Can You Go to Jail for Not Paying a Judgment? Legal Reality in the US

No, you cannot be jailed just for not paying a civil judgment—such as medical bills, personal loans, or credit card debt. However, willful disobedience of court orders related to those debts can result in civil contempt and even jail time. Understanding the line between debt and defiance of court orders is crucial to protecting your rights.

Table of Contents

Why Civil Debt ≠ Jail

Under U.S. law, debtor’s prisons are unconstitutional. The U.S. Constitution (Art. I, §9) and major case law—such as Turner v. Rogers, 564 U.S. 431 (2011)—make it clear: you cannot be incarcerated for simply owing a debt.

Yet many Americans are caught off guard by procedural pitfalls that can result in jail.

“Your freedom is protected—unless you defy the court, not the creditor.” — National Consumer Law Center.

Jail Exception: Civil Contempt of Court

While owing money is not a crime, violating court orders related to debt enforcement is.

Common contempt triggers include:

- Skipping debtor’s examinations (mandatory court sessions where you’re questioned about your assets)

- Hiding income or assets when under oath

- Ignoring payment orders or subpoenas

- Lying about finances in legal disclosures

Key Example:

In Illinois, over 400 people were jailed in 2023 for missing post-judgment hearings—not for the debt itself.

Court Orders You Must Not Ignore

| Order Type | Description | Contempt Risk |

| Debtor’s Exam | Court-ordered financial questioning | High |

| Payment Scheduling Orders | Agreed-upon repayment plans | Moderate |

| Appearances | Required court hearings | High |

| Subpoenas | Compelling document production | High |

Related article: What Do Debt Buyers and Collection Agencies Really Pay for Your Debt?

State-by-State Enforcement Snapshot

| State | Max Jail Time | Common Trigger | Key Protection Mechanism |

| Texas | 6 months | Missing debtor exam | File Affidavit of Indigence |

| New York | 90 days | Hiding inheritance | File exemption claims |

| California | 5 days | Employer garnishment fraud | Report to Labor Commissioner |

| Florida | 0 days | Debt jail banned by law | Protected by Art. I, §11 of FL Constitution |

4 Crucial Protections to Avoid Jail

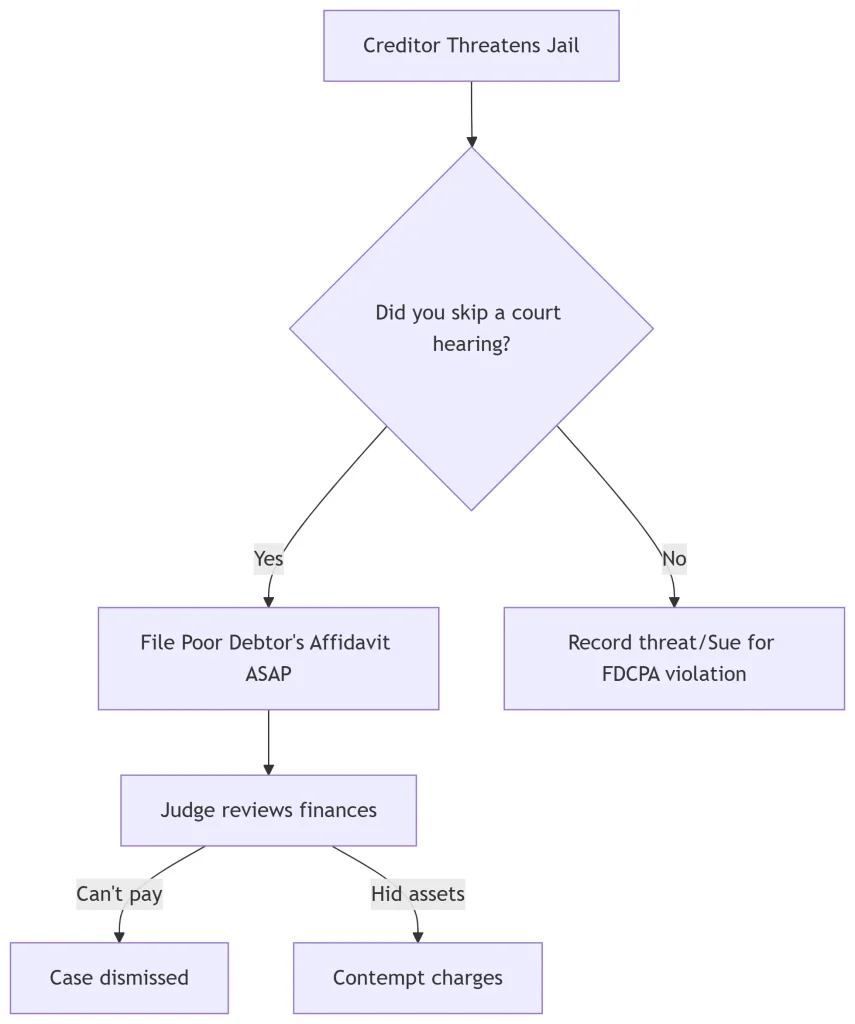

- File a Poor Debtor’s Affidavit

Available in 48 states; legally declares inability to pay. - Attend All Hearings

Bring documentation—bank records, pay stubs, proof of assets. - Disclose Exempt Assets

Social Security, pensions, primary residences, and basic tools are protected. - Demand Legal Counsel if Jail Is on the Table

Turner v. Rogers guarantees representation where incarceration is a risk.

3 Creditor Tactics That Feel Like Jail Threats

| Tactic | Reality |

| “Body Attachment” Orders | Rare and only issued for proven noncompliance |

| Sheriff Deliveries | Subpoena service only—no arrest for debt alone |

| Collector Threats | Illegal under FDCPA §807(4); sue for $1,000+ damages |

Pro Tip: If a debt collector threatens jail, record the call (legal in 38 states) and file a complaint with the FTC or CFPB.

Responding to Jail Threats: Legal Scripts

Say on the phone:

“Are you threatening jail for a civil debt? That violates FDCPA §807(4).”

Send in writing:

“Per FDCPA §805, cease all jail-related threats. Further communication must be in writing.”

What Happens If You’re Arrested for Contempt?

- Judge issues a bench warrant

- You’re arrested by law enforcement

- You stay in jail until you:

- Appear in court

- Submit required financial info

- Pay a compliance bond

- Appear in court

- You’re released once the order is satisfied or inability to comply is proven

No one is held indefinitely—courts must confirm your willful refusal to comply.

Templates to Stay Compliant

Sample Motion to Delay Compliance:

plaintext

CopyEdit

I, [Your Name], respectfully request additional time to comply with the debtor’s exam subpoena due to [medical/family/work reasons]. I intend to comply fully by [Date].

Attach proof: doctor’s note, employment letter, or financial hardship form.

Know the Difference: Other Jail-Triggering Debts

| Debt Type | Jail Risk? | Legal Reason |

| Child Support | Yes | Criminal contempt if you can pay but don’t |

| Tax Fraud | Yes | Jail for criminal tax evasion or false returns |

| Civil Judgment | No | Jail only if you ignore court orders, not for debt |

Global Comparison

- UK: Contempt-based detention allowed in civil enforcement

- Canada & Australia: Jail possible under contempt law at the provincial/state level

Final FAQs

Will I go to jail for not paying a judgment?

No, unless you disobey court orders.

What if I missed a hearing by mistake?

Notify the court immediately. File a motion to quash or reschedule.

Can they hold me in jail indefinitely?

No. Jail ends when you comply or prove inability.

Final Takeaways

| Key Insight | Action Step |

| Owing debt ≠ criminal | Don’t ignore summons or hearings |

| Court orders must be obeyed | File proper motions if you need more time |

| Collectors can’t threaten jail | Record, report, and sue under the FDCPA |

| Legal tools exist to protect you | Use affidavits, exemption claims, legal aid |

Act Fast:

- Download a [Poor Debtor’s Affidavit Template]

- Visit LawHelp.org for legal assistance

- Report collector abuse at the FTC Complaint Assistant

Sources:

- U.S. Constitution (Art. I, §9)

- Turner v. Rogers, 564 U.S. 431 (2011)

- Fair Debt Collection Practices Act (FDCPA)

- Federal Trade Commission (FTC)

- Consumer Financial Protection Bureau (CFPB)

- State-specific civil contempt statutes

- Upsolve.org, Investopedia, LawHelpMN.org

About the Author

Sarah Klein, JD, is a former consumer rights attorney who spent years helping clients with issues like unfair billing, product disputes, and debt collection practices. At All About Lawyer, she simplifies consumer protection laws so readers can defend their rights and resolve problems with confidence.

Read more about Sarah