How to File a Wage and Hour Complaint Report? Step-by-Step Wage Claim Process

One of the most fundamental aspects of employment is fair compensation for your time and effort. Unfortunately, wage and hour violations are not uncommon, leaving many workers shortchanged and frustrated. If you believe your employer has violated wage and hour laws, it’s essential to know How to File a Wage and Hour Complaint and seek resolution. This article guide will walk you through the process of submitting a wage claim and help you navigate the complexities of labor disputes.

Understanding Wage and Hour Laws

Before delving into the complaint process, it’s important to understand the basics of wage and hour laws. These regulations are designed to protect workers’ rights and ensure fair compensation. The primary federal law governing wages and work hours is the Fair Labor Standards Act (FLSA), but many states have additional labor laws that may provide even greater protections.

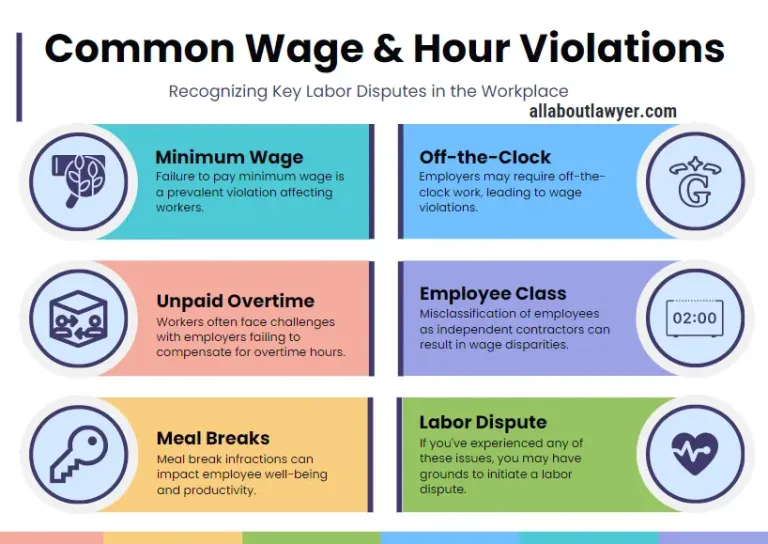

Common wage and hour violations include:

1. Failure to pay minimum wage

2. Unpaid overtime

3. Meal break infractions

4. Off-the-clock work requirements

5. Misclassification of employees as independent contractors

If you’ve experienced any of these issues, you may have grounds to initiate a labor dispute.

Gathering Evidence for Your Claim

Before you submit a wage claim, it’s crucial to gather all relevant documentation to support your case. This evidence will be essential during the investigation procedure and any potential administrative hearing. Collect the following items:

1. Pay stubs

2. Time records

3. Employment contract or offer letter

4. Job description

5. Any communication records related to your work hours or pay

6. Personal notes detailing instances of wage violations

The more comprehensive your documentation, the stronger your case will be when you report pay violations.

Identifying the Appropriate Agency

To lodge an employment grievance effectively, you need to determine which agency has jurisdiction over your claim. At the federal level, the Wage, and Hour Division (WHD) of the Department of Labor handles most wage-related complaints. However, many states have their own labor boards or employment standards offices that may be better suited to handle your case, especially if state laws offer stronger protections than federal regulations.

Research your state’s specific worker protection bureau to understand your options. In some cases, you may be able to file complaints at both the state and federal levels.

Steps to File a Wage and Hour Complaint

Once you’ve gathered your evidence and identified the appropriate agency, you’re ready to pursue your compensation claim. Here’s a step-by-step guide to help you through the process:

1. Choose Your Filing Method:

Most agencies offer multiple ways to submit wage claims, including:

– Online submission through the agency’s website

– Mail-in form

– In-person filing at a local office

– Phone report to a helpline

– Email complaint to a designated address

Select the method that’s most convenient for you and aligns with the agency’s preferences.

2. Provide Personal Information:

You’ll need to supply basic details about yourself, including:

– Full name

– Contact information (address, phone number, email)

– Social Security Number or work permit number for non-citizens

3. Employer Information:

Include accurate details about your employer:

– Company name

– Business address

– Owner or manager’s name

– Contact information for the employer

4. Describe the Violation:

Clearly explain the nature of the wage and hour violation. Be specific about dates, times, and amounts of unpaid wages. If you’re reporting multiple infractions, list each one separately.

5. Include Supporting Documentation:

Attach copies (not originals) of all relevant documents you’ve gathered to support your claim.

6. Review and Submit:

Carefully review all the information you’ve provided to ensure accuracy. Submit your complaint according to the agency’s instructions.

What Happens After Filing Wage and Hour Complaint

After you submit your wage claim, the agency will initiate an investigation procedure. Here’s what you can expect:

1. Acknowledgment:

You should receive confirmation that your complaint has been received, often with a case number for reference.

2. Initial Review:

The agency will review your complaint to determine if it falls within their jurisdiction and if there’s sufficient information to proceed.

3. Investigation:

If the claim moves forward, an investigator may:

– Contact you for additional information

– Reach out to your employer for their side of the story

– Review payroll records and other documents

– Interview co-workers or managers

4. Mediation or Settlement:

In some cases, the agency may attempt to mediate the dispute between you and your employer. This could lead to a settlement negotiation.

5. Determination:

Based on the investigation findings, the agency will make a determination about whether wage and hour laws were violated.

6. Resolution:

If violations are found, the agency may:

– Order your employer to pay back wages

– Impose penalty fees

– Require changes in the employer’s practices

– In severe cases, pursue legal action against the employer

Time Constraints and Deadlines

It’s crucial to be aware of the statute of limitations for wage claims. These filing deadlines vary depending on the jurisdiction and the nature of the violation. Generally:

– Federal wage claims must be filed within 2 years of the violation, or 3 years for willful violations.

– State deadlines can range from 1 to 6 years, depending on local laws.

Don’t delay in submitting your complaint, as waiting too long could result in your claim being time-barred.

Protecting Yourself from Retaliation

Many workers fear retaliation from their employers for filing wage complaints. However, it’s important to know that anti-retaliation measures are in place to protect employees who exercise their rights. The law prohibits employers from firing, demoting, or otherwise punishing workers for filing wage claims.

If you experience retaliation after submitting a complaint, report it immediately to the same agency handling your wage claim. This could lead to additional penalties for your employer and further protections for you.

Seeking Legal Assistance

While it’s possible to navigate the wage claim process on your own, some situations may benefit from legal representation. Consider consulting with an employment attorney if:

– Your case is complex or involves substantial amounts of money

– You’re unsure about the strength of your claim

– Your employer has retained legal counsel

– You’ve experienced retaliation for filing a complaint

Many employment lawyers offer free initial consultations and may work on a contingency basis, meaning they only get paid if you win your case.

Conclusion

Filing a complaint with wage and hour authorities is an significant step in protecting your rights as a worker and ensuring fair compensation for your labor. By understanding the process, gathering proper documentation, and following the steps outlined in this guide, you can effectively pursue your claim and seek resolution for wage and hour violations.

Remember, the law is on your side when it comes to fair pay practices. Don’t hesitate to stand up for your rights and report violations when they occur. Your actions not only benefit you, but also help maintain a fair and just workplace for all employees.

Related Articles For You:

Frontier and United Airlines Embroiled in Federal Wage Theft Lawsuits in Colorado

What’s the Difference Between a Salary and an Hourly Wage?

FAQs

1. How long does it take to resolve a wage and hour complaint?

The resolution time can vary widely depending on the complexity of the case and the agency’s workload. Simple cases might be resolved in a few weeks, while more complex issues could take several months or even over a year.

2. Can I file a complaint anonymously?

While some agencies offer confidential or anonymous reporting options, it’s generally more effective to file a complaint with your name attached. This allows for better follow-up and a more thorough investigation.

3. What if my employer pays me in cash?

Cash payments are legal as long as proper tax withholdings are made and the employer maintains accurate payroll records. If you’re paid in cash and suspect wage violations, keep your own detailed records of hours worked and payments received.

4. Can I file a complaint if I’m an independent contractor?

Independent contractors are not covered by most wage and hour laws. However, if you believe you’ve been misclassified as an independent contractor when you should be an employee, you can file a complaint about this misclassification.

5. What kinds of compensation can I receive if my claim is successful?

If your claim is successful, you may be entitled to:

– Back pay for unpaid wages

– Overtime compensation

– Liquidated damages (in some cases, equal to the amount of back pay owed)

– Interest on unpaid wages

– Penalty fees paid by the employer

About the Author

Sarah Klein, JD, is a former employment attorney who has advised clients on wrongful termination, workplace discrimination, wage disputes, and employee rights. At All About Lawyer, she writes practical, legally sound guides to help workers understand labor laws and stand up for fair treatment at work.

Read more about Sarah