Can You Ignore a Collection Agency? Here’s What You Must Know

You can ignore a collection agency—but only under very specific, legally sound circumstances. In nearly all other cases, ignoring a debt collector leads to credit damage, lawsuits, and financial distress. Understanding your rights and choosing a strategic response is essential for protecting your financial health.

Table of Contents

What Happens When You Ignore a Collection Agency?

Let’s be clear—ignoring debt collectors rarely makes them go away. In fact, silence can escalate the problem. Here’s what typically happens when you ignore their contact:

| Time Since First Contact | Collection Activity | Potential Consequences |

| Day 1 | Calls, letters, emails begin | Immediate stress and pressure |

| Day 30 | Credit bureaus notified | Credit score drops by 100–150 points |

| Day 60 | Lawsuit filed (if debt is enforceable) | Risk of default judgment |

| Day 90+ | Wage garnishment or bank levies | Up to 25% of paycheck may be withheld |

The 5 Critical Risks of Ignoring Debt Collectors

- Lawsuits & Default Judgments

Collectors can sue within your state’s statute of limitations (SoL)—typically 3 to 10 years. Ignoring legal notices often leads to automatic default judgments, enabling:- Wage garnishment

- Bank account freezes

- Property liens

- Wage garnishment

- Credit Score Damage

Unpaid collections remain on credit reports for 7 years, significantly lowering your score and blocking access to:- Mortgages and loans

- Rental housing

- Employment opportunities

- Mortgages and loans

- “Zombie Debt” Revival

Making a small payment or acknowledgment can restart the SoL clock on expired debt, making it legally collectible again. - Escalated Harassment

Persistent contact via calls, texts, emails, and even outreach to employers or relatives—though disclosing your debt is illegal under the FDCPA. - Inflating Balances

Debts can grow significantly due to:- Contractual interest rates

- Collection fees

- Late payment penalties

- Contractual interest rates

Related article: 11 Words To Stop a Debt Collector? The Truth and What Actually Works

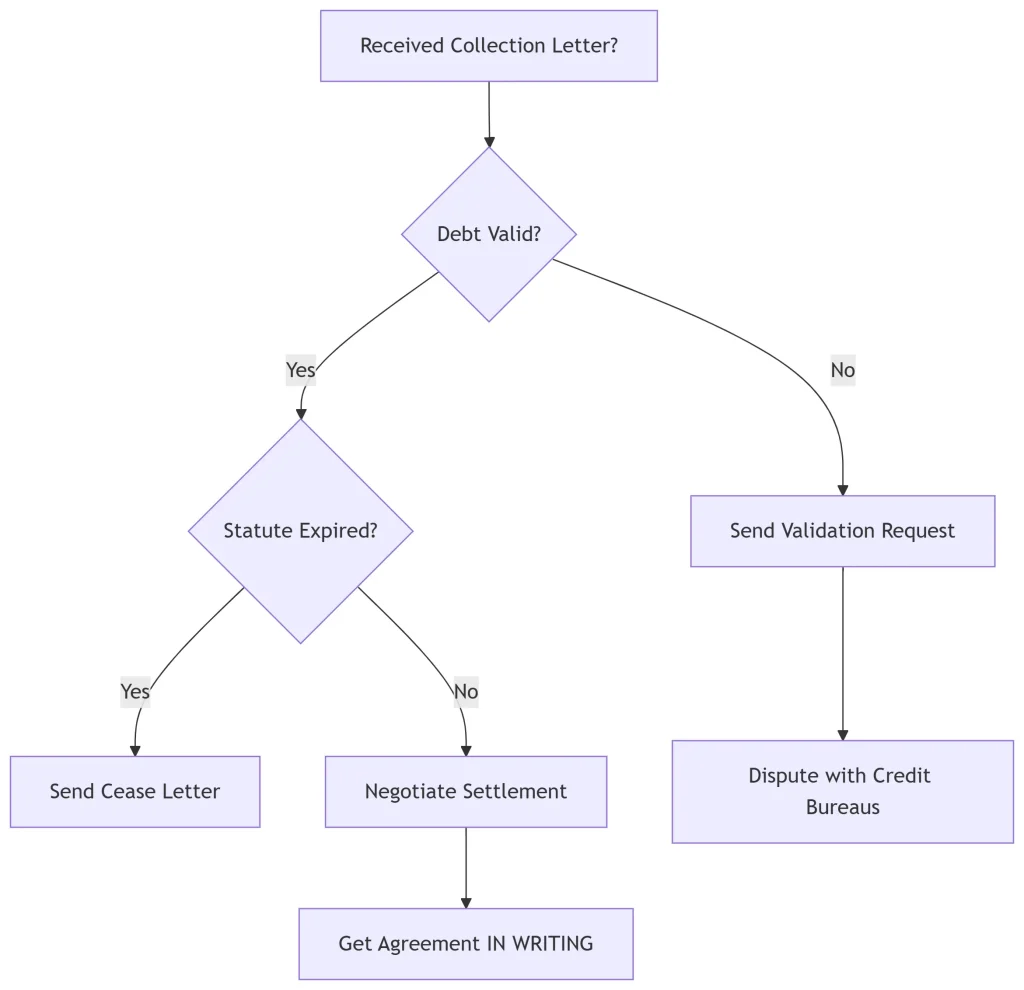

When It’s Legally Safe to Ignore Collectors

Silence can be strategic—but only under strict conditions:

1. The Debt Is Time-Barred

- Your state’s statute of limitations has expired (e.g., 3–6+ years of inactivity).

- Send a cease letter referencing FDCPA §805(c):

“This debt is time-barred. Cease all collection efforts.”

Never acknowledge or pay—doing so revives the statute.

2. The Debt Is Invalid or Not Yours

- 34% of sold debts contain errors. If you suspect fraud:

- Demand a debt validation letter within 30 days.

- Dispute unverified accounts with credit bureaus.

- Do not pay until the debt is legally validated.

- Demand a debt validation letter within 30 days.

3. You’re Judgment-Proof

- If your only income is from Social Security, disability, or other exempt sources, collectors may not legally seize it—even if they win a lawsuit.

Strategic Responses: What To Do Instead of Ignoring

| Step | Action | Why It Matters |

| 1 | Send a Debt Validation Letter | Forces proof of debt ownership & accuracy |

| 2 | Refer to your State’s SoL | Determines if the debt is legally enforceable |

| 3 | Dispute with Credit Bureaus | Removes unverifiable or outdated listings |

| 4 | Issue a Limited Cease-and-Desist | Legally restricts how they can contact you |

| 5 | Negotiate a Settlement or Payment Plan | Leverage “pay-for-delete” deals |

| 6 | Prepare for Legal Defense | File an answer to avoid default judgment |

Pro Tip: Debt buyers pay 3–7 cents on the dollar. Use this leverage to offer 20–40% lump-sum settlements—but only with written confirmation.

Sue for FDCPA Violations

Collectors break the law in over 1 in 3 interactions. You can sue for:

- Up to $1,000 in damages

- Legal costs covered

Common FDCPA Violations Include:

- Threatening arrest or jail time

- Contacting after 9 p.m. or before 8 a.m.

- Disclosing your debt to others

- Misstating the amount owed

State-Specific Legal Advantages

| State | Key Protection | Statute of Limitations |

| Texas | No wage garnishment for consumer debt | 4 years |

| New York | Collections drop off credit reports after 5 years | 6 years |

| California | Collectors can’t add fees beyond original contract | 4 years |

Global Considerations

- Canada: SoL varies by province (2–6 years). Acknowledgment or payment restarts the clock.

- UK: 6-year SoL. Ignoring court notices can result in a County Court Judgment (CCJ).

- Australia: Rules differ by state—never ignore legal correspondence.

Protect Your Emotional & Financial Health

- Log all interactions: date, time, content, contact name.

- Limit contact to mail: Block calls and filter emails.

- Seek help: Legal aid, nonprofit credit counseling, or mental health services.

- Use tools:

- Nomorobo to block spam calls

- AnnualCreditReport.com for credit checks

- Template Letters for validation and cease contact

- Nomorobo to block spam calls

Final Verdict: Should You Ignore?

| Scenario | Recommended Action |

| Debt is expired (SoL passed) | Send cease letter; do not pay |

| Debt is unverified or disputed | Send validation letter; dispute |

| Debt is valid and enforceable | Negotiate or prepare legal defense |

| You’re judgment-proof | Monitor but don’t fear lawsuits |

Bottom Line:

Ignoring a collection agency is only viable when the debt is invalid, expired, or unenforceable—and you are prepared to act if sued. Otherwise, proactive communication, legal awareness, and negotiation are far more effective.

Sources:

- Federal Trade Commission (FTC)

- Consumer Financial Protection Bureau (CFPB)

- Fair Debt Collection Practices Act (FDCPA)

About the Author

Sarah Klein, JD, is a former consumer rights attorney who spent years helping clients with issues like unfair billing, product disputes, and debt collection practices. At All About Lawyer, she simplifies consumer protection laws so readers can defend their rights and resolve problems with confidence.

Read more about Sarah