Can a Lawyer Be an Executor of a Will? | Role and Implications Benefits With Challenges

The role of an executor is crucial—handling everything from paying off debts to distributing assets according to the deceased’s wishes. In the U.S., over 70% of adults have not updated their estate plans in the last five years, leaving potential legal gaps and ambiguities. Given the importance of getting it right, it’s no surprise that many people turn to legal professionals for help.

A loved one passes away, leaving behind a will that clearly outlines their wishes. But instead of naming a family member or close friend as the executor, they appoint their trusted lawyer to handle their estate. Is this a smart decision, or does it open the door to complications?

Table of Contents

The Role of an Executor: An Overview

Before we delve into the specifics of a lawyer serving as an executor, it’s crucial to understand the role and responsibilities of this position. An executor, also known as a personal representative in some jurisdictions, is responsible for managing the deceased person’s estate and carrying out the instructions laid out in their will. Key duties include:

1. Identifying and securing the deceased’s assets

2. Paying off debts and taxes

3. Distributing the remaining assets to beneficiaries

4. Representing the estate in legal proceedings

5. Managing the estate throughout the probate process

Given these responsibilities, it’s clear that the role requires a high level of trust, competence, and attention to detail.

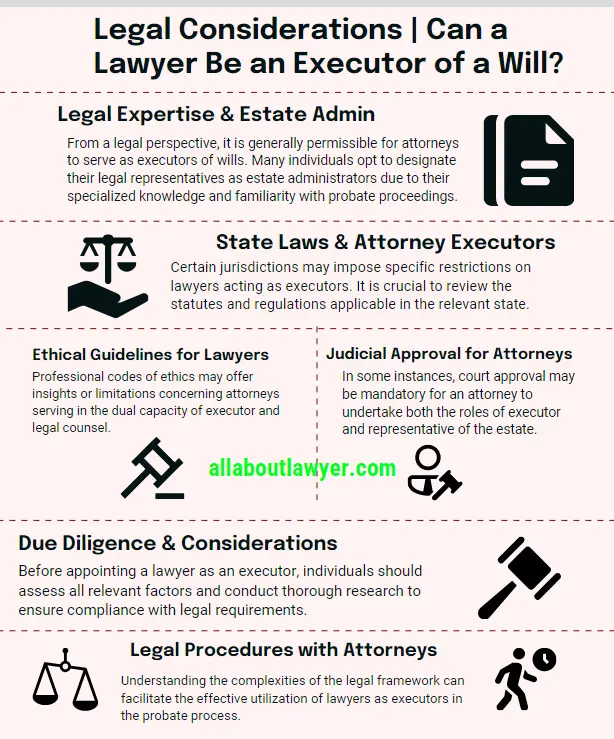

Legal Considerations | Can a Lawyer Be an Executor of a Will?

From a purely legal standpoint, in most jurisdictions, there is no prohibition against a lawyer acting as the executor of a will. In fact, many people choose to appoint their attorney as the estate administrator due to their legal expertise and familiarity with the probate process. However, while it’s generally legal, there are several factors to consider:

1. State Laws:

Some states may have specific regulations regarding attorneys serving as executors. It’s essential to check local laws and regulations.

2. Bar Association Guidelines:

Professional ethics rules may provide guidance or restrictions on lawyers serving in this capacity.

3. Court Approval:

In some cases, court approval may be required for an attorney to serve as both the executor and the legal representative of the estate.

Benefits of Appointing a Lawyer as Executor

There are several advantages to having a legal professional overseeing probate and managing the decedent’s estate:

1. Legal Expertise: Lawyers are well-versed in probate law and can navigate complex legal issues efficiently.

2. Objectivity: As a neutral third party, an attorney can make impartial decisions, potentially reducing family conflicts.

3. Efficiency: Legal professionals are familiar with court procedures, potentially expediting the probate process.

4. Asset Protection: Lawyers understand how to properly secure and manage estate assets.

5. Tax Knowledge: Many attorneys have experience with estate taxes and can help minimize tax liabilities.

Related Articles For You:

Questions-to-ask-a-probate-lawyer-before-hiring

Will Dispute Attorney Understanding the Role of Will Dispute Lawyers

Potential Drawbacks and Ethical Considerations

While there are clear benefits, appointing a lawyer as an executor also comes with potential drawbacks and ethical considerations:

1. Conflict of Interest: There’s a potential conflict if the lawyer serves as both the executor and the estate’s legal counsel.

2. Cost: Lawyers typically charge for their services as executors, which can be more expensive than a family member serving in this role.

3. Lack of Personal Knowledge: An attorney may not have intimate knowledge of the deceased’s personal affairs or family dynamics.

4. Time Commitment: Serving as an executor can be time-consuming, which may impact the lawyer’s ability to serve other clients.

5. Perceived Favoritism: Other family members might perceive the appointment as favoritism if the lawyer had a close relationship with the deceased.

Ethical Guidelines for Lawyers Serving as Executors

When a legal professional accepts the role of estate administrator, they must adhere to strict ethical guidelines:

1. Disclosure: The lawyer must clearly disclose their dual role to all beneficiaries and interested parties.

2. Informed Consent: The testator should give informed consent to the lawyer’s appointment as executor.

3. Fair Compensation: Any fees charged for executor services should be reasonable and transparent.

4. Avoiding Conflicts: The attorney should be vigilant about potential conflicts of interest and address them promptly.

5. Maintaining Professionalism: Despite any personal relationships, the lawyer must maintain professional objectivity in executing the will.

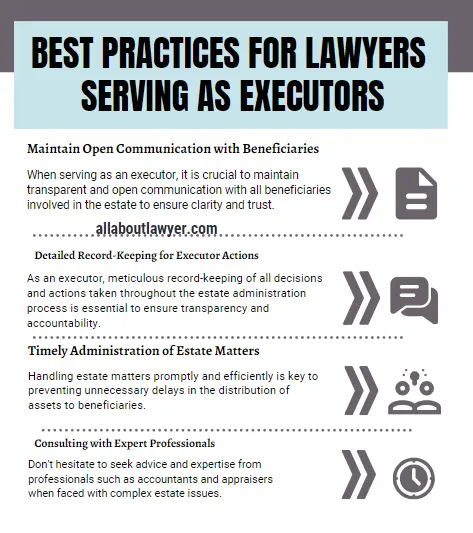

Best Practices for Lawyers Serving as Executors

If a lawyer does take on the role of executor, there are several best practices to follow:

1. Clear Communication: Maintain open and transparent communication with all beneficiaries throughout the process.

2. Detailed Record-Keeping: Keep meticulous records of all actions taken and decisions made as executor.

3. Timely Administration: Handle estate matters promptly to avoid unnecessary delays in distribution.

4. Seek Expert Help: Don’t hesitate to consult with other professionals (e.g., accountants, appraisers) when needed.

5. Regular Updates: Provide regular updates to beneficiaries on the status of the estate administration.

Alternatives to Appointing a Lawyer as Executor

While having an attorney serve as executor can be beneficial, there are alternatives worth considering:

1. Family Member or Friend: A trusted individual who knows the deceased’s wishes well.

2. Professional Fiduciary: A neutral third party who specializes in estate administration.

3. Bank or Trust Company: Financial institutions often offer executor services.

4. Co-Executors: Appointing both a lawyer and a family member to serve jointly.

The Decision-Making Process| Factors to Consider

When deciding whether to appoint a lawyer as the executor of a will, consider the following factors:

1. Estate Complexity: For complex estates with significant assets or potential legal issues, a lawyer’s expertise can be invaluable.

2. Family Dynamics: If there’s potential for conflict among beneficiaries, a neutral legal professional might be the best choice.

3. Testator’s Wishes: Consider the preferences of the person making the will and their reasons for choosing a particular executor.

4. Cost Considerations: Weigh the potential costs of having a lawyer serve as executor against the benefits.

5. Time and Availability: Ensure the chosen attorney has the time and resources to effectively manage the estate.

Legal Requirements for Will Executors Lawyer

If a lawyer is appointed as an executor, they must fulfill certain legal requirements:

1. Fiduciary Duty: The attorney must act in the best interests of the estate and its beneficiaries.

2. Competence: They must have the necessary skills and knowledge to effectively manage the estate.

3. Diligence: The lawyer-executor must handle estate matters promptly and thoroughly.

4. Accounting: Regular and accurate accounting of estate assets and transactions must be provided.

5. Compliance: All relevant laws and regulations must be followed throughout the probate process.

Compensation for Lawyer-Executors

When a legal professional serves as an estate administrator, compensation can be a complex issue:

1. Statutory Fees: Some jurisdictions have set fees for executors based on the estate’s value.

2. Hourly Rates: Lawyers may charge their regular hourly rate for executor services.

3. Flat Fees: Some attorneys offer flat-fee arrangements for straightforward estates.

4. Dual Compensation: If serving as both executor and legal counsel, the lawyer must clearly differentiate between these roles in their billing.

5. Court Approval: In many cases, executor fees must be approved by the probate court.

Potential Challenges and How to Address Them

Appointing a lawyer as executor can present certain challenges:

1. Beneficiary Objections:

Some beneficiaries might object to a lawyer serving as executor. Clear communication and transparency can help address these concerns.

2. Complexity of Dual Roles:

Balancing the roles of executor and potential legal counsel requires careful management and clear delineation of duties.

3. Time Management:

Lawyers must ensure they can dedicate sufficient time to executor duties without neglecting other clients.

4. Emotional Detachment:

While objectivity is important, lawyers must also be sensitive to the emotional aspects of estate administration.

Conclusion

The question of whether a lawyer can be an executor of a will is not just a matter of legal permissibility but also of ethical consideration and practical suitability. While attorneys can certainly serve in this capacity, bringing valuable legal expertise to the role, it’s crucial to carefully weigh the potential benefits against the drawbacks and ethical considerations.

Ultimately, the decision to appoint a lawyer as an executor should be made based on the specific circumstances of the estate, the wishes of the testator, and the potential impact on beneficiaries. By understanding the role, responsibilities, and implications of having a legal professional manage the deceased’s affairs, you can make an informed decision that best serves the interests of the estate and its beneficiaries.

Whether you choose a lawyer, a family member, or another trusted individual to serve as executor, the most important factor is that the person is capable, trustworthy, and committed to carrying out the testator’s wishes with integrity and diligence.

FAQs

Can a lawyer who drafted the will also serve as its executor?

Yes, in most jurisdictions, the lawyer who drafted the will can also serve as its executor. However, this dual role must be clearly disclosed and agreed upon by the testator, and potential conflicts of interest must be carefully managed.

How much does a lawyer typically charge to serve as an executor?

Fees can vary widely depending on the complexity of the estate and local regulations. Some lawyers charge hourly rates, while others may charge a percentage of the estate’s value (often 2-4%). Always discuss fees upfront and ensure they comply with local laws.

Can beneficiaries object to a lawyer serving as executor?

Beneficiaries can raise objections to any executor appointment, including a lawyer. The court will consider these objections but will ultimately make a decision based on the best interests of the estate and the testator’s wishes.

Is it better to have a lawyer or a family member as an executor?

This depends on the specific circumstances. Lawyers bring legal expertise and objectivity, while family members may have better personal knowledge of the deceased’s affairs. Consider the estate’s complexity, family dynamics, and the testator’s preferences when making this decision.

Can a lawyer-executor also represent the estate in legal matters?

While it’s possible in some jurisdictions, it’s a complex situation that requires careful management of potential conflicts of interest. In many cases, it may be advisable to have separate legal representation for the estate.

About the Author

Sarah Klein, JD, is an experienced estate planning attorney who has helped clients with wills, trusts, powers of attorney, and probate matters. At All About Lawyer, she simplifies complex estate laws so families can protect their assets, plan ahead, and avoid legal headaches during life’s most sensitive moments.

Read more about Sarah