5 Strategic Reasons You Should Never Pay a Collection Agency (And What to Do Instead)

Paying a collection agency outright can worsen your legal and financial position—reviving expired lawsuits, damaging your credit further, and validating questionable debts. Instead, deploying strategic alternatives grounded in U.S. consumer law can protect your rights, credit, and cash flow.

Table of Contents

1. It Resets the Statute of Limitations

The Risk:

Making a single payment, signing a settlement agreement, or even acknowledging a debt in writing or over the phone can reset the statute of limitations (SoL) in most states—enabling collectors to sue you again.

Example: In Mississippi (3 years) or Ontario (2 years), a $10 payment on an old debt can legally reset the entire countdown.

Data Point:

43% of collection attempts rely on reviving expired debts through “good faith” payments.

Strategic Action:

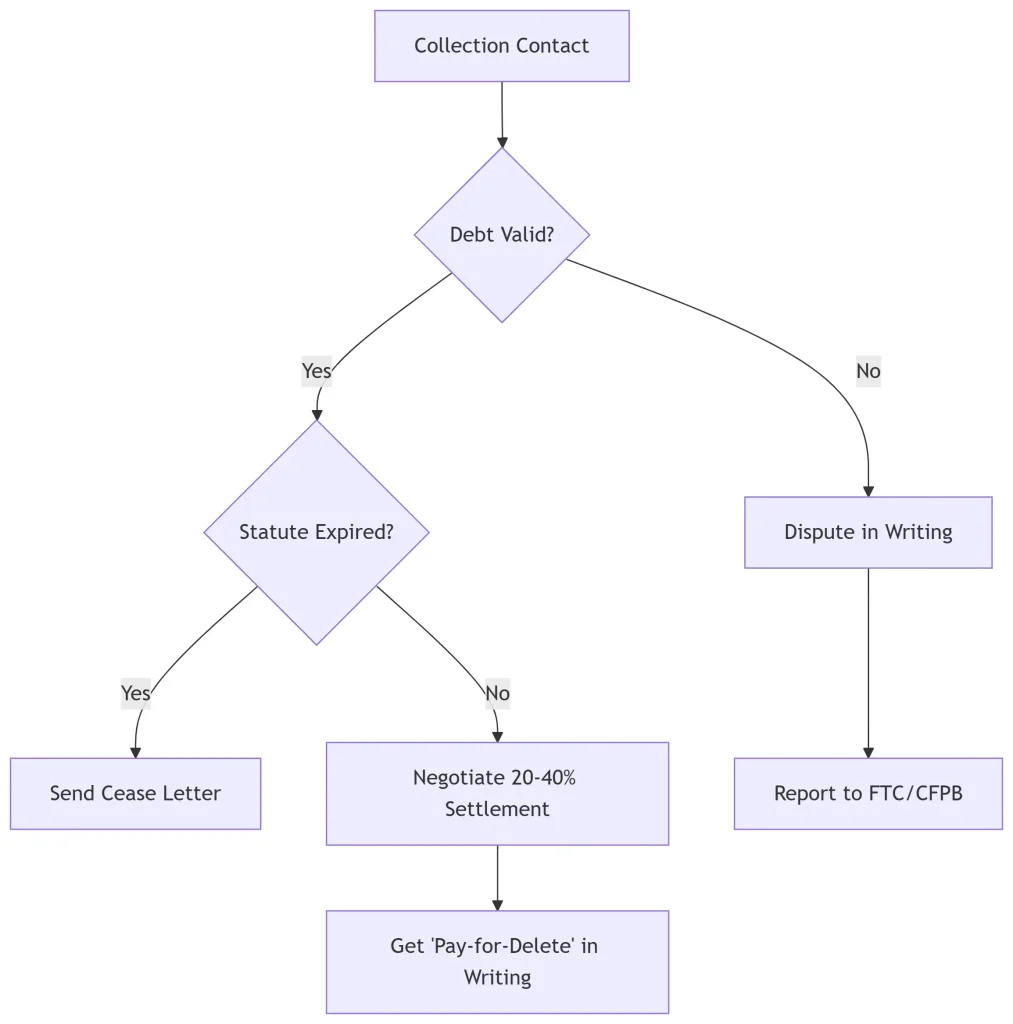

Before engaging, determine your state’s statute of limitations. If expired, send a cease-and-desist letter:

“Per FDCPA §805(c), this debt is time-barred. Cease all collection efforts.”

2. Payment Can Hurt Your Credit Score More Than Help

The Myth: Paying a collection boosts your score.

The Reality: It may re-age the account, restarting the 7-year reporting window and prolonging damage.

Impact Table:

| Status | Report Duration | FICO 8/10 Score Drop |

| Unpaid | 7 years from default | 100–150 points |

| Paid | 7 years from last payment | 80–130 points |

| Settled | 7 years from default | 70–120 points |

Note: Some lenders (e.g., mortgage underwriters) require settled collections, but this is the exception, not the rule.

Strategic Action:

Negotiate deletion from credit reports before any payment. Never assume a paid collection will be automatically removed.

Related article: Can I Pay the Company Instead of the Collection Agency?

3. You Might Not Even Owe the Debt

Key Insight:

Roughly 60% of purchased debt is flawed—whether due to outdated info, identity theft, or incorrect balances.

Risks of Blind Payment:

- Waives your right to dispute

- Revives “zombie” debts

- Encourages future collector contact

Strategic Action:

Under FDCPA §809, demand validation within 30 days of first contact. Dispute debts if:

- The collector lacks proof of ownership

- The amount is inflated

- The debt is time-barred

Stat: 34% of debts disappear when properly challenged.

Validation Letter Template:

less

CopyEdit

[Date]

[Collector Name & Address]

Re: Account #[#]

I dispute this debt and request validation under FDCPA. Please provide:

• Name of original creditor

• Proof of assignment or purchase

• Itemized balance details

• Licensing credentials (if required by state law)

Sincerely,

[Your Name]

4. You Lose All Negotiating Power by Paying in Full

Market Truth:

Debt buyers often purchase debts for 3–7 cents on the dollar. If you pay the full balance, you surrender massive leverage.

Smart Negotiation Strategy:

- Start low: Offer 20–30% in a lump sum.

- Demand “pay-for-delete” in writing—success rate ~15%, but impactful.

- Never admit ownership: Instead say, “To resolve this issue, I’m willing to pay 30% without acknowledging the validity.”

Tip: Use email to document all offers and keep your position enforceable.

5. Payment Can Trigger New Legal Liability

Key Consequences:

- Acknowledgment or payment may allow the agency to sue for the full balance if future payments lapse.

- Wage garnishment is possible in many states (up to 25% in Maryland).

- Unauthorized fees and interest can be added if your original agreement allows.

Red Flag: Suing or threatening to sue on expired debts violates the FDCPA. You may sue collectors for up to $1,000 plus attorney fees under federal law.

What to Do Instead: 6 Legal-Smart Steps

Step 1: Validate the Debt Immediately

Send a validation letter by certified mail within 30 days. Request:

- Original creditor name and balance

- Proof the agency owns the debt

- Breakdown of all fees/charges

- Licensing credentials if required

Step 2: Check the Statute of Limitations

Most debts expire in 3–6 years. Use a state-by-state SoL chart to confirm. If expired:

- Do not pay

- Respond to any lawsuits citing the time-barred status

Step 3: Decide on a Strategic Response

- Invalid or expired debt? Dispute and ignore further contact.

- Valid debt? Negotiate before paying. Use pay-for-delete tactics and require written agreements.

Step 4: Document Everything

- Log all calls: Date, agent name, summary

- Save emails, physical letters, and settlement terms

- Keep certified mail receipts and signed documents

Step 5: Follow Up Post-Payment

- Confirm payment receipt

- Check your credit within 30–45 days

- If incorrect, send a bureau update request:

“This account was settled per agreement with [agency] on [date]. Please mark as ‘Paid & Deleted.’ Enclosed are payment and confirmation documents.”

Step 6: Take Care of Yourself

- Limit contact method: “Mail only” is enforceable under the FDCPA

- Use financial counseling if overwhelmed

- Explore bankruptcy or consumer proposals if needed

International Note

UK/Canada/Australia: Similar debt validation rights exist, but collection timelines and reporting standards vary. Consult local laws before acting.

Resources

- FDCPA Full Text

- State-by-State Statute of Limitations Tables

- Debt Validation & Pay-for-Delete Templates

- CFPB & FTC Guidance

- Zombie Debt and Identity Theft Protections

Final Thought

Never pay a collection agency impulsively. Protect your credit, preserve your rights, and secure your financial future with a legally sound strategy—not guilt, guesswork, or fear.

“The collector’s purchase price doesn’t define your obligation. But your rights can redefine the game.” — FTC Debt Collection Guidelines

Written by Dan Wallace, Esq. | All About Lawyer

Strategic, authoritative, and results-driven legal guidance for smart consumers.

About the Author

Sarah Klein, JD, is a former consumer rights attorney who spent years helping clients with issues like unfair billing, product disputes, and debt collection practices. At All About Lawyer, she simplifies consumer protection laws so readers can defend their rights and resolve problems with confidence.

Read more about Sarah