Can I Pay the Company Instead of the Collection Agency? 2025 Guide to Rights, Risks & Recovery

You can pay the original creditor—but only if they still legally own the debt. Once it’s sold to a collection agency or debt buyer, your obligation transfers. Paying the wrong party won’t resolve the debt—and could even leave you paying twice.

Understanding Debt Ownership: Assignment vs. Sale

Debt moves through two primary channels:

- Assignment: The creditor retains ownership but hires a third-party collection agency to recover the funds. You may still pay the original creditor.

- Sale: The creditor sells the debt outright to a debt buyer. You now owe the buyer—not the original company.

Tip: If your credit report shows “transferred” or “sold,” the debt has likely changed hands. If it still shows a balance with the original creditor, it may still be assigned.

Table of Contents

When You CAN Pay the Original Creditor

1. Debt is Assigned, Not Sold

If the creditor retains ownership, they may recall the debt from the collection agency.

- Best timing: Within 3–6 months of assignment.

- Action: Contact the creditor’s collections department and ask them to recall the debt.

- Proof: Always get written confirmation that payment resolves the debt and halts further collection action.

2. You’re in Early Arrears (Pre-Collections Phase)

This window—30 to 60 days after a missed payment—is the most strategic time to act.

- Leverage: Creditors recover 70–90% on pre-collection debts versus just 20–50% after sale.

- Action: Contact the creditor and ask to resolve the issue before it escalates.

3. Medical or Utility Debts

Hospitals and utility providers often retain flexibility—even if the account is assigned.

- Example: A $10,000 medical debt can sometimes be settled directly with the provider for $6,000.

- Tip: Negotiate quickly and request recall.

Related article: 5 Strategic Reasons You Should Never Pay a Collection Agency (And What to Do Instead)

When You CANNOT Pay the Original Creditor

1. Debt Has Been Sold

Once the original creditor sells the debt, the collector becomes the legal owner. Paying the original creditor will not resolve the debt.

- Red flag: If the creditor refers you to the agency without offering a payment plan, the debt is likely sold.

- Legal risk: You may be forced to pay twice.

2. Debt Is Charged Off (Typically After 180 Days)

After six months of non-payment, most creditors charge off the debt and sell it.

- Action required: Engage with the collection agency directly—but strategically.

Key Risks If You Pay the Wrong Party

| Risk | Impact |

| Double Payment Trap | Paying the creditor after a sale doesn’t stop the collector from demanding full payment. |

| Zombie Debt Revival | Partial payments can restart the statute of limitations, making time-barred debts collectible again. |

| Credit Score Damage | Paid collections remain on reports for up to 7 years—hurting your credit even after resolution. |

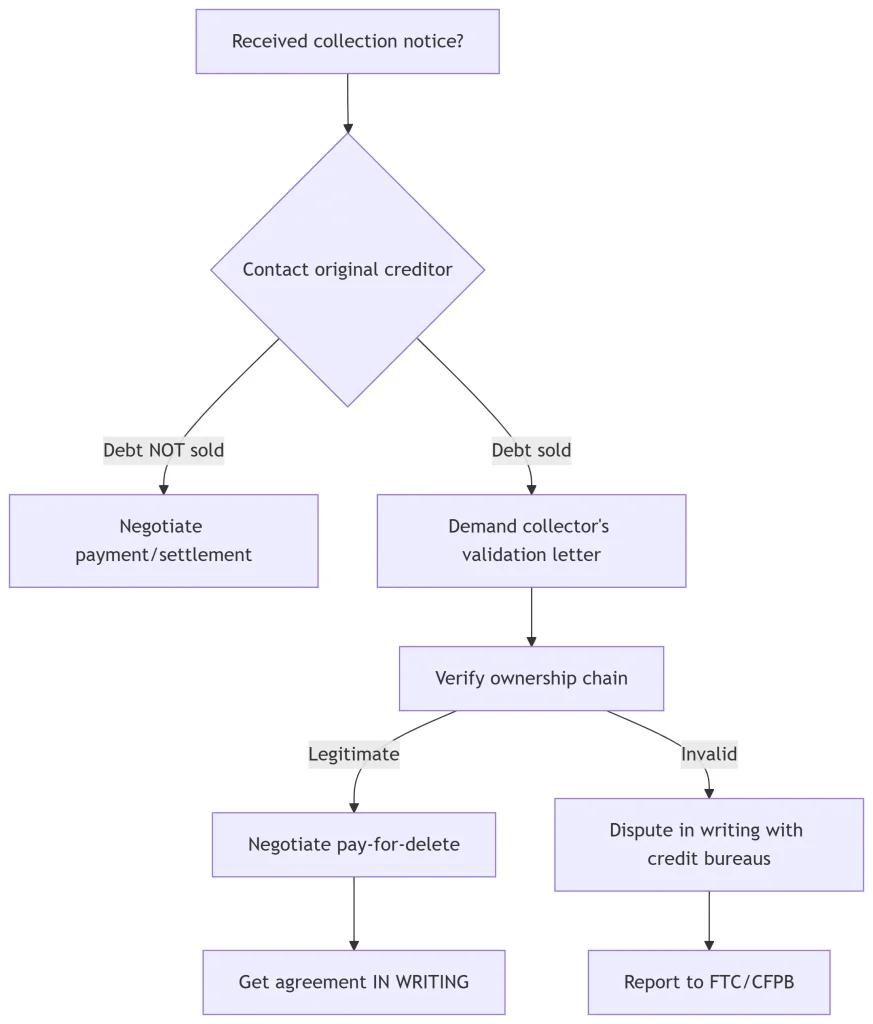

How to Confirm Who Owns Your Debt (4-Step Process)

- Ask the Collector for Validation

Under the FDCPA, they must provide this within five days of initial contact. - Call the Original Creditor

Ask: “Has my account been sold or is it still assigned?” - Check Your Credit Reports

Look for phrases like “transferred,” “charged off,” or “sold.” - Request the Chain of Title

Collectors must document the ownership trail if you challenge it.

Visit AnnualCreditReport.com to dispute any inaccuracies.

How to Pay (Strategically)

With the Original Creditor (If Debt Isn’t Sold)

- Negotiate: Offer 30–50% lump-sum settlements (e.g., $3,000 debt = $1,500 payoff).

- Script:

“I can pay $X today if you recall the debt from collections and report it as ‘Paid as Agreed’ to all credit bureaus.” - Demand Written Terms: Never pay without a documented agreement.

With the Collection Agency (If Debt Is Sold)

- Leverage: Debt buyers purchase for 4–7 cents on the dollar.

- Negotiate: Aim for 20–40% settlement.

- Use Pay-for-Delete: Only 15% agree, but it’s possible.

- Script:

“I’ll pay 40% if you delete this from all credit reports and send me a satisfaction letter in writing.” - Avoid Restarting the Clock: Don’t acknowledge the debt if it’s time-barred.

Credit Score Strategy

| Action | Effect on Credit Report | Score Impact |

| Pay Original Creditor | May be removed | Minor (10–30 pts) |

| Pay Collection Agency | Remains 7 years | Severe (100+ pts) |

| Settle for Less | Remains 7 years | Moderate (50–80 pts) |

| Ignore Debt | Remains 7 years | Catastrophic (150+ pts) |

Use credit bureau dispute letters post-payment to request record updates.

Legal Protections to Enforce

- FDCPA: Collectors must validate debt and avoid harassment (e.g., threats or after-hours calls).

- State Laws:

| State | Key Protection | Limitations Period |

| Texas | No wage garnishment for consumer debt | 4 years |

| California | No added fees beyond contract terms | 4 years |

| New York | Collections drop off credit reports after 5 years | 6 years |

Scripts & Templates

Original Creditor Call Script:

“I’d like to confirm if my account [####] is still with you or sold. If not sold, can you recall it from collections and set up a payment plan?”

Collector Settlement Template:

“I can pay $X if the debt is marked as paid and removed from my credit report. Please confirm this in writing before I send payment.”

Credit Bureau Update Letter:

“My account #[…] has been paid and should reflect as ‘Paid in Full’ or be removed per agreement. Please update accordingly.”

Decision Flowchart

Global Context

UK, Canada, Australia: Debt ownership and dispute rights are broadly similar. However, rules on recalling debts and credit bureau updates vary. Always verify regional legal standards before acting.

When to Consult a Lawyer

- You’re Sued: Respond to court summons within 14–30 days to avoid default judgment.

- Debt Ownership is Disputed: Collectors must prove ownership or drop the claim.

- You’re Harassed: FDCPA violations (e.g., threats, repeated calls) allow you to sue for $1,000+ in damages.

Final Takeaway

Paying the original company can be better—but only if they still own your debt. Otherwise, you’re legally obligated to deal with the collector. The most effective path forward is:

- Confirm Ownership

- Negotiate Wisely

- Get Everything in Writing

- Monitor Your Credit Reports

“The collector’s purchase price doesn’t change your obligation. But your knowledge changes your leverage.” — FTC Guidelines

About the Author

Sarah Klein, JD, is a former consumer rights attorney who spent years helping clients with issues like unfair billing, product disputes, and debt collection practices. At All About Lawyer, she simplifies consumer protection laws so readers can defend their rights and resolve problems with confidence.

Read more about Sarah