How Much Does a Debt Collection Lawyer Cost?

When faced with the challenge of recovering unpaid debts, many creditors and businesses turn to debt collection attorneys for assistance. However, one of the first questions that often arises is: How much does a debt collection lawyer cost? This article will explore the various factors that influence debt recovery attorney fees and provide insights into what you can expect when engaging legal services for debt collection.

Table of Contents

Understanding Debt Collection Legal Services

Before delving into the costs, it’s essential to understand what services a debt collection attorney typically provides. These may include:

1. Sending demand letters to debtors

2. Negotiating payment plans or settlements

3. Filing lawsuits to recover debts

4. Representing creditors in court proceedings

5. Pursuing post-judgment collection actions

The scope of services required will significantly impact the overall cost of hiring a debt collection lawyer.

Factors Influencing Debt Collection Attorney Costs

Several factors can affect the fees charged by debt enforcement lawyers:

1. Complexity of the Case:

More complex cases involving multiple debtors, large sums, or intricate legal issues typically incur higher fees.

2. Amount of Debt:

Many attorneys base their fees on the amount of debt being collected, often charging a percentage of the recovered amount.

3. Stage of Collection:

Fees may vary depending on whether the case is pre-litigation, in active litigation, or in post-judgment collection.

4. Attorney’s Experience:

More experienced debt recovery representation may charge higher rates but potentially offer greater efficiency and success rates.

5. Geographic Location:

Legal fees can vary significantly based on the cost of living and competitive landscape in different regions.

6. Fee Structure:

Attorneys may use different fee structures, which can impact the overall cost.

Common Fee Structures for Debt Collection Attorneys

Debt collection lawyers typically use one of several fee structures:

1. Contingency Fees:

The attorney receives a percentage of the amount collected, typically ranging from 25% to 40%. This structure is common in consumer debt cases.

2. Hourly Rates:

Lawyers charge for their time, with rates typically ranging from $150 to $350 per hour, depending on experience and location.

3. Flat Fees:

For certain services, such as sending demand letters or filing a lawsuit, attorneys may charge a set fee.

4. Retainer Agreements:

Clients pay an upfront fee, from which the attorney’s hourly or flat fees are deducted as work is performed.

5. Hybrid Models:

Some attorneys use a combination of these structures, such as a lower hourly rate plus a smaller contingency fee.

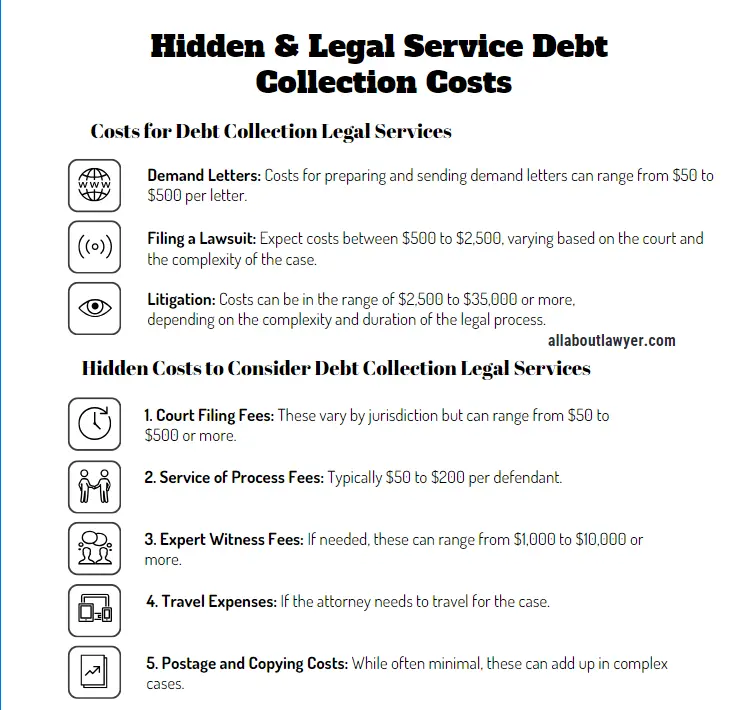

Typical Costs for Debt Collection Legal Services

While costs can vary widely, here are some general ranges for common debt collection legal services:

1. Demand Letters: $50 to $500 per letter

2. Filing a Lawsuit: $500 to $2,500, depending on the court and complexity

3. Litigation: $2,500 to $35,000+, depending on case complexity and duration

4. Post-Judgment Collection: Often charged on a contingency basis, 25% to 50% of amounts recovered

It’s important to note that these are rough estimates, and actual costs can fall outside these ranges depending on the specific circumstances of the case.

Hidden Costs to Consider

When budgeting for debt collection legal fees, be aware of potential additional costs:

1. Court Filing Fees: These vary by jurisdiction but can range from $50 to $500 or more.

2. Service of Process Fees: Typically $50 to $200 per defendant.

3. Expert Witness Fees: If needed, these can range from $1,000 to $10,000 or more.

4. Travel Expenses: If the attorney needs to travel for the case.

5. Postage and Copying Costs: While often minimal, these can add up in complex cases.

Cost-Benefit Analysis of Hiring a Debt Collection Attorney

When considering the expenses of debt collection litigation, it’s crucial to perform a cost-benefit analysis:

1. Likelihood of Recovery: Assess the debtor’s ability to pay and the strength of your claim.

2. Potential Recovery Amount: Ensure the potential recovery justifies the legal expenses.

3. Time Value of Money: Consider how long the collection process might take and the impact on the debt’s present value.

4. Impact on Business Relationships: Weigh the potential costs against the impact on customer or business partner relationships.

Alternatives to Hiring a Debt Collection Lawyer

In some cases, alternatives to full legal representation may be more cost-effective:

1. Debt Collection Agencies: Often charge lower fees but may have lower success rates for complex cases.

2. Small Claims Court: For smaller debts, representing yourself in small claims court can be a cost-effective option.

3. Mediation or Arbitration: These alternative dispute resolution methods can be less expensive than full litigation.

4. DIY Legal Resources: For simple cases, using legal templates and resources can be a low-cost option, though it carries risks.

Negotiating Fees with Debt Collection Attorneys

When engaging a debt collection lawyer, don’t hesitate to discuss fees and potentially negotiate:

1. Ask for a Clear Fee Structure: Ensure you understand exactly how and when you’ll be charged.

2. Discuss Payment Plans: Some attorneys may offer payment plans to make their services more accessible.

3. Consider Volume Discounts: If you have multiple collection cases, you may be able to negotiate better rates.

4. Explore Risk-Sharing Arrangements: Some attorneys may be open to arrangements where they share more of the risk (and reward) of collection.

The Impact of Debt Amount on Legal Fees

The amount of debt being collected can significantly influence the cost of legal services:

1. Small Debts (Under $5,000): Often handled on a flat fee or high contingency percentage basis.

2. Medium Debts ($5,000 to $50,000): May use a combination of flat fees and contingency or hourly rates.

3. Large Debts (Over $50,000): More likely to involve hourly billing or lower contingency percentages.

Specialized Debt Collection Scenarios

Certain types of debt collection may involve specialized legal services and potentially higher costs:

1. Commercial Debt Collection: Often more complex, potentially involving higher hourly rates.

2. International Debt Collection: Can involve significantly higher costs due to the complexity of cross-border legal issues.

3. Secured Debt Collection: May involve additional legal work related to collateral, potentially increasing costs.

The Role of Technology in Debt Collection Legal Costs

Advancements in legal technology are impacting the cost of debt collection services:

1. Automated Document Preparation: Can reduce costs for routine legal tasks.

2. Online Case Management Systems: May improve efficiency and potentially reduce billable hours.

3. AI-Assisted Legal Research: Can speed up case preparation, potentially lowering overall costs.

Evaluating the ROI of Debt Collection Legal Services

When assessing the cost of debt collection legal services, consider the potential return on investment:

1. Success Rates: Ask potential attorneys about their success rates in similar cases.

2. Time to Resolution: Understand how quickly the attorney typically resolves cases.

3. Total Recovery: Consider not just the percentage of debt recovered, but also interest and potentially legal fees.

Conclusion

The cost of hiring a debt collection lawyer and can an Idiana lawyer collect Debt from Alabama can vary widely based on numerous factors, including the complexity of the case, the amount of debt, and the fee structure used. While legal fees for debt collection can be substantial, they should be weighed against the potential for recovering otherwise lost revenue.

When considering engaging a debt collection attorney, it’s crucial to:

1. Clearly understand the fee structure and all potential costs

2. Perform a thorough cost-benefit analysis

3. Consider alternatives for smaller or simpler debts

4. Negotiate fees when possible

5. Evaluate the potential return on investment

By carefully considering these factors, creditors and businesses can make informed decisions about whether and how to engage legal services for debt collection, balancing the costs against the potential for successful debt recovery.

FAQs

Q: Is it worth hiring a lawyer for a small debt?

A: For very small debts, the cost of legal representation may outweigh the potential recovery. Consider alternatives like small claims court or debt collection agencies for smaller amounts.

Q: Can I recover legal fees from the debtor?

A: In many cases, yes. Many contracts include provisions for recovering collection costs, and some jurisdictions allow for the recovery of reasonable attorney’s fees in debt collection cases.

Q: How long does the debt collection legal process typically take?

A: The duration can vary widely, from a few months for simple cases to several years for complex litigation. Your attorney should be able to provide an estimated timeline based on your specific case.

Q: What if I can’t afford a debt collection lawyer?

A: Consider alternatives like contingency fee arrangements, debt collection agencies, or representing yourself in small claims court for smaller debts.

Q: How do I choose the right debt collection attorney?

A: Look for attorneys with specific experience in debt collection, a track record of success, clear communication, and a fee structure that aligns with your needs and budget.

About the Author

Sarah Klein, JD, is a former consumer rights attorney who spent years helping clients with issues like unfair billing, product disputes, and debt collection practices. At All About Lawyer, she simplifies consumer protection laws so readers can defend their rights and resolve problems with confidence.

Read more about Sarah