about these changes is crucial when considering bankruptcy.

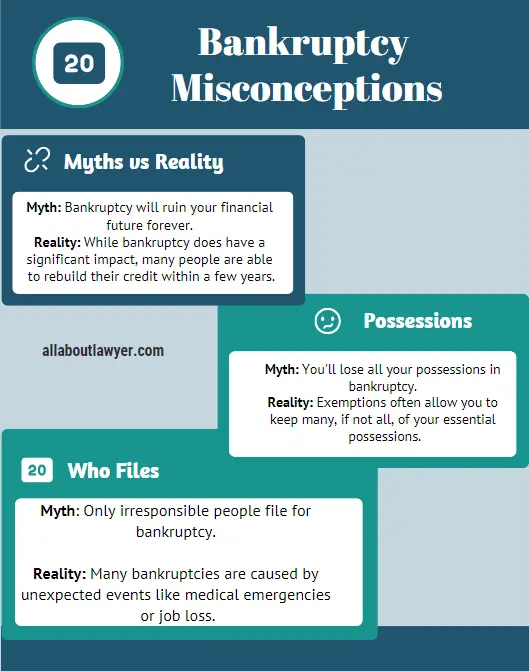

Common Misconceptions About Bankruptcy in Naples

There are several myths surrounding bankruptcy that can deter people from seeking help:

1. Myth: Bankruptcy will ruin your financial future forever.

Reality: While bankruptcy does have a significant impact, many people are able to rebuild their credit within a few years.

2. Myth: You’ll lose all your possessions in bankruptcy.

Reality: Exemptions often allow you to keep many, if not all, of your essential possessions.

3. Myth: Only irresponsible people file for bankruptcy.

Reality: Many bankruptcies are caused by unexpected events like medical emergencies or job loss.

Understanding the reality behind these myths can help you make an informed decision about bankruptcy.

Choosing the Right Bankruptcy Attorney in Naples

When seeking a Naples bankruptcy attorney, consider the following factors:

– Experience with Naples consumer bankruptcy law

– Track record of successful cases

– Communication style and availability

– Fees and payment structure

– Client reviews and testimonials

Taking the time to find the right attorney can significantly impact your bankruptcy experience and outcome.

Conclusion

Naples consumer bankruptcy law provides a pathway to financial recovery for those struggling with overwhelming debt. While the process can be complex, understanding your options and seeking professional guidance can help you navigate this challenging time and emerge with a fresh financial start.

Remember, bankruptcy is not a sign of failure, but a tool for financial rehabilitation. If you’re facing insurmountable debt in Naples, don’t hesitate to explore your options under consumer bankruptcy law. With the right approach and guidance, you can overcome your financial challenges and build a more stable financial future.

FAQs

Q: How long does the bankruptcy process typically take in Naples?

A: The duration can vary, but generally, Chapter 7 bankruptcies can be completed in 3-6 months, while Chapter 13 plans typically last 3-5 years.

Q: Will I lose my home if I file for bankruptcy in Naples?

A: Not necessarily. Florida’s generous homestead exemption often allows filers to keep their primary residence, subject to certain conditions.

Q: Can I file for bankruptcy without a lawyer in Naples?

A: While it’s possible to file pro se (without a lawyer), it’s generally not recommended due to the complexity of bankruptcy laws and procedures.

Q: How often can I file for bankruptcy in Naples?

A: You can file for Chapter 7 bankruptcy once every 8 years, or Chapter 13 once every 2 years, though there are some exceptions to these rules.

Q: Will bankruptcy stop wage garnishment in Naples?

A: Yes, the automatic stay that goes into effect upon filing bankruptcy will halt most wage garnishments, with some exceptions for certain types of debts.

About the Author

Sarah Klein, JD, is a former consumer rights attorney who spent years helping clients with issues like unfair billing, product disputes, and debt collection practices. At All About Lawyer, she simplifies consumer protection laws so readers can defend their rights and resolve problems with confidence.

Read more about Sarah