$5.47 Billion Blue Cross Blue Shield Lawsuit Settlement, How Much Per Person + Individual Payout Guide

The Blue Cross Blue Shield settlement has created a massive $5.47 billion payout pool – consisting of $2.67 billion for consumers and $2.8 billion for healthcare providers. Blue Cross Blue Shield payments to about 6 million people are set to go out more than two years after the health insurer reached a $2.67 billion settlement with subscribers. This comprehensive guide reveals everything you need to know about individual settlement amounts, eligibility requirements, and exactly when you can expect your check.

Quick Settlement Summary: Total Amounts & Deadlines

| Settlement Type | Total Amount | Recipients | Per Person Range | Payment Status |

| Consumer Settlement | $2.67 Billion | ~6 Million BCBS Subscribers | $50 – $1,500+ | Rolling out February 2025 |

| Provider Settlement | $2.8 Billion | Healthcare Providers | Varies by Practice Size | Claims closed July 29, 2025 |

| Combined Total | $5.47 Billion | – | – | – |

Table of Contents

Blue Cross Blue Shield Settlement Per Person: Exact Payout Amounts

Consumer Settlement Individual Payouts

It is very difficult to estimate how much any employer or individual might receive as a payment. There have been tens of millions of people covered under BCBS plans during the settlement period and the settlement includes 13 years for fully-insured plans (2008-2020).

Estimated Individual Payment Ranges:

- Basic Coverage (1-3 years): $50 – $200

- Extended Coverage (4-8 years): $200 – $600

- Long-term Coverage (9-13 years): $600 – $1,500+

- Family Plans/High Premiums: Potentially $2,000+

Factors That Determine Your Payout Amount:

- Length of BCBS membership during 2008-2020 class period

- Premium amounts paid (higher premiums = larger payouts)

- Plan type (individual vs. family vs. employer-sponsored)

- Geographic location and specific Blue Cross Blue Shield plan

- Total number of valid claims filed (affects distribution percentage)

Why Settlement Amounts Vary So Much

The settlement uses a pro-rata distribution system, meaning your payout depends on:

- Your proportional share of total premiums paid by all class members

- The complexity of calculating damages across 36 independent Blue plans

- Different market conditions in various states during the 13-year period

Related Lawsuit: DermaRite Industries Hand Soap Recall Lawsuit “Destroy Immediately” Warning Triggers Massive DermaRite Lawsuit as 32+ Bathroom Products Linked to Life-Threatening Infections

People Also Ask: Blue Cross Blue Shield Settlement FAQ

“Am I Eligible for the BCBS Settlement?”

You’re eligible if you: ✅ Had Blue Cross Blue Shield insurance between 2008-2020 ✅ Paid premiums directly or through employer deductions ✅ Filed a claim by November 5, 2021 deadline ✅ Were not a federal government employee (they’re excluded)

You’re NOT eligible if you: ❌ Only had Medicare or Medicaid coverage ❌ Were covered under federal employee health plans ❌ Had coverage outside the 2008-2020 timeframe ❌ Missed the November 5, 2021 claim deadline

“When Will I Get My Blue Cross Blue Shield Settlement Check?”

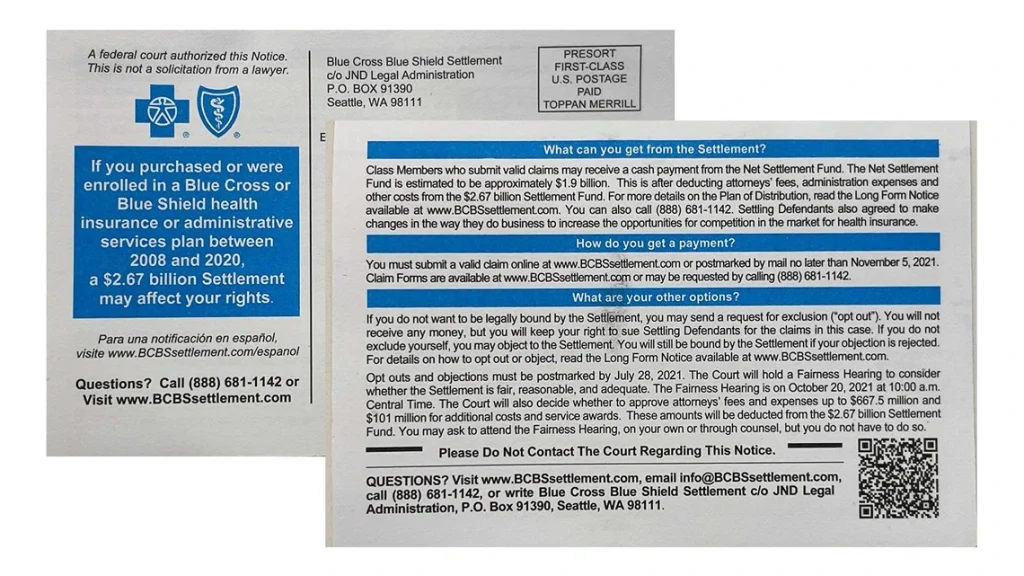

If you purchased or were enrolled in a Blue Cross or Blue Shield health insurance or administrative services plan between 2008 and 2020, you may be eligible to claim a portion of a $2.67 billion class action settlement.

Payment Timeline:

- February 2025: First wave of payments began

- March-April 2025: Bulk of payments rolling out

- Summer 2025: Final payments expected

How You’ll Receive Payment:

- Direct deposit (if banking info provided)

- Physical check mailed to your address

- Email notifications sent before payment arrives

“How Do I Know If My Claim Was Approved?”

Check These Sources:

- Email notifications from bcbssettlement.com (check spam folders)

- Official settlement website claim lookup tool

- Settlement administrator phone line: (contact info on official site)

Red Flags – Scam Warning: ⚠️ Real settlement communications come ONLY from @bcbssettlement.com ⚠️ Never provide Social Security numbers or bank info via email ⚠️ Official settlement administrator never requests upfront fees

Related Lawsuit: Doral Volkswagen Lawsuit, Everything Miami Customers Need to Know Before It’s Too Late

“What Was the Blue Cross Blue Shield Lawsuit About?”

The lawsuit alleged that Blue Cross Blue Shield Association and its member plans:

Primary Allegations:

- Market allocation schemes: Each Blue plan was given exclusive geographic territories

- Restricted competition: Blue plans couldn’t compete against each other

- Price fixing: Coordinated to keep premiums artificially high

- Reduced benefits: Limited coverage options for consumers

Legal Violations:

- Federal antitrust laws (Sherman Act)

- State consumer protection statutes

- Unfair business practices

What the Top News Results Don’t Tell You

The Real Impact on Your Premiums

Before Settlement (2008-2020):

- Average premium increases: 8-12% annually

- Limited plan choices within geographic regions

- Higher out-of-pocket costs due to reduced competition

After Settlement (2021+):

- Required increase in market competition

- BlueCard program modifications

- Enhanced consumer protections

Federal Government Employee Exclusion Explained

Government employees are not eligible to receive damages in the settlement. This is an antitrust case about whether Blue Cross can assign exclusive territories to each licensee. The federal government has a contract with the entire Blue Cross Blue Shield Association

Why Federal Employees Are Excluded:

- Federal Employee Health Benefits Program (FEHBP) operates differently

- Government negotiates directly with entire BCBS Association

- Not subject to the geographic restrictions that harmed other consumers

Provider Settlement Details Most Sites Miss

The $2.8 billion provider settlement affects:

- Hospitals and health systems

- Individual physicians and group practices

- Mental health providers (including psychologists)

- Specialists and subspecialists

Provider Payment Factors:

- Revenue volume with BCBS plans

- Years of participation in BCBS networks

- Geographic market served

- Type of medical services provided

Settlement Implementation: What Changed

Business Practice Modifications Required

BlueCard Program Changes:

- Enhanced provider network access

- Reduced administrative barriers

- Improved claim processing efficiency

Market Competition Requirements:

- Elimination of exclusive territory agreements

- Increased plan portability between states

- Enhanced consumer choice protections

Long-Term Consumer Benefits

Beyond direct payments, the settlement provides:

Immediate Benefits:

- Direct monetary compensation to 6 million consumers

- Reduced regulatory barriers for new insurance competitors

- Enhanced transparency in pricing and coverage

Long-Term Benefits:

- Estimated premium savings of 5-10% over next decade

- Increased insurance plan innovation

- Better consumer protection mechanisms

Legal Representation and Professional Guidance

When You Still Need an Attorney

Even though claim deadlines have passed, legal consultation may help with:

- Understanding settlement documents and tax implications

- Business law matters for healthcare providers affected by industry changes

- Consumer protection issues related to insurance disputes

- Employment matters for healthcare workers impacted by settlement changes

Tax Implications of Settlement Payments

Important Tax Considerations:

- Settlement payments may be taxable income

- Form 1099 likely required for payments over $600

- Consult tax professionals for specific guidance

- Keep settlement documentation for tax records

Professional Resources:

- Family law attorneys for coverage disputes

- Business litigation lawyers for provider issues

- Consumer protection attorneys

How to Verify Your Payment Status

Official Settlement Resources

Legitimate Contact Information:

- Website: bcbssettlement.com (consumer settlement)

- Email: [email protected]

- Provider Settlement: bcbsprovidersettlement.com

Protecting Yourself from Scams

Red Flags: ❌ Requests for upfront fees or processing charges ❌ Urgent demands for personal financial information ❌ Communications from non-official email domains ❌ Phone calls demanding immediate action

Verification Steps: ✅ Cross-reference information with official settlement websites ✅ Contact settlement administrators directly using published phone numbers ✅ Verify all communications through official channels

State-by-State Settlement Variations

Regional Differences in Payouts

Higher Payout States (Less Competition):

- Rural markets with single Blue Cross dominance

- States with limited insurance company presence

- Markets with highest premium increases during class period

Moderate Payout States:

- Mixed competitive landscapes

- Multiple insurance options available

- Varying Blue Cross market penetration

Lower Payout States:

- Highly competitive insurance markets

- Multiple Blue Cross competitors

- Lower premium increase rates during class period

Settlement Timeline: Key Dates and Milestones

Historical Timeline

2008-2020: Class period for consumer harm October 16, 2020: Initial settlement agreement reached November 5, 2021: Consumer claim deadline June 24, 2024: Settlement appeal resolved, final approval February 2025: Consumer payments begin July 29, 2025: Provider claim deadline closed

Future Expectations

2025 Remaining:

- Completion of consumer payment distribution

- Resolution of any payment disputes

- Final accounting of settlement fund distribution

2026 and Beyond:

- Implementation of ongoing business practice changes

- Monitoring of increased market competition

- Assessment of consumer benefit realization

Conclusion: Maximizing Your Settlement Benefits

The Blue Cross Blue Shield settlement represents one of the largest healthcare antitrust settlements in U.S. history, with $5.47 billion in total compensation. About 6 million people are set to receive payments from the consumer portion alone.

Key Takeaways:

- Payment amounts vary widely based on your specific BCBS coverage history

- Payments are rolling out now through summer 2025

- No new claims can be filed – deadlines have passed

- Beware of scams – only trust official settlement communications

For Ongoing Legal Needs: Whether dealing with healthcare coverage disputes, business legal matters, family law issues, or consumer protection concerns, qualified legal representation ensures your rights remain protected.

The BCBS settlement not only provides direct compensation to affected consumers and providers but also establishes important precedents for healthcare market competition and consumer protection. As the industry continues evolving, staying informed about your rights and available legal remedies remains crucial for protecting your healthcare and financial interests.

Stay Alert: Monitor your email and mail for official settlement communications, and remember that legitimate settlement administrators will never request upfront fees or demand immediate personal financial information.

About the Author

Sarah Klein, JD, is a licensed attorney and legal content strategist with over 12 years of experience across civil, criminal, family, and regulatory law. At All About Lawyer, she covers a wide range of legal topics — from high-profile lawsuits and courtroom stories to state traffic laws and everyday legal questions — all with a focus on accuracy, clarity, and public understanding.

Her writing blends real legal insight with plain-English explanations, helping readers stay informed and legally aware.

Read more about Sarah

This information is false AT BEST.

NO PAYMENTS HAVE YET TO BE SENT OUT TO INDIVIDUALS BY JND FOR THIS BCBS SETTLEMENT.

0

There is nothing left to review.

JND is intentionally waiting to send out payments so they can collect more interest on your money.

Even though.

they were paid out FIRST 600 MILLION DOLLARS.

JND llc is 4 lawyers and 4 interns btw.

This is how america get great.