What’s the Difference Between a Salary and an Hourly Wage?

Two primary payment structures dominate in the employment setting: salaries and hourly wages. While both serve the purpose of compensating employees for their work, they differ significantly in how they’re calculated, administered, and impact both employers and employees. This article guide will delve into the intricacies of the difference between a salary and an hourly wage in two compensation models. Exploring their characteristics, advantages, disadvantages, and the factors that influence which structure is most appropriate for different employment scenarios.

Understanding Salary Compensation

A salary is a fixed amount of money paid to an employee on a regular basis, typically annually, regardless of the number of hours worked. This form of compensation is often associated with professional, managerial, and executive positions, though it’s not limited to these roles.

Key Characteristics of Salary Compensation:

1. Fixed Periodic Payments:

Salaries are usually paid in equal installments throughout the year, often on a monthly or bi-weekly basis.

2. Consistent Income:

Salaried employees receive the same amount each pay period, providing a stable and predictable income.

3. No Direct Correlation to Hours Worked:

Unlike hourly wages, salaries are not directly tied to the number of hours worked in a given period.

4. Exempt Status:

Many salaried positions are classified as exempt from overtime pay under the Fair Labor Standards Act (FLSA).

5. Annual Focus:

Salaries are typically discussed and negotiated on an annual basis, even if they’re paid out more frequently.

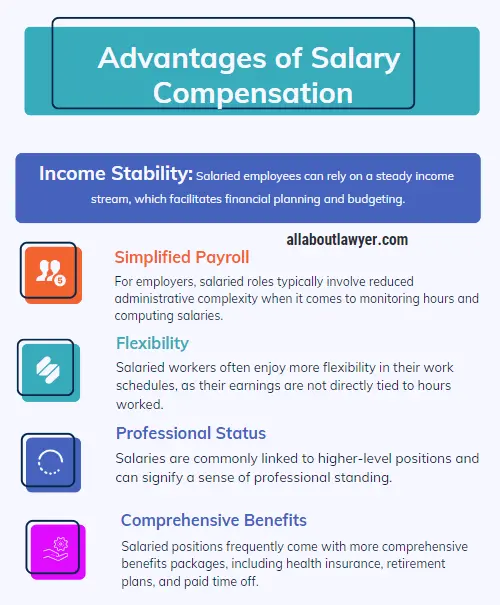

Advantages of Salary Compensation

1. Income Stability:

Salaried employees can count on a consistent paycheck, which aids in financial planning and budgeting.

2. Simplified Payroll:

For employers, salaried positions often require less administrative overhead in terms of tracking hours and calculating pay.

3. Flexibility:

Salaried employees may have more flexibility in their work schedules, as their pay is not directly tied to hours worked.

4. Professional Status:

Salaries are often associated with higher-level positions and can convey a sense of professional status.

5. Comprehensive Benefits:

Salaried positions frequently come with more comprehensive benefits packages, including health insurance, retirement plans, and paid time off.

Disadvantages of Salary Compensation

1. Potential for Unpaid Overtime:

Salaried employees may end up working more hours without additional compensation, especially if they’re exempt from overtime pay.

2. Less Transparency:

The connection between work hours and pay can be less clear for salaried positions.

3. Limited Earning Potential:

Unlike hourly workers who can increase their earnings through overtime, salaried employees typically have a fixed income regardless of extra hours worked.

4. Difficulty in Partial Work Periods:

Calculating pay for partial work periods (e.g., when an employee starts mid-month) can be more complex with salaries.

Understanding Hourly Wage Compensation

An hourly wage is a set amount of money paid for each hour an employee works. This form of compensation is common in many industries, particularly in retail, service, and manufacturing sectors, as well as for part-time and temporary positions.

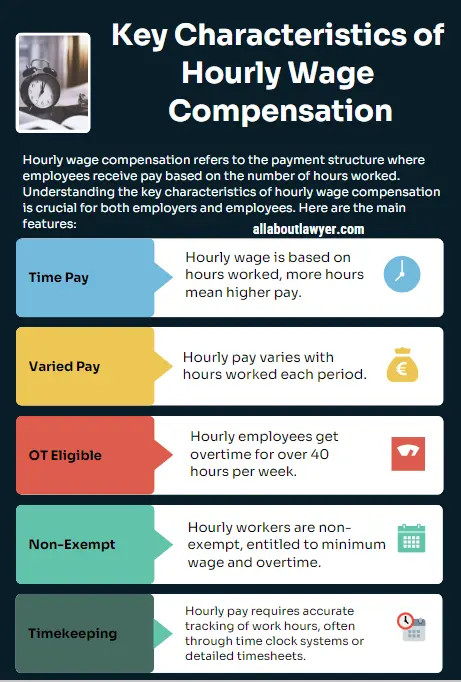

Key Characteristics of Hourly Wage Compensation:

1. Time-Based Remuneration: Pay is directly tied to the number of hours worked.

2. Variable Earnings: The total pay can vary from period to period based on hours worked.

3. Overtime Eligibility: Most hourly employees are eligible for overtime pay for hours worked beyond 40 per week (in the U.S.).

4. Non-Exempt Status: Hourly workers are typically classified as non-exempt under the FLSA, meaning they’re entitled to minimum wage and overtime protections.

5. Precise Timekeeping: Hourly pay requires accurate tracking of work hours, often through time clock systems or detailed timesheets.

Advantages of Hourly Wage Compensation

1. Direct Correlation to Work Performed: Employees are paid for every hour they work, ensuring fair compensation for time spent on the job.

2. Overtime Potential: Hourly workers can increase their earnings through overtime pay, typically at 1.5 times their regular rate.

3. Transparency: The relationship between hours worked and pay received is clear and easily understood.

4. Flexibility for Employers: Hourly wages allow employers to adjust labor costs based on business needs by increasing or decreasing scheduled hours.

5. Accurate Compensation for Part-Time Work: Hourly wages are well-suited for part-time or variable-schedule positions.

Disadvantages of Hourly Wage Compensation

1. Income Instability: Earnings can fluctuate based on scheduled hours, which can make financial planning challenging for employees.

2. Limited Benefits: Hourly positions, especially part-time ones, may come with fewer or no benefits compared to salaried roles.

3. Lower Perceived Status: Hourly wages are sometimes associated with lower-level positions, which may impact an employee’s professional status.

4. Administrative Burden: Tracking and calculating hours worked can be time-consuming for both employees and employers.

5. Potential for Wage Disputes: Discrepancies in time tracking can lead to disputes over pay.

Factors Influencing the Choice Between Salary and Hourly Wage

Several factors come into play when determining whether a position should be compensated with a salary or an hourly wage:

1. Nature of the Work:

Jobs that require consistent work hours and have clearly defined tasks are often better suited for hourly wages. Positions with variable workloads or that require significant independent judgment may be better as salaried roles.

2. Industry Standards:

Certain industries have established norms for compensation structures. For example, retail and food service often use hourly wages, while professional services tend to favor salaries.

3. Legal Requirements:

Labor laws, such as the FLSA in the United States, set guidelines for which positions can be classified as exempt (typically salaried) or non-exempt (typically hourly).

4. Company Size and Structure:

Larger companies may have more standardized pay structures, while smaller businesses might have more flexibility in choosing between salary and hourly compensation.

5. Employee Preferences:

Some workers prefer the stability of a salary, while others value the potential for overtime pay with hourly wages.

6. Budget Considerations:

Employers must consider their budget and cash flow when deciding between fixed salary costs and variable hourly wage expenses.

7. Work Schedule Flexibility:

Positions that require flexible schedules or on-call availability may be better suited for salaried arrangements.

Legal Considerations: Exempt vs. Non-Exempt Status

One of the most significant legal distinctions between salaried and hourly employees in the United States is their classification as exempt or non-exempt under the Fair Labor Standards Act (FLSA).

Exempt Employees:

– Typically paid a salary

– Not entitled to overtime pay

– Must meet specific salary and job duties tests as defined by the FLSA

– Often include executive, administrative, professional, and outside sales positions

Non-Exempt Employees:

– Usually paid hourly wages

– Entitled to overtime pay (1.5 times regular rate) for hours worked over 40 in a workweek

– Protected by minimum wage laws

– Include most blue-collar workers, service employees, and lower-level white-collar workers

It’s crucial for employers to correctly classify their employees, as misclassification can lead to significant legal and financial consequences.

The Impact of Compensation Structure on Work-Life Balance

The choice between a salary and an hourly wage can significantly impact an employee’s work-life balance:

Salaried Positions:

– May offer more flexibility in work hours and location

– Can lead to better work-life balance if employers respect boundaries

– Risk of “always on” mentality, where employees feel obligated to work beyond normal hours

Hourly Positions:

– Provide clear delineation between work and personal time

– Offer potential for increased earnings through overtime

– May result in less flexibility in work schedules

The Role of Benefits in Compensation Packages

While the base pay structure is a crucial component of compensation, benefits play a significant role in the overall package:

Salaried Positions:

– Often come with more comprehensive benefits packages

– May include health insurance, retirement plans, paid time off, and professional development opportunities

– Benefits are typically a larger portion of the total compensation package

Hourly Positions:

– May have limited or no benefits, especially for part-time roles

– When offered, benefits are often pro-rated based on hours worked

– Some companies offer full benefits to full-time hourly employees

Career Progression and Compensation Structures

The compensation structure can influence career progression and professional development:

Salaried Positions:

– Often associated with career advancement opportunities

– May include performance bonuses and merit-based raises

– Can provide a clearer path to management and leadership roles

Hourly Positions:

– Career advancement may involve moving to salaried roles

– Progression often tied to gaining new skills or certifications

– May offer opportunities for increased hourly rates or shift differentials

The Future of Work and Compensation Models

As the nature of work evolves, so too do compensation models:

1. Remote Work: The rise of remote work is challenging traditional notions of salaried vs. hourly compensation, with some companies exploring hybrid models.

2. Gig Economy: The growth of freelance and contract work is introducing new compensation structures that blend elements of both salary and hourly models.

3. Performance-Based Pay: Some companies are moving towards models that tie compensation more directly to performance metrics, regardless of whether the base pay is salaried or hourly.

4. Flexible Work Arrangements: As work becomes more flexible, compensation models may need to adapt to accommodate non-traditional schedules and work patterns.

Conclusion

The choice between a salary and an hourly wage is more than just a matter of how an employee’s pay is calculated. It reflects broader considerations about the nature of work, legal requirements, industry standards, and the balance between employer needs and employee preferences. Both compensation structures have their advantages and disadvantages, and the best choice depends on a variety of factors specific to each employment situation.

As the workplace continues to evolve, it’s likely that we’ll see further innovations in compensation models that seek to combine the best aspects of both salaried and hourly wage structures. Regardless of the specific model, the goal remains the same: to fairly compensate employees for their work while meeting the operational and financial needs of employers.

Understanding the differences between salary and hourly wage compensation is crucial for both employers and employees. It allows for informed decision-making, fair negotiations, and the creation of mutually beneficial employment arrangements. As we move forward, staying informed about these compensation structures and their implications will be essential for navigating the ever-changing landscape of work and employment.

Related Articles For You:

How to File a Wage and Hour Complaint Report?

What Are Wage and Hour Violations?

FAQs

1. Can an employer change an employee from salary to hourly pay?

Yes, an employer can change an employee’s pay structure from salary to hourly or vice versa. However, this change should be communicated clearly and in advance. It may also affect the employee’s exempt or non-exempt status, which has legal implications.

2. Do salaried employees get paid if they don’t work a full week?

Generally, salaried exempt employees must receive their full salary for any week in which they perform work, regardless of the number of hours or days worked. There are some exceptions, such as for personal leave or disciplinary suspensions.

3. Can hourly employees ever be exempt from overtime?

While most hourly employees are non-exempt and eligible for overtime, there are some exceptions. Certain highly compensated hourly employees in computer-related fields, for example, may be exempt from overtime requirements.

4. Is it better to be paid salary or hourly?

There’s no universal answer as it depends on individual circumstances. Salary offers stability and often comes with better benefits, while hourly pay provides the potential for overtime and a direct correlation between hours worked and pay received.

5. How do benefits typically differ between salaried and hourly employees?

Salaried employees often receive more comprehensive benefits packages, including health insurance, retirement plans, and paid time off. Hourly employees, especially part-time workers, may receive limited benefits or none at all, though this can vary by employer.

About the Author

Sarah Klein, JD, is a former employment attorney who has advised clients on wrongful termination, workplace discrimination, wage disputes, and employee rights. At All About Lawyer, she writes practical, legally sound guides to help workers understand labor laws and stand up for fair treatment at work.

Read more about Sarah