Is Polymarket Legal in the US? How to Access Polymarket Legally Without Getting Banned

Yes, But It’s Complicated

Yes, Polymarket is legal at the federal level in the US. The platform received CFTC approval in September 2025 and relaunched with regulated operations in late 2025. However, state-level legal battles continue, and access remains limited through a waitlist system as of February 2026.

Why This Matters to You

This affects you if you’re considering using Polymarket to trade on political outcomes, sports events, or other real-world predictions. Understanding Polymarket’s legal status could save you from account freezes, potential fund loss, or accessing an illegal platform in your state. The regulatory landscape changed dramatically in 2025-2026, shifting from an outright US ban to conditional federal approval with ongoing state challenges.

What You Came to Know

Is Polymarket Currently Legal in the United States?

As of February 2026, Polymarket operates legally under federal law following CFTC approval. In July 2025, the platform acquired QCEX for $112 million—a CFTC-licensed derivatives exchange and clearinghouse. This acquisition allowed Polymarket to bypass years of regulatory battles and re-enter the US market through an “Amended Order of Designation” granted by the CFTC in September 2025.

The platform officially relaunched US operations in December 2025, but only through an invite-only waitlist system. Trading volume on the US app hit $450 million in its first month, but most Americans still cannot access it freely.

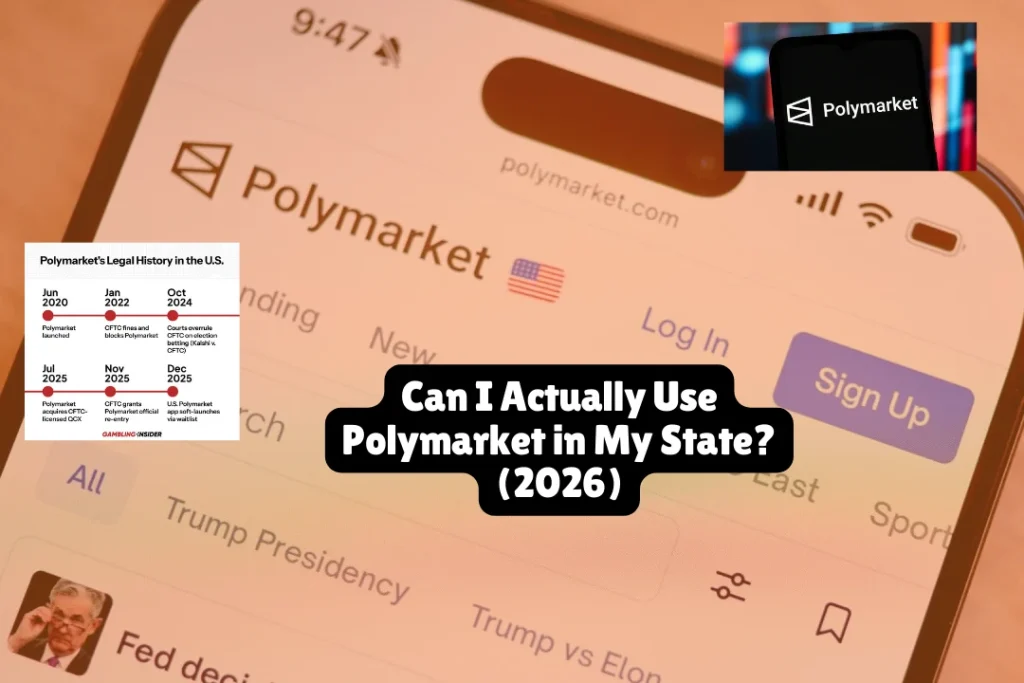

How Polymarket’s Legal Status Changed (2022-2026)

In January 2022, the CFTC fined Polymarket $1.4 million for operating an unregistered futures exchange. The company was forced to block all US users and operate offshore for nearly four years. During this exile period, Polymarket’s trading volume exploded globally—reaching over $3 billion monthly by October 2025.

The DOJ and CFTC investigations into whether Polymarket continued serving US users were formally dropped in July 2025, clearing the path for its regulated return.

What Makes the US Version Different

The US version of Polymarket operates nothing like the global platform. Here’s the truth: American users now face strict KYC requirements, must fund accounts through regulated brokers, and can only access approved event contracts. The global version allows direct crypto wallet connections, while US users go through a heavily regulated workflow that resembles traditional financial services more than crypto betting.

Bottom line: There are two Polymarkets in 2026—a global crypto-native version and a US regulated version operating under CFTC oversight.

State-Level Legal Challenges Threatening Access

Here’s what most sites won’t tell you: Federal approval doesn’t guarantee access in your state. In January 2026, Nevada’s Gaming Control Board filed a civil complaint seeking to prevent Polymarket from offering event contracts to Nevada residents without a state gaming license. Massachusetts courts have issued preliminary injunctions against similar platforms like Kalshi, ruling prediction market contracts function as illegal sports wagering under state law.

As of February 2026, at least 19 states have taken legal action against prediction market platforms. California, New York, Florida, and Texas remain accessible for now, but state attorneys general are actively evaluating whether prediction markets violate gambling laws. This creates a patchwork of uncertainty where your access could be blocked despite federal legality.

What You Must Know

The Insider Trading Problem Nobody’s Solving

In January 2026, a newly created Polymarket account made over $400,000 from betting on events involving Venezuela—just hours before they happened publicly. The trader placed $30,000 on specific outcomes that materialized within days, raising obvious insider trading red flags.

CFTC Chairman Michael Selig acknowledged in January 2026 that the agency is “still grappling” with how to address insider trading on prediction markets. Unlike stock markets where SEC rules apply, prediction markets exist in a regulatory gray area. No individual user has been prosecuted yet for insider trading on CFTC-regulated prediction markets, but that could change.

Your Account Could Still Be Frozen

Even with federal approval, Polymarket aggressively monitors for suspicious trading patterns. If you’re flagged for potential insider information use, your funds can be frozen immediately. The platform also uses sophisticated geoblocking and wallet analysis. If you try accessing the global version with a VPN to avoid KYC, your account may be permanently banned per the 2022 CFTC settlement terms.

The Waitlist Reality

As of February 2026, Polymarket’s US launch remains incomplete. Despite promises of a full rollout in late 2025, most Americans still cannot access the platform. Industry analysts expect the 500,000-user mark by end of Q1 2026, but there’s no guaranteed timeline for when the waitlist opens to everyone.

What to Do Next

Check Your State’s Legal Status

Visit your state attorney general’s website and search for guidance on prediction markets or event contracts. States like Nevada have explicitly filed complaints, while others remain silent. The FanDuel Faces Multiple Lawsuits situation shows how quickly state-level enforcement can shift against betting platforms.

Monitor CFTC Guidance

Visit the CFTC’s official website (cftc.gov) for updates on prediction market regulations. Chairman Selig announced in January 2026 that new rules for prediction markets are being drafted. These rules will establish “clear standards” for platforms like Polymarket and address ongoing questions about insider trading, market manipulation, and state jurisdiction conflicts.

Understand the Financial Risks

You can lose 100% of your investment if your prediction is incorrect. Additionally, state-level legal battles could result in your account being banned or frozen despite federal CFTC approval. Never invest money you cannot afford to lose completely.

💡 Pro Tip

Subscribe to the CFTC’s press release list and follow major prediction market litigation. The legal landscape changes monthly—what’s legal today in your state could face enforcement action tomorrow. Nevada’s January 2026 complaint against Polymarket shows states aren’t backing down despite federal approval.

FAQs

Can US users access Polymarket in 2026?

Yes, but only through an invite-only waitlist system requiring full KYC verification and regulated broker accounts. Most Americans still cannot access the platform as of February 2026.

Is Polymarket legal in all 50 states?

No. Federal CFTC approval doesn’t override state gambling laws. Nevada filed a civil complaint in January 2026, and Massachusetts courts have ruled similar platforms violate state law. Access varies by state.

What happened to the old Polymarket before 2025?

The CFTC fined Polymarket $1.4 million in January 2022 for operating without registration. The platform blocked US users and operated offshore until acquiring QCEX in July 2025 and receiving CFTC approval in September 2025.

Can I use a VPN to access Polymarket’s global version?

No. Using a VPN to bypass geoblocking violates Polymarket’s terms and the 2022 CFTC settlement. The platform uses wallet analysis to detect US users on the global version and will freeze your funds if caught.

Is insider trading illegal on Polymarket?

The legal status remains unclear. The CFTC acknowledged in January 2026 it’s “grappling with this difficult question.” No users have been prosecuted yet, but suspicious trades involving the Venezuela events in January 2026 are under scrutiny.

How is Polymarket different from sports betting apps like FanDuel?

Polymarket operates under CFTC regulation as a commodity exchange, while sports betting apps are regulated state-by-state under gambling laws. Polymarket argues its event contracts are fundamentally different from gambling, though some states disagree.

What’s the biggest risk of using Polymarket right now?

State-level enforcement action. Even with federal approval, your state could file a complaint prohibiting Polymarket from operating in your jurisdiction, potentially freezing your account or blocking access mid-trade.

Disclaimer: This article provides general information about Polymarket’s legal status in the United States and is not legal advice. Polymarket’s regulatory status continues evolving as state and federal agencies address prediction market oversight. The legal status of Polymarket varies by jurisdiction and may change as regulations develop. AllAboutLawyer.com does not provide legal services, does not represent Polymarket, and is not affiliated with the platform. For specific legal advice about using Polymarket or prediction markets in your state, consult a qualified attorney or contact your state’s attorney general office and regulatory authorities including the CFTC and SEC.

Want to stay updated on financial regulations and emerging legal issues? Explore more legal guides at AllAboutLawyer.com covering consumer protection, regulatory compliance, and your rights in the digital economy.

Stay informed, stay protected. — AllAboutLawyer.com

Last Updated: February 9, 2026 — We keep this current with the latest legal developments

About the Author

Sarah Klein, JD, is a licensed attorney and legal content strategist with over 12 years of experience across civil, criminal, family, and regulatory law. At All About Lawyer, she covers a wide range of legal topics — from high-profile lawsuits and courtroom stories to state traffic laws and everyday legal questions — all with a focus on accuracy, clarity, and public understanding.

Her writing blends real legal insight with plain-English explanations, helping readers stay informed and legally aware.

Read more about Sarah